Data Snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

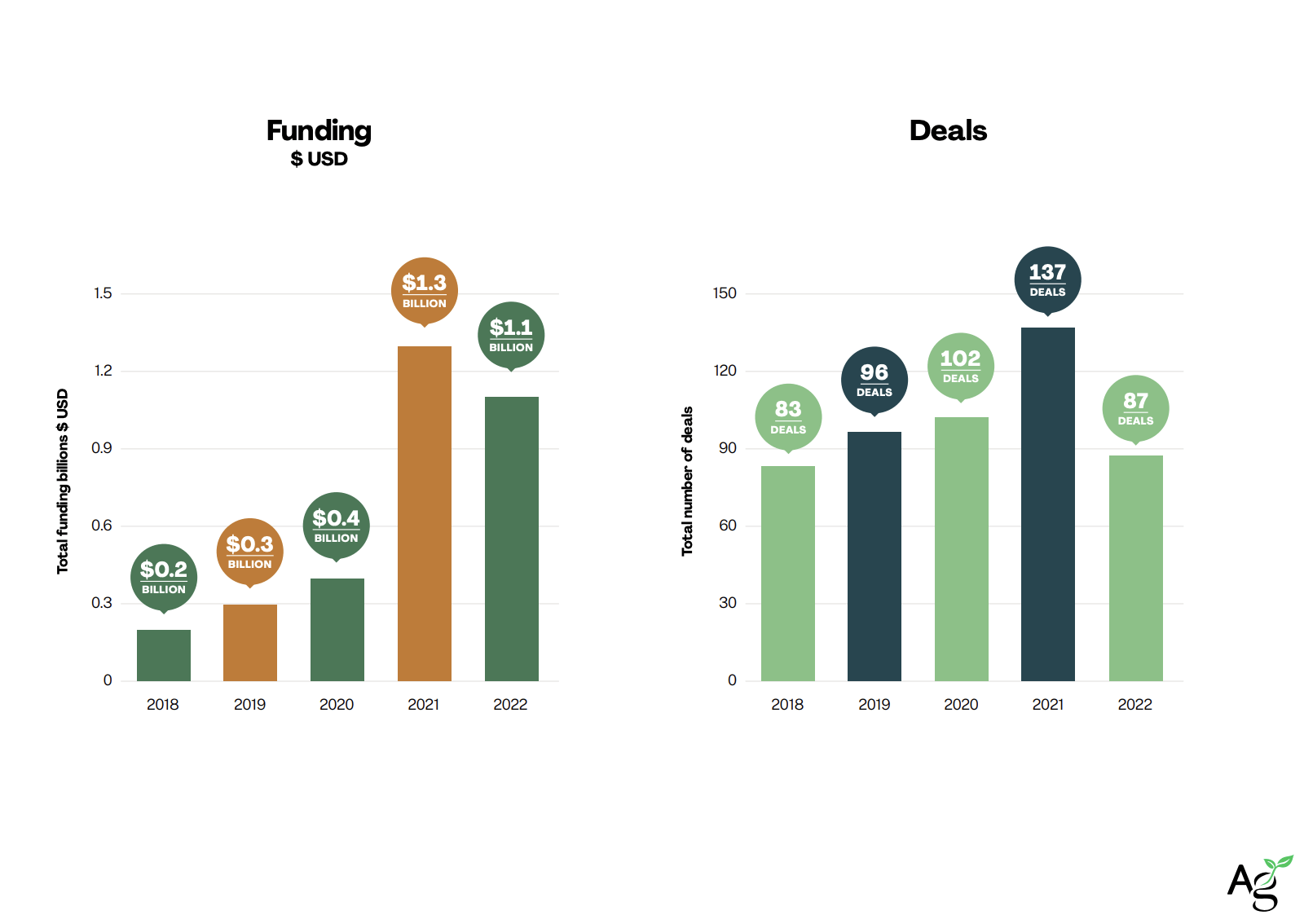

Despite market forces creating difficult fundraising environment over the last year, India’s farmtech sector has remained “relatively strong” for the most part. Startups raised $1.1 billion in 2022, only a modest 15% drop from $1.3 billion in 2021, according to AgFunder’s India AgriFoodTech Investment Report 2023.

Funding in this sector is partly driven by rising concerns around the impact of climate change on Indian agriculture, which in turn have underscored the need to get efficient and affordable technology into the hands of farmers.

Farmtech is an umbrella term for investment categories close to the farm (or lab) such as mechanization, biologicals and ag marketplaces. Startups in this arena closed 87 deals in 2022, a 37% decrease from 2021’s 137 deals. However, the decrease in deal number is indicative of higher deal values and more mature startups tackling chronic inefficiencies in the value chain.

The state of smallholder farming in India

Smallholder farmers — those that own less than 2 hectares of land — account for 86% of all India’s farmers. Despite the size and importance of this group, smallholder farmers are some of the country’s poorest. Smallholders earn 39% of what medium-sized farmers earn and just 13% of what large farmers gain, according to the World Economic Forum.

Limited access to logistics tools and credit, as well as fragmented supply chains and exploitative middlemen hamper smallholders’ productivity.

Farmtech tools and services have the potential to alleviate many of these issues, as they often seek to streamline operations, create more direct access to inputs and credit, and close the gap between farmers and their customers. Additionally, farmtech startups in India are addressing the impacts of climate change such as extreme heat and drought.

Farmtech includes all technologies used by farmers in their operations. The vast majority of these categories are upstream, close to the farm or lab. Two exceptions include farm-to-consumer eGrocery and agrifood finance.

India’s top farmtech deals

“With the global population breaching the 8 billion mark and dwindling natural resources, food security challenges need to be addressed urgently,” Ecozen, which optimizes cold chain storage and irrigation, said in AgFunder’s report.

Top farmtech deals from the last 12 months (Aug. 1 2022 – Aug. 1 2023) reflect this urgency, with investors funding a mix of ag marketplaces, farm management systems and farm robotics, amongst other technologies.

Agribusiness marketplace DeHaat closed a $60 million Series E round in December led by Sofina Ventures and Temasek. [Disclosure: AgFunder is an investor in DeHaat.]

DeHaat is one of the fastest-growing startups in the agribusiness marketplace sector. Its AI-based platform serves more than 110,000 villages over 150 districts across India, with over 1.5 million users.

ReshaMandi, a B2B marketplace for the fiber supply chain, had the second-highest round with its $55 million Series B round. This was followed by a $25 million Series C round for the aforementioned Ecozen.

Farm management software and systems were prominent in India’s top rounds, with Aquaconnect ($14.5 Series A), Cropin ($13.7 million), WayCool ($11.8 million) and MoooFarm ($11.5 million) raising capital.

India’s top 10 farmtech deals all went to companies raising Series A or higher rounds, illustrating the maturation of startups in this area.