Data Snapshot is a new regular feature from AFN which takes a looking glass to the key trends, stats, and numbers coming out of the growing agrifoodtech space.

For our first outing, we’re delving into the 2021 AgriFoodTech Investment Report published earlier this year by our parent company AgFunder.

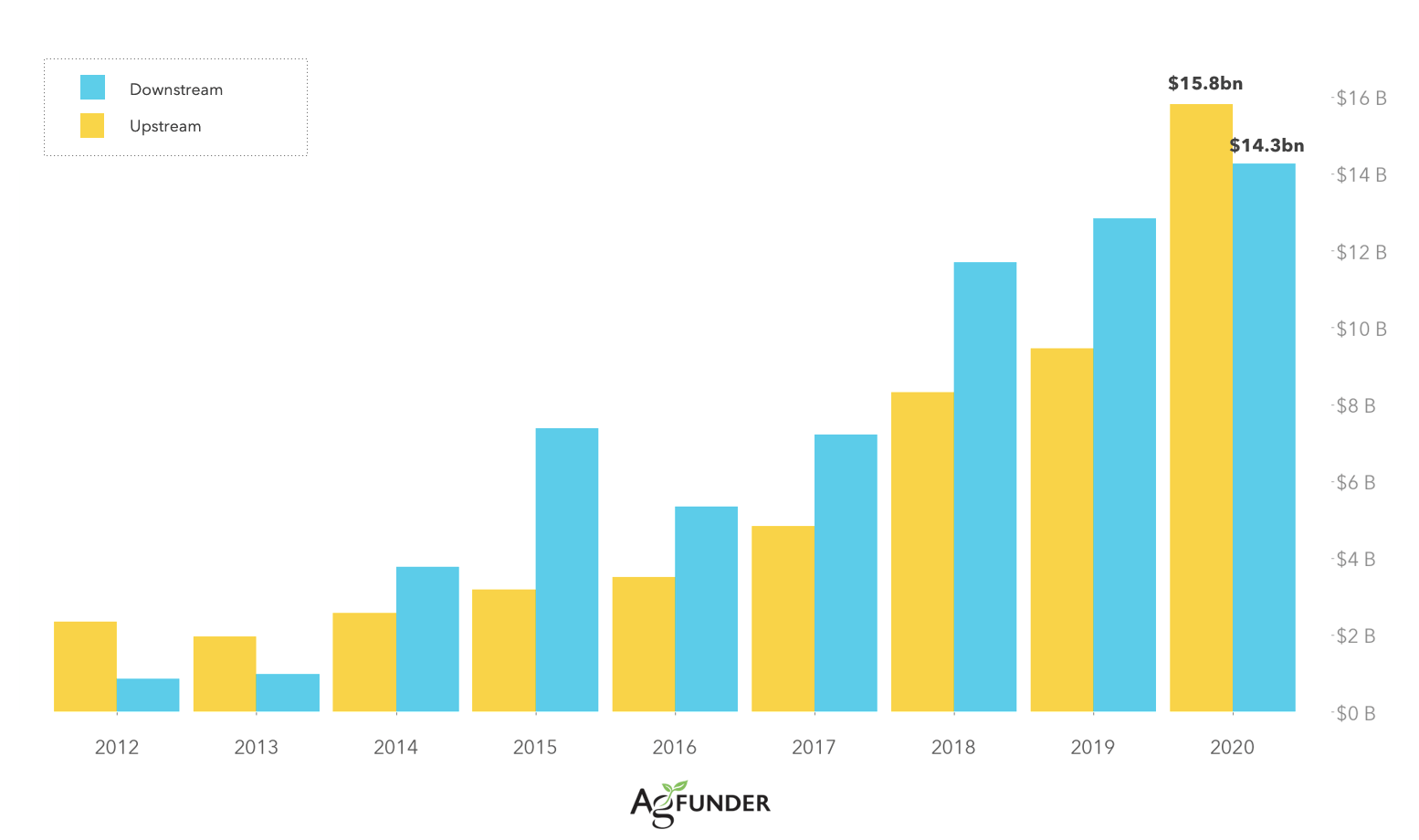

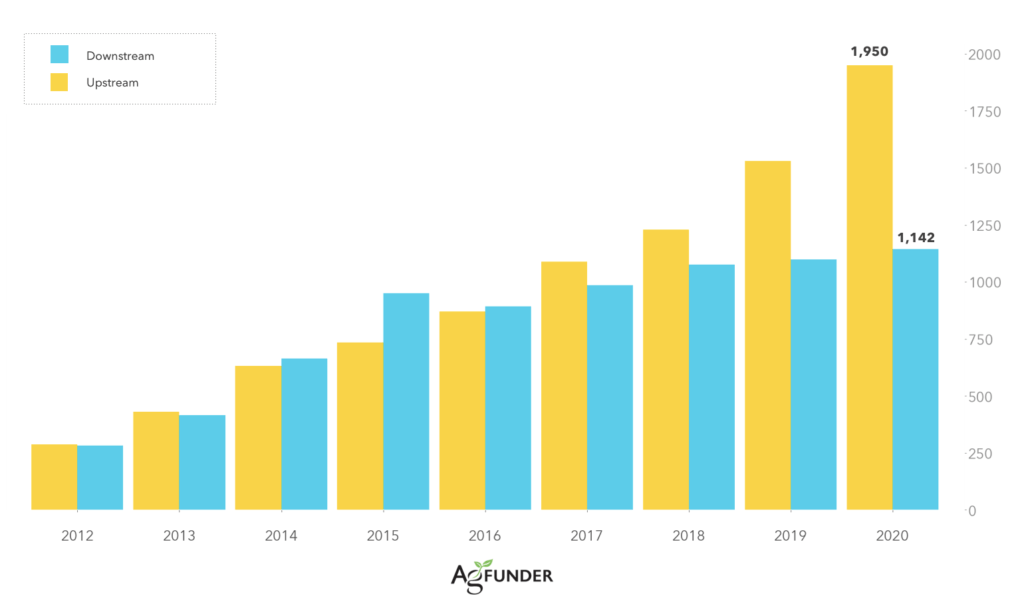

According to the report, global agrifoodtech investment was set to hit a record $30.5 billion last year; that’s nearly 3x the amount of funding in the sector just five years ago, and all in spite of the Covid-19 pandemic.

Notably, dollar investment into upstream categories — that is, technologies and business models nearer the farm or lab, including ‘deep tech’ areas such as ag biotech, robotics, and cellular agriculture — outstripped downstream funding for the first time since 2013:

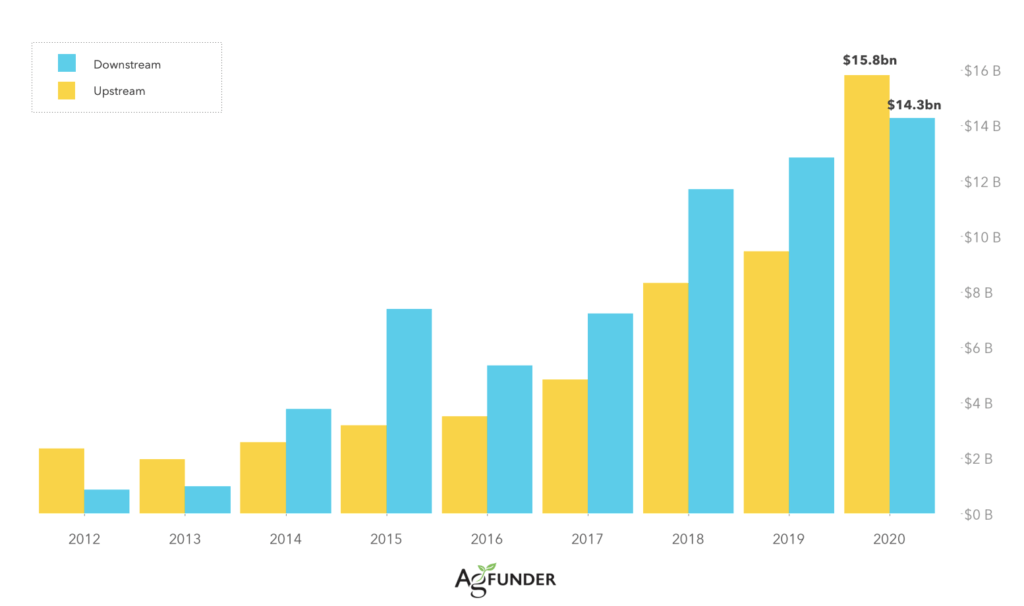

In terms of deal numbers, too, upstream funding stole a march – opening up the biggest gap on downstream deal numbers since AgFunder published its first global investment report in 2012:

As AFN wrote at the time, we are neutral observers. But what’s exciting about the performance of the upstream side of agrifoodtech is that it signifies investors’ growing confidence in our complex industry. The technologies closest to the farm tend to be more capital intensive and difficult to test (see below); they also take longer to get to market and secure customers than their typically software-heavy downstream peers.

Even just a few years ago, biological inputs, farm robots, alt-proteins, and novel ingredients were deemed too ‘risky’ for all but the most specialized investors. But with the pandemic shining a light on the need for a technological update to many upstream categories, investors moved in. How times have changed.

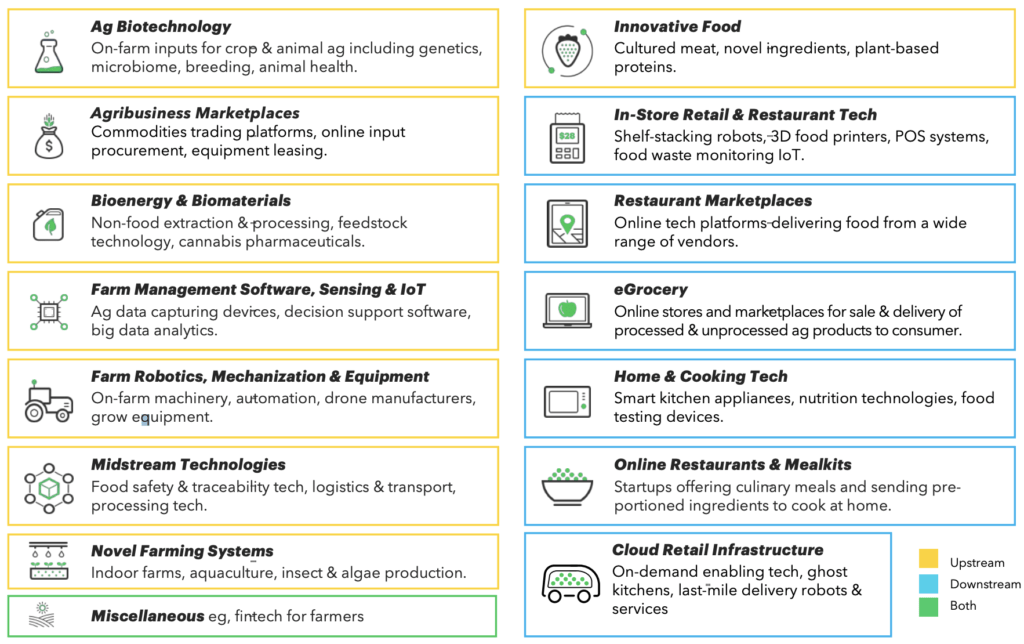

Which categories are ‘upstream’?

Upstream technologies and business models sit ‘earlier’ in the agrifood value chain than consumer-facing solutions; broadly speaking, they relate to agriculture, food production, and logistics.

AgFunder uses a number of self-defined categories in its research reports, grouped into upstream and downstream (ie, consumer-facing) categories. AgFunder’s upstream categories include:

- Ag Biotechnology (on-farm inputs for crop and animal ag, plant breeding and genetics, microbiome)

- Agribusiness Marketplaces (commodities trading platforms, online farm input procurement, equipment leasing)

- Farm Management Software, Sensing & IoT (data-capturing devices, farmer decision support software)

- Innovative Food (cell-cultured meat, novel ingredients, plant-based proteins)

- Novel Farming Systems (indoor farms, vertical farming, tech-enabled aquaculture, insect and algae production)

Here’s a full breakdown of AgFunder’s upstream and downstream categories:

Why are upstream technologies more difficult to test and validate?

While downstream solutions can be market-tested directly with retailers and consumers, leading to hundreds of iterations every year, validation can be much tougher farther upstream, particularly for outdoor farm tech. Agriculture is an ancient and cyclical industry built on tried-and-tested manual practices; introducing novel agricultural technologies into that equation can meet with resistance or skepticism from farmers. Even those who are open to trying out new tech may be unwilling or unable to take on the costs and perceived risks associated with it. Without extensive farmer and agribusiness buy-in, it can be difficult for agtech innovators to test-drive their technologies at scale and ensure they’re up to scratch.

But even more importantly, there are a limited number of chances each year to test and iterate on a technology product because crops have just one maybe two growing seasons a year. For animal agriculture technology, limited breeding cycles could also be limiting.

The regulatory environment also presents problems; technologies such as gene-editing, which can be used to develop crops with desirable traits such as disease resistance or enhanced nutritional value, may not be legal in some territories (or at least may reside in regulatory gray areas.)

Likewise, food technologies such as cell-cultured protein remain largely unregulated. Singapore was the first country to approve a cultivated meat product for sale to consumers in late 2020.