European startups raked in a whopping $9 billion in agrifoodtech investment in 2021 — but there’s a catch.

A few mega-deals from a handful of eGrocery startups made up almost half of that investment, according to the latest European AgriFoodTech Investment report from AgFunder in collaboration with F&A Next. [Disclosure: AgFunder is AFN’s parent company.]

Take eGrocery out of that mix, and the data tells a different story: European agrifoodtech investment totaled $5 billion in 2021 which, if not quite as inspiring, is still a nearly 50% year-over-year increase in investment, according to the report.

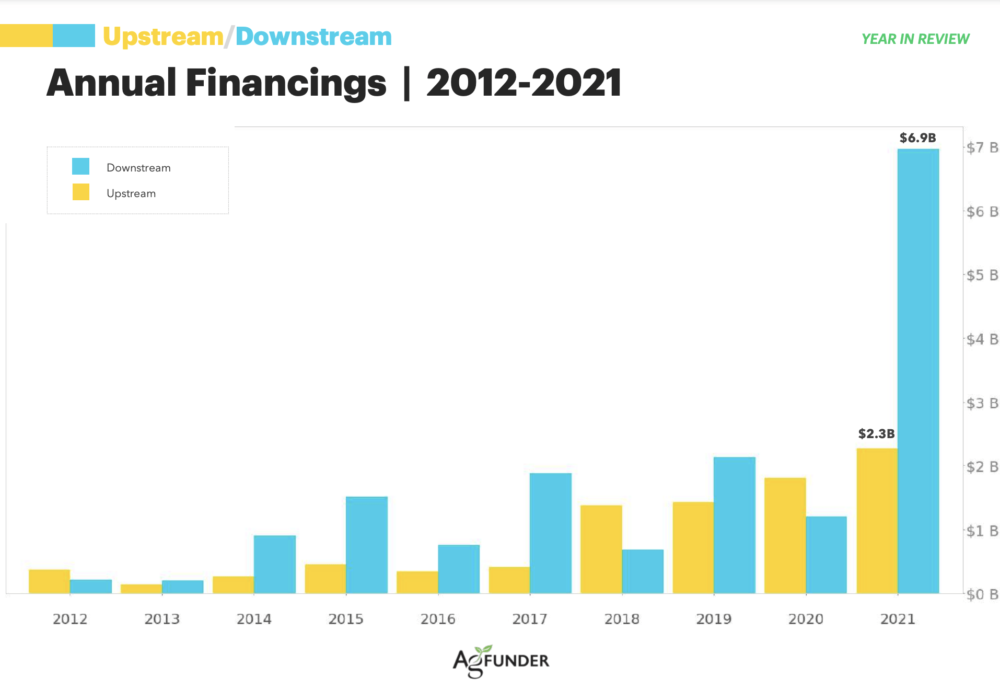

Upstream and downstream investment without eGrocery were almost ‘on par,’ with Upstream companies reeling in $2.3 billion and Downstream, minus eGrocery, $2.7 billion.

Individual downstream categories such as Cloud Retail Infrastructure and Restaurant Marketplaces raked in bigger dollar figures, but Upstream startups — those closer to the farm or manufacturing food — had a significantly higher deal count. As the report notes, this speaks to more early-stage activity and fewer mature startups.

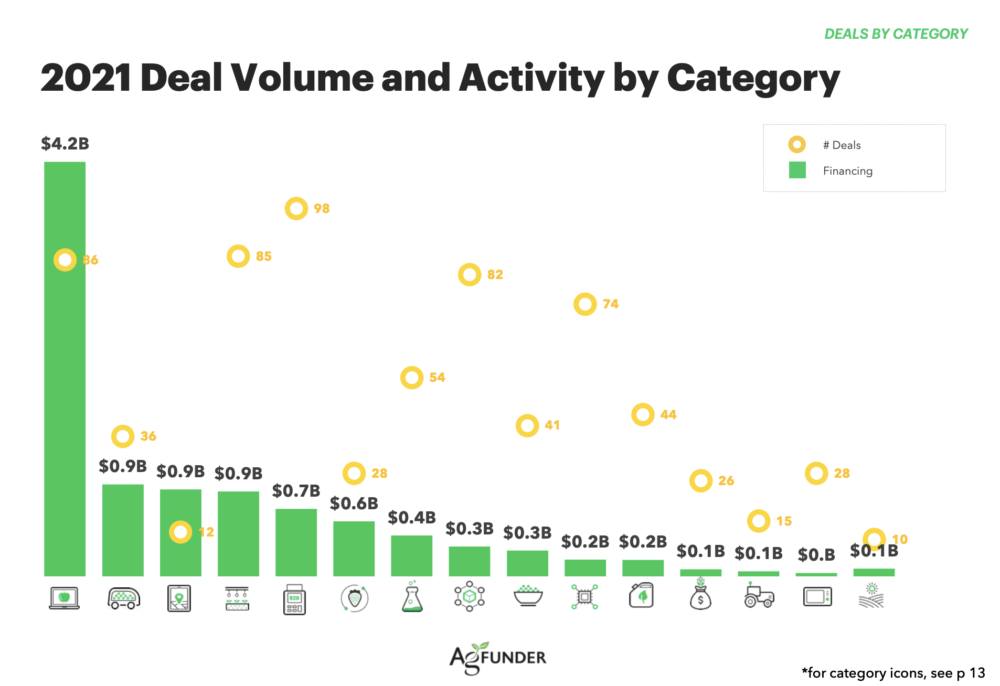

Top investment categories for European agrifoodtech

Once again removing eGrocery from the analysis, the top investment categories in European agrifoodtech for 2021 were largely downstream, in areas closer to the consumer: Cloud Retail Infrastructure (ghost kitchens, last-mile delivery, etc.) and Restaurant Marketplaces each raised $9 million, as did one upstream category, Novel Farming Systems. In-Store Retail & Restaurant Tech brought in $700 million of investment.

It’s a substantially different picture from 2020, when upstream investment in European agrifoodtech surpassed downstream and categories like Novel Farming Systems and Innovative Food nabbed the top spots for deal volume and activity.

Upstream’s prominence in 2020 reflects a larger food industry trend that unfolded as Covid-19 shuttered the global economy and capital swam upstream in response. Worldwide, downstream investment reclaimed its lead this year, so it isn’t too surprising it did the same, albeit just barely, in Europe.

But again, it’s worth noting that eGrocery made up a huge portion of downstream investment this year, in Europe and the rest of the world. As we’ve already covered at AFN, that sector is now flailing thanks to a tech downturn, inflation, and a growing awareness of how urgently more climate-focused technologies need capital.

My colleague Jessica Pothering recently questioned whether agrifoodtech investors were backing the right things, given that we’re a mere eight years out from the Paris climate deadline for avoiding catastrophic climate change. Given the state of the world right now — war, supply chain issues, food shortages, inflation, climate change — we may soon see another upswing in upstream investment.