Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Climate-forward investors should keep a close eye on alternative proteins as the world moves closer to its 2030 Paris climate accord deadline, according to a special report from AgFunder and Dutch state-backed impact investor Invest-NL.

“Climate Investing in European Agrifoodtech in 2022,” released as an addendum to AgFunder’s Europe 2022 Agrifoodtech Investment Report in collaboration with F&A Next, mapped 2021 regional funding data to Invest-NL’s three priority themes for fighting climate change: alternative proteins, sustainable farming, and circular food systems.

The addendum found that while these three areas hold the greatest potential for climate impact in European VC investment, right now they are not getting anywhere near as much money or attention as downstream categories like eGrocery and Online Restaurants.

Innovative Food — an AgFunder-defined category mainly comprising alt-proteins and related products — accounted for $600 million, or 5.4%, of the $9 billion raised by European agrifoodtech startups in 2021. That’s actually an increase from last year, when regional investment into Innovative Food totaled $408 million. The number of deals in the category also increased, and 92.9% of them were climate related in 2021. But it still falls far behind key downstream categories.

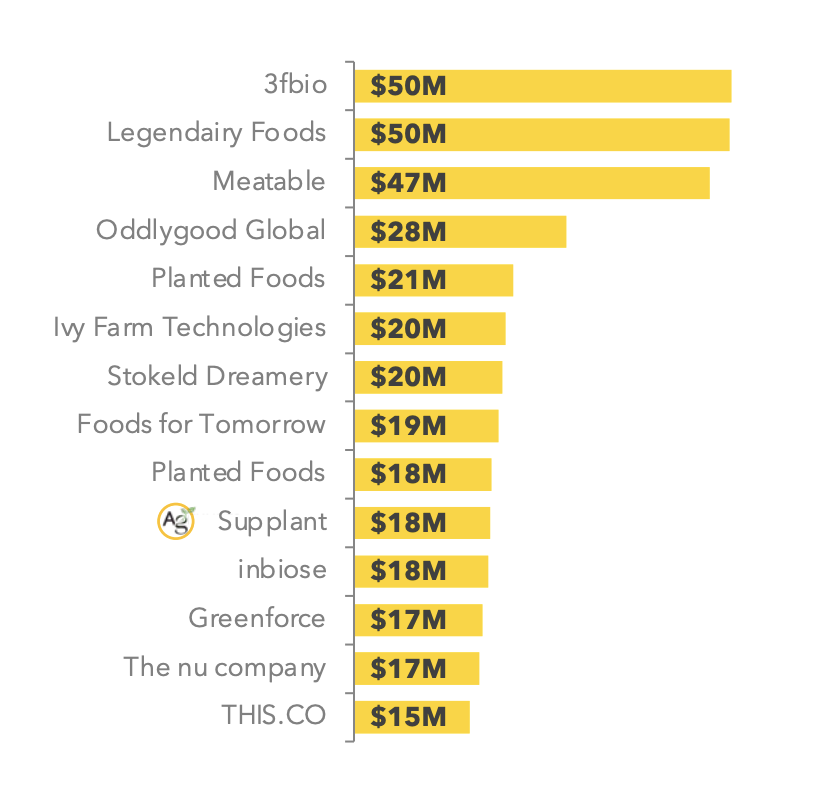

Europe’s top Innovative Food deals in 2021

Innovative Food’s biggest deal went to UK-based fungi fermentation company Enough (formerly known as 3F Bio) with its $50 million Series B round. Next was Germany’s Formo (previously Legendairy Foods) with its $50 million Series A round, followed by Dutch company Meatable, which is developing cultivated meat products.

Of the 87 Innovative Food rounds in Europe in 2021, only four were Series B or later.

Innovative Food as climate tech

As noted above, AgFunder’s Innovative Food category is largely made up of alt-protein startups making meat and dairy analogs via plant-based, fermentation, and cell-culture methods. Invest-NL also adds insect protein and textiles (such as “vegan leather”) to its alternative proteins theme.

As shown in the above chart, investment in these sub-categories is in keeping with developments in the wider food industry, where plant-based proteins — especially meat analogs — still lead the alt-protein sector.

AgFunder and Invest-NL found that plant-based proteins — including pea, oat, and soy-based products — grabbed almost half of all European alt-protein funding in 2021, raising just over $200 million. The sub-category’s lead isn’t surprising, as plant-based ingredients remain the fastest, most tested way for alt-protein to get to market.

Fermentation-based startups raised $144 million. Cellular biotech, which includes cultivated meat and dairy and has the most barriers to entry of any sub-category, raised $113 million.

For now, these sub-categories remain pretty distinct from one another, though that’s changing. Some companies are combining plant-based and cultivated ingredients and methods to make “blended” products.

Meanwhile, the fashion industry is under increasing pressure to find more sustainable methods and materials, which could provide a bigger opportunity for bio-textile startups in the future and subsequently increase the sub-category’s slice of the investment pie. The same could happen for insect protein as it becomes an increasingly critical part of the food system for both animals and humans.