Editor’s Note: Rob Leclerc is a Founding Partner at venture capital firm AgFunder where he co-leads the investment team with Founding Partner Michael Dean. The opinions expressed are those of the authors. They do not purport to represent the opinions or views of AFN’s Editor or its diverse and independent team of journalists.

America’s biggest milk producer has just filed for bankruptcy — a newsflash that’s been a bit like hearing thunder after seeing lightning: stunning, but predictable.

Alternative products and changing consumer trends proved the undoing for Dean Foods, which had been a robust survivor in almost a century of dairy dominance. The company powered through the Great Depression and the Second World War, cementing itself as a case study in how to outpace rivals in a dairy industry churning with technological change. Now it’s become a cautionary tale about disruption.

Causes of the curdle

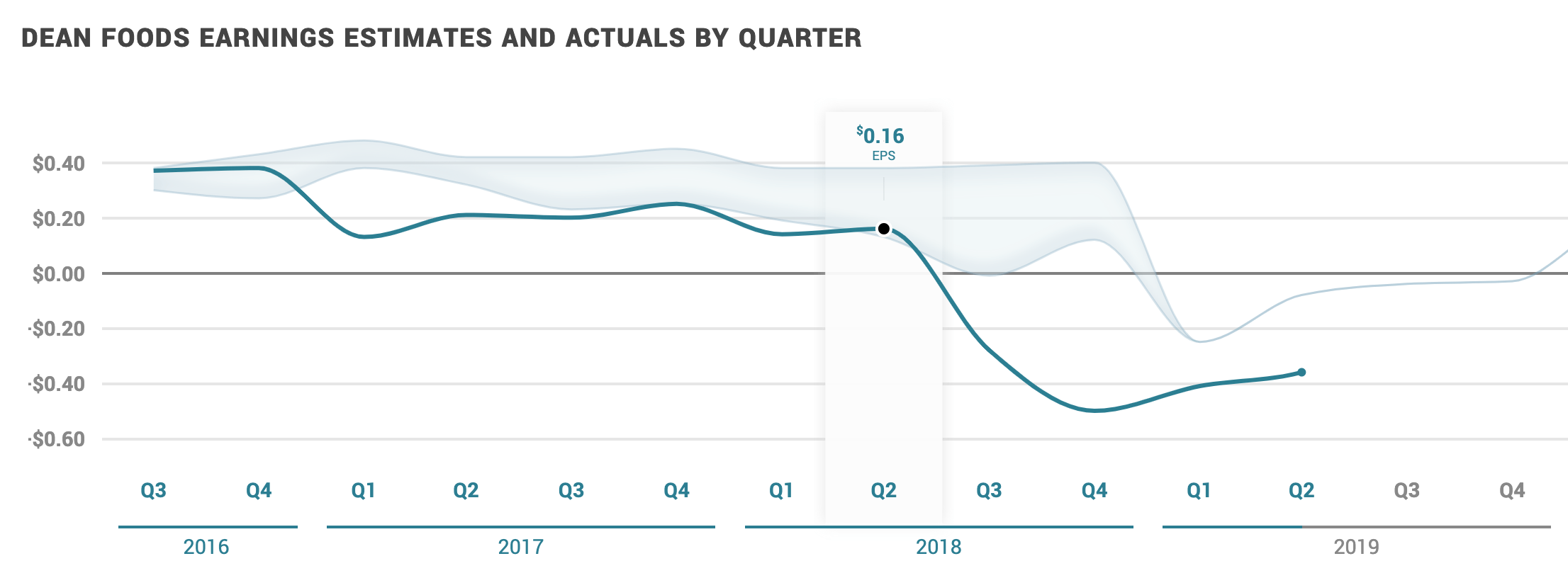

As the chart below shows, there were plenty of warning signs that things were beginning to curdle. Revenues for Dean Foods had reached a record high of $12.6 billion in 2011. But by last year, these had almost halved, sinking to $7.5 billion. Its share price plummeted accordingly — down 80% over the last year, with investors pressing the ejector seat after four quarters of negative earnings and mounting debt. Most analysts, though, didn’t even see this coming: just 30 days ago, four out of five coverage analysts still had a Hold rating; only one advised Sell (Credit Suisse). When disruption happens, it happens fast.

Dean Foods CEO Eric Beringause explained these numbers in the context of a tough market for dairy as a whole. “Despite our best efforts to make our business more agile and cost-efficient,” he wrote, “we continue to be impacted by a challenging operating environment marked by continuing declines in consumer milk consumption.”

The ghost of a WhiteWave past

This sudden shift in consumer demand is one of the totems we used to build out our recent White Paper, a thesis charting the reasons for launching our New Carnivore Fund. But a sour sectoral outlook is not the whole story. The moral of this downfall is not that they failed to respond to the rise of alt milks. They had. Instead, the story is a more ironic tale of turning their backs on them. Shockingly, Dean Foods was well-positioned for the changes ahead when, in 2002, it acquired WhiteWave Foods, the maker of Silk Soymilk, for $205 million.

And what an acquisition it was. WhiteWave was founded back in 1977 by a 29-year old ex-hippie named Steve Demos living in Boulder Colorado; its mission: the “creative integration of soy into the average American diet.” After iterating on hundreds of products, Steve eventually landed on Silk Soymilk. He built authentic and mission-driven branding, and had the ingenious idea to position Silk in the dairy aisle, away from other unrefrigerated soy beverages he called “Armageddon food.” From then on sales soared. Dean’s initially bought a small piece of the company as part of a distribution agreement but seeing the growth, acquired WhiteWave in 2002. But by 2012, the execs at Dean Foods had other ideas and decided to spinout WhiteWave to “destroy unlock significant shareholder value,” taking it public at a $3 billion valuation and forking dividends out to shareholders. Five years on, Danone buys WhiteWave for $12.5 billion. And Dean Foods has now gone bust.

The surprising New Carnivores

The decision of Dean Foods to distance itself from alt protein should serve as a cautionary tale for the animal products industry more broadly. The same changes we’ve seen over the last few decades in dairy are inevitably coming to the animal protein market. But with the path already paved and with a much greater market opportunity, we can expect that change to happen much more quickly this time around.

Fortunately many in the industry seem to get it. When we launched our New Carnivore Fund, we expected most investor interest to come from vegan and impact investors, but surprisingly most investor interest is coming from veteran players in the meat and dairy industry. Quietly and decisively, investors and executives are taking stock of consumer trends and are choosing to embrace change. The demise of Dean Foods only serves as another reminder of the need to do so.