Editor’s note: Bioengineer and microbiologist Saron Berhane is an independent consultant and was the cofounder of Australian agtech startup BioScout.

The views expressed in this guest article are the author’s own and do not necessarily represent those of AFN.

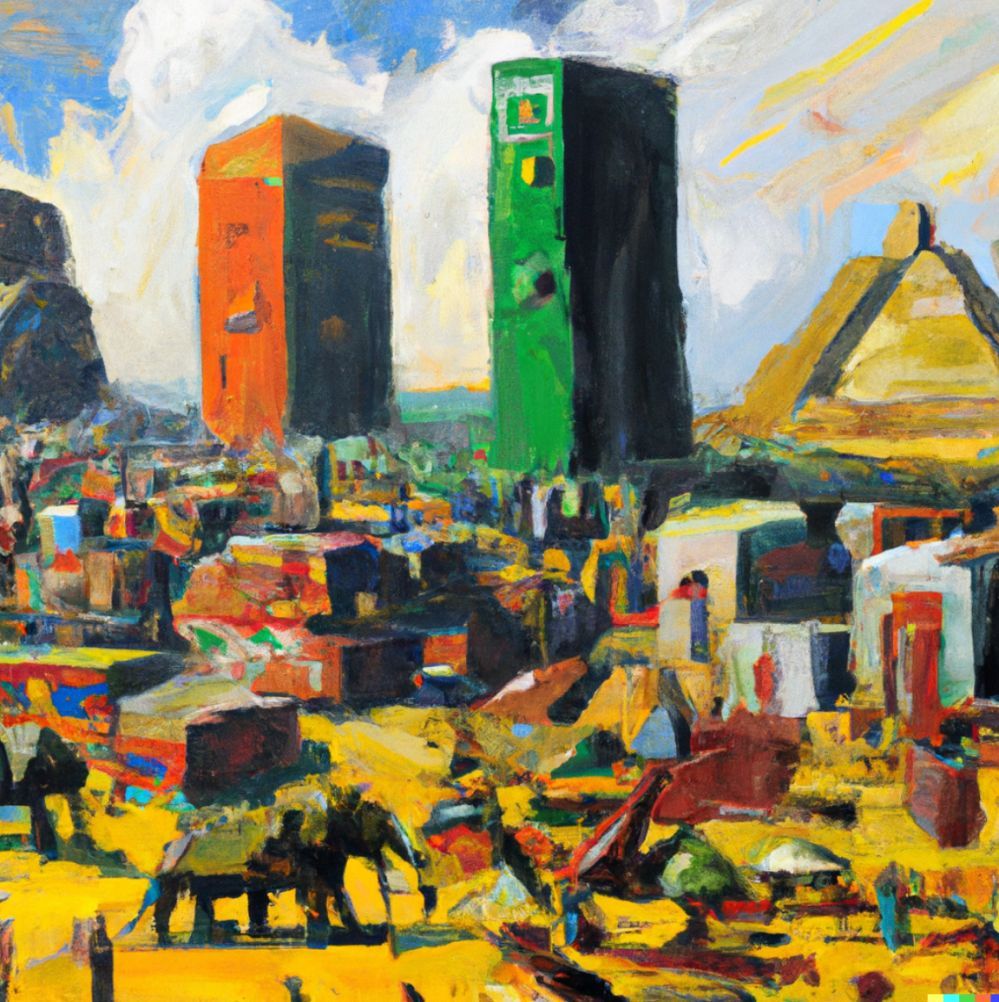

Investment in agrifoodtech will be key to the stable, sustainable and prosperous development of Africa.

I realized this while living on the continent over the last year. I made the decision to leave Australia and spend time living in Ghana, Rwanda and Kenya to get an up-close understanding of the rapid changes that were taking place across Africa’s burgeoning agtech ecosystem.

Despite the challenges the continent has faced over the years, the sense of optimism and opportunity felt among its people and spectators across the globe is growing. This is fueled by the fast pace of technological change, the young and rapidly growing population, the diverse cultures across the continent as well as the spirit of resilience and innovation of the people.

Africans have a long history of resilience and innovation, from the ancient empires of Axum, Ghana and Mali to the modern-day tech hubs of Lagos and Nairobi. Anything is possible in Africa.

The case for greater investments into African agrifood tech

On a continent where 80% of farming takes place on less than 2% of its land mass, Sub-Saharan Africa (SSA) faces serious food insecurity. 80% of SSA countries are net importers of food at a cost of $40 billion annually. Meanwhile, Africa exports mainly raw materials, gems and oil, making it vulnerable to global market forces and external events.

If Africa’s food and agriculture sector is to become a $1 trillion dollar market by 2030, serious investments into agritech are needed. According to AgFunder’s 2023 Global AgriFoodTech Investment report, Africa was the only region globally where agrifood tech investment increased in 2022.

Startups raised $640 million in 2022, up from $528 million in 2021, with the top five deals focused on tech to improve the supply chain and make food trade or transport more efficient.

Below are some observations and opportunities I identified after visiting several cocoa, cassava, plantain, and coffee farms.

Observation #1: Growing and harvesting practices are still very manual

Machetes and scythes were the tools of choice for 100% of the farms I visited. I don’t think this trend differs too much from horticulture farming practices in the West (e.g. berries, apples) where harvesting is still quite a manual process and labor can be hard to find.

While there have been greater efforts to support mechanization on the continent (e.g. in the Northern Region of Ghana and in row crop production), greater government support and innovation is needed.

Opportunity #1: Precision agriculture

Precision agriculture tools can play a key role in improving productivity; however, an understanding of country- and crop-level farming systems is needed for successful implementation.

Mechanization, robotics and precision agriculture have immense potential to improve productivity and quality by providing data on weather, soil quality, and crop yield enabling African growers to make data-driven decisions on planting, irrigation and fertilization. This can improve labor efficiency and increase crop yields while supporting the practice of agroforestry and regenerative agriculture that are prevalent among smallholder farmers.

While a lot of Western agronomy and mechanization principles apply in SSA, implementation requires specific considerations of local farming systems. Ultimately, it’s important to remember that smallholder farmers account for approximately 80% of all farms and produce about 90% of the food consumed in the region.

Successful startups must consider factors such as smaller plot sizes, farm cash flow, variable terrains, multi-purpose application support, financing options, specialized crops and their asynchronous harvesting, among many other things.

We can look at the uptake of solar energy in regional SSA as evidence that localized adaptation of financing and distribution models are key for implementation.

African agrifoodtech startups to watch in this space:

- Hello Tractor – a Nigerian marketplace and fleet management startup that is increasing access to affordable mechanization for smallholder farmers. It recently received investment from Deere & Co. after participating in John Deere’s startup collaborator program.

- Tolbi – a Senegalese-based startup using moisture and soil sensors as well as satellite imagery to improve crop yields in Senegal.

- SupPlant – an Israeli-based startup developing irrigation systems and water- saving tools for use in emerging markets such as South Africa and Mexico.

- Apollo Agriculture – a Kenyan startup that uses machine learning and remote sensing to provide small-scale farmers with customized advice on planting, irrigation, and fertilizer use, improving crop yields and reducing labor costs.

- Aerobotics – a South African startup that uses drones and artificial intelligence to identify pests and diseases in tree crops.

- Agrix Tech – a Cameroonian startup that provides a mobile app for farmers to access information (e.g. diseases affecting their crops), financing, and market opportunities to improve agricultural productivity.

Observation #2: Road networks and infrastructure have improved, but there’s still more work to do

Transport infrastructure has improved significantly over the last decade and farmers stated that this has greatly improved their ability to transport produce to market. Government investments into roads and the infrastructure impact of China’s Belt and Road Initiative is trickling into areas of agricultural productivity in SSA.

However, there is still quite a long way to go in improving road connections between farms, villages and major cities. Furthermore, cold chain logistics has successfully been used to support the export of perishable goods such as fresh fruits and flowers to international markets.

British company, Blue Skies, is an example of this. It sources and packs fresh fruit in West Africa and supplie it to supermarkets and wholesalers in the UK and Europe. However, inadequate transportation and storage infrastructure (e.g. power supply fluctuations) contributes to significant food loss and reduced income for farmers.

Refrigerated transportation instability is the reason why cold chain logistics is nine times more expensive in Africa than the rest of the world. Furthermore, education and awareness of the benefits of cold chain logistics is still lacking.

Opportunity #2: Supply chain innovation

Advanced logistics technology can provide the bridge between the government’s investments in road infrastructure/networks and the needs of smallholder farmers.

Opportunities should be focused on reducing post-harvest losses, enabling efficient and timely transportation of produce and farmer/community education.

African agrifoodtech startups to watch in this space:

- Releaf – a Nigerian startup building hardware and software to streamline the processing of agricultural goods, increasing efficiency and profitability for smallholder farmers in Africa.

- Twiga Foods – a Kenyan startup that uses mobile technology to connect vendors, fast moving consumer goods companies, manufacturers and farmers.

- CowTribe – a Ghanaian startup that provides mobile veterinary services to smallholder farmers, solving the problem of inaccessible veterinary care in rural areas.

- ColdHubs – a Nigerian startup that provides solar-powered cold storage facilities for small-scale farmers and food vendors, improving the quality and shelf life of their produce and reducing food waste.

- Zipline – a US-based startup that uses drones to deliver medical supplies to remote areas in Rwanda, Kenya, Côte D’Ivoire and Nigeria. The company has now expanded into the delivery of agricultural products, using drones to transport vital inputs to farmers.

- Lori Systems – a Kenyan logistics platform that uses technology to optimize trucking routes and reduce transportation costs for cargo across Africa.

- SokoFresh – a Kenyan startup offering farm-level cold storage using a ‘pay-as-you-store’ model that enables adoption of cold storage without any upfront investment by farmers, aggregators and buyers.

- Koolboks – a Paris-based startup offering accessible, solar-powered refrigeration to individuals, small businesses, and health care facilities in sub-Saharan Africa.

Observation #3: Post-harvest loss rates remain high

The FAO estimates that 37% or 120-170 kg/year per capita of food produced in SSA is lost or wasted. Losses are typically highest among cereal crops, roots and tubers. This is not only a major threat to food security but also wastes important production inputs such as water, fertilizer, energy and land.

This waste ultimately leads to the acceleration of deforestation, species extinction and fragile ecosystems.

Opportunity #3: Building a more circular economy, tackling food waste

The principles of circularity and zero-waste must be adopted and encouraged across all parts of the value chain. The valorization of waste in African food systems has not been extensively explored, although it could provide a huge opportunity to minimize losses along the value chain while also providing economic opportunities, jobs and overall value to communities.

Huge opportunities exist to close the nutrient loop and establish more resilient rural and urban food systems.

Another way that food losses associated with storage and handling can be minimized is through value-added food processing closer to farms and sources of waste (e.g. cassava flour, solar dried food, biochar production).

This is a strategic focus of many African nations and is supported by the 2022 launch of the Special Agro-industrial Processing Zones (SAPZ) program in rural areas of Nigeria. This $520 million program is funded by the African Development Bank and will be implemented in 17 other African countries with a goal of ending hunger and achieving food security.

Finally, government education and grower extension programs that focus on storage and handling education play a vital role in solving farm waste issues. With increasing rates of mobile phone penetration across Africa – smartphones will account for almost two thirds of connections in SSA by 2025 – mobile and web apps will play a prominent role in effectively disseminating educational information to African farmers.

African agrifoodtech startups to watch in this space:

- CassVita – a Cameroonian and US-based startup that purchases cassava directly from farmers and uses proprietary technology to increase its shelf life from three days to 18 months.

- Proteen – a Ugandan/Dutch startup that feeds organic waste to black soldier fly (BSF) larvae which then produce a high-quality protein feed for the livestock and aquaculture industries.

- Taimba – a Kenyan startup that has developed a B2B mobile app that connects smallholder farmers with buyers and markets, reducing post-harvest losses by ensuring timely delivery of fresh produce.

- Zowasel – a Nigerian startup that leverages data science and mobile technologies to provide smallholder farmers with access to financing, training and technology to improve their yields and reduce post-harvest losses.

- BMTA&C – a Moroccan startup developing solar-powered refrigeration for farmers to reduce post-harvest losses.

- Cupmena – an Egyptian startup that uses coffee waste to grow mushrooms.

- Regen Organics – another insect farming startup turning organic waste into organic fertilizer and insect-based protein using black soldier fly larvae.

- NetZero – a French and Cameroonian-based company producing biochar using coffee husk waste.

- Tiantian Xuenong – a Chinese startup that has developed an agtech knowledge learning platform for Chinese farmers. It provides farmers with courses about agtech solutions, farm management, agricultural product marketing as well as skill certification. Its app has apparently been downloaded more than 6 million times.

The time to invest is now

With its vast agricultural potential and agrifood tech opportunities, Africa stands at the precipice of a transformative era, where technology, innovation and policy are aligning to revolutionize the way food is produced, processed and distributed.

The convergence of mobile technology, robust infrastructure and precision farming techniques holds immense promise to empower farmers, improve productivity, and ensure food security for a rapidly growing population.

Supported by a burgeoning agritech startup scene and a favorable policy environment, African countries have the potential to leapfrog traditional practices to create sustainable and inclusive agrifood tech systems.

There is no better time than now for Africa to unlock a brighter future where the continent’s agricultural bounty nourishes its people, drives prosperity and fosters environmental resilience.

Read part two—which focuses on biomanufacturing— next week!