Swiss agro-chemical giant Syngenta is hoping to tackle nitrogen use in China while maintaining productivity through a new partnership with one of its portfolio companies: Emeryville, California-based molecular biology startup Sound Agriculture.

“There is high nitrogen fertilizer use in China compared to other large agricultural markets mostly because there hasn’t been the attention and regulation from both industry and government like there has been in the US,” Sound Ag CEO Adam Litle tells AFN.

Nitrogen is an essential nutrient for plant growth, but its overuse can have devastating effects on environmental health. In many cases, plants only utilize 50% to 70% of the nitrogen applied. The remainder can seap from fields and negatively impact air and water quality.

Syngenta and Sound Ag believe they can reduce nitrogen application by 7.5 million metric tons annually in China alone. They equate this to removing 220 million tons of carbon dioxide, or 50 million cars from the road, each year.

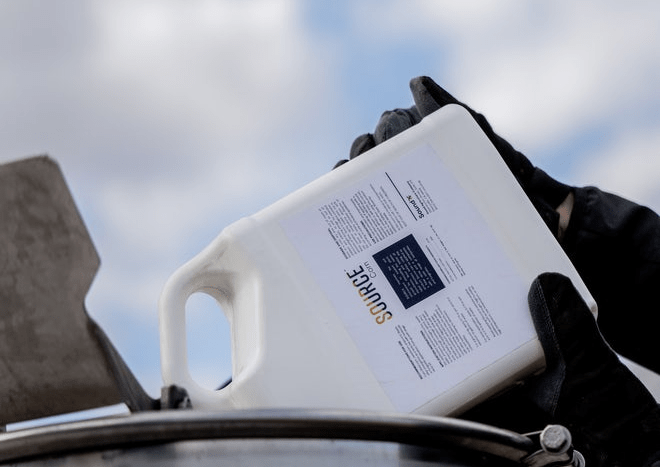

The partners say the star of the show is Source, Sound Ag’s flagship product, which the startup describes as “enhancing the natural systems that already exist in the field.” Source works by “activating” soil microbes to provide plants with access to more nitrogen and phosphorus.

Sound Ag doesn’t define Source as a biological product, but rather “bio-inspired” because its mode of action is still a chemistry, Litle explains.

The made its commercial debut in 2020 after three years of field trials that showed a positive yield across the US.

“There’s a lot of snake oil perception in the space so we need to make sure that it’s really authentic and backed up with data,” Litle says, referring to the the growing market in biological crop inputs.

“We are complementary with that whole movement, but what we find is [Source’s] yield impact and consistency is higher because it is a green chemistry, not a microbial,” he claims.

“We are fans of biologicals and think the movement makes sense. But we don’t need it to work because there are already such rich microbiomes in the soil. We can activate what is already there in China.”

The partnership will see Syngenta conduct trials of the product and, if successful, commercialize it in China with an initial focus on corn and wheat. The plan is to expand to rice, potatoes, and other crops later on – and potentially to other Asian markets, as well.

Syngenta restructured, rebranded, and relaunched after taking a $5.6 billion Chinese business on board. Read more here

Syngenta will take on the responsibility for product formulation, field development, and marketing, while Sound Ag will manufacture Source. The first commercial year will ideally be 2024, Litle says.

The tie-up offers the US startup a bridge to a new market that would have been far too intimidating for it to tackle on its own, he adds. Being able to benefit from Syngenta’s resources and existing presence within China provide a quick and more cost-effective entrance.

“We have a go-to-market effort in the US and we want to continue that, but it was unrealistic for us as a startup to go commercialize it in China ourselves,” Litle says.

“We don’t know the Chinese farmer that well. Admittedly, we’re a core technology company and we’re very much depending on the Syngenta deal to help navigate through that. That’s a large part of the value they bring to the table.”

Sound Ag closed a $22 million Series C round in May 2020 led by S2G Ventures with participation from Syngenta Ventures, Cavallo Ventures, Cultivian Sandbox, and Fall Line Capital.