Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

A recurring theme at AFN of late is that climate tech VC investment in Europe is still very much in its infancy, and that we need a lot more of it.

The continent’s generally early-stage agrifoodtech ecosystem is blooming with startups addressing food-related climate challenges head-on. What’s needed: more growth and late-stage funding to get these technologies out of the lab and into the field (literally) at scale.

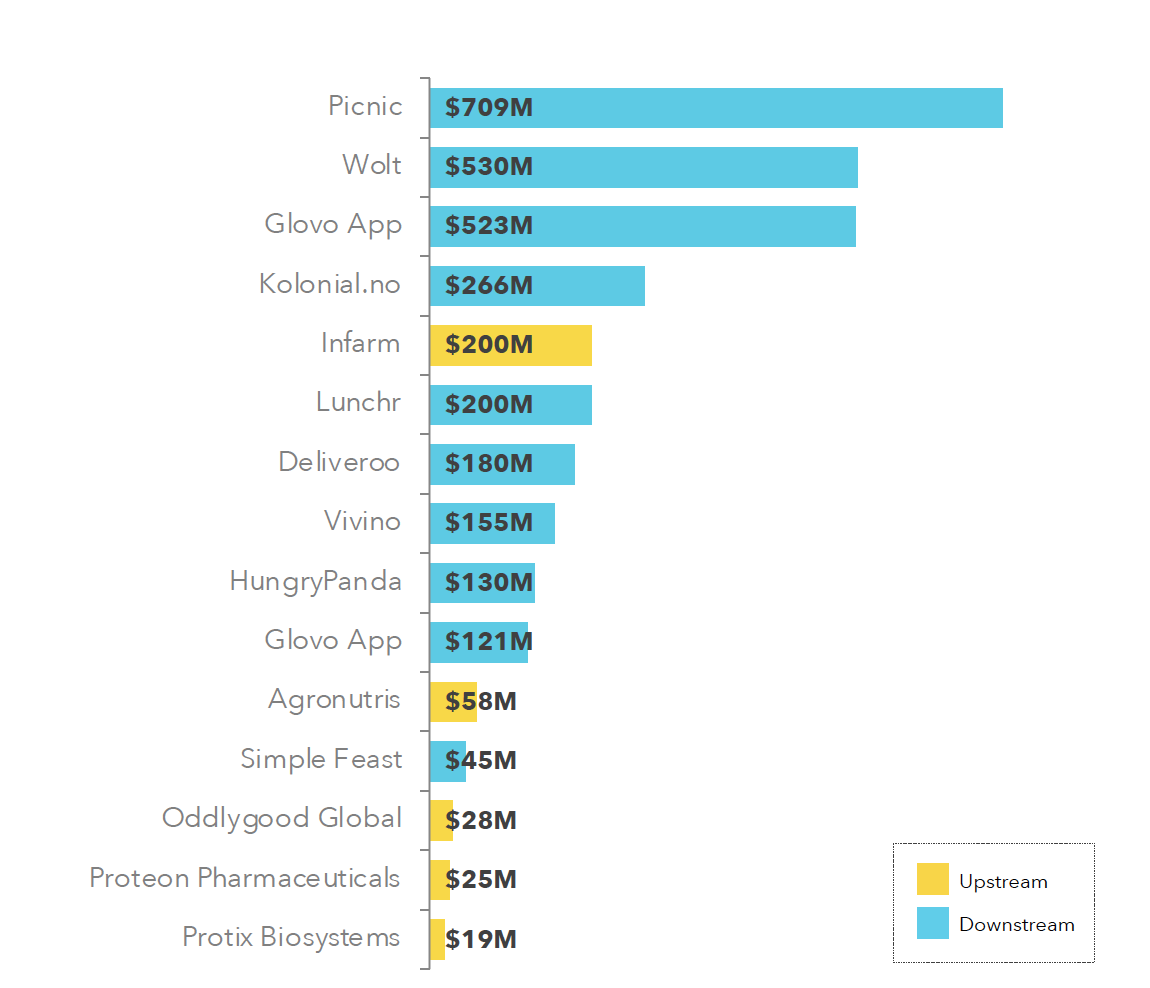

One quick look at the top late-stage deals for 2021 European agrifoodtech startups underscores the point.

Companies developing upstream technologies, or those closer to the farm or lab, were few and far between when it came to late-stage VC investments in Europe last year. According to data in AgFunder’s 2022 European AgriFoodTech Investment report, just one upstream company scored a $100-million-plus late-stage (Series D and after) round last year.

Four others made it on the top 15 list, but with round sizes smaller than most of the top Series A and B rounds.

Since upstream categories tend to be more closely aligned to climate strategies than those downstream, it’s safe to say climate-tech isn’t yet raking in the kinds of mega-deals the eGrocery sector has enjoyed up to now.

German vertical farming startup Infarm came the closest, raising $200 million round at the tail end of last year. Widening the number of top late-stage deals to 15, a few more upstream companies make it into the mix, but none of those rounds passed the $60 million mark and fell far below Picnic‘s $709 million or Wolt‘s $500-plus million raises.

Climate tech: what it is, why it matters

The most recent report from the Intergovernmental Panel on Climate Change identifies eight key agrifood climate-impacting sectors that need more investment: soil carbon management, agroforestry, use of biochar, improved rice cultivation, livestock and nutrient management, shifting to sustainable healthy diets, reducing food waste, and building with wood, biochemicals, bio-textiles and bio-materials.

In an addendum to the European Agrifoodtech Investment report, AgFunder worked with Dutch impact investor Invest-NL to identify the types of technologies and companies that could positively impact how food is produced and consumed, mapping the report data to three themes: Alternative Proteins, Sustainable Farming and Circular Food Systems. Those three themes encompass many of the IPCC’s eight priority areas of agrifood.

We’re less than eight years out from the 2030 deadline for achieving the Paris climate accord and keeping global warming below 1.5 degrees Celsius by 2050 and trillions of dollars short on funding to meet that deadline.

Even so, investors committed just 16% of European agrifoodtech capital to the three thematic areas targeted in AgFunder/Invest-NL’s research. AgFunder also notes that many sectors with the most climate impact potential actually decreased in funding from 2020 to 2021.

Looking ahead

It’s not all bad news, though. While last year’s best-funded late-stage sectors (like eGrocery) are now struggling to stay afloat in the current downturn, climate-focused tech startups appear to be holding steady. Climate tech startups raised $18.6 billion in the first half of 2022, according to Climate Tech VC. While funding declined 21% compared to the second half of 2021, H1’22 investment still outpaced H1’21 ($16 billion).

Climate Tech VC notes that Seed and Series A funding and deal count more than doubled during this time.

Investors should view this time as an opportunity to invest in more climate-forward companies that sit further upstream in the food value chain.