Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Startups in California — and more specifically Silicon Valley — scooped up almost half of all VC funding for US companies in 2022, according to AgFunder’s Global AgriFoodTech Investment Report 2023.

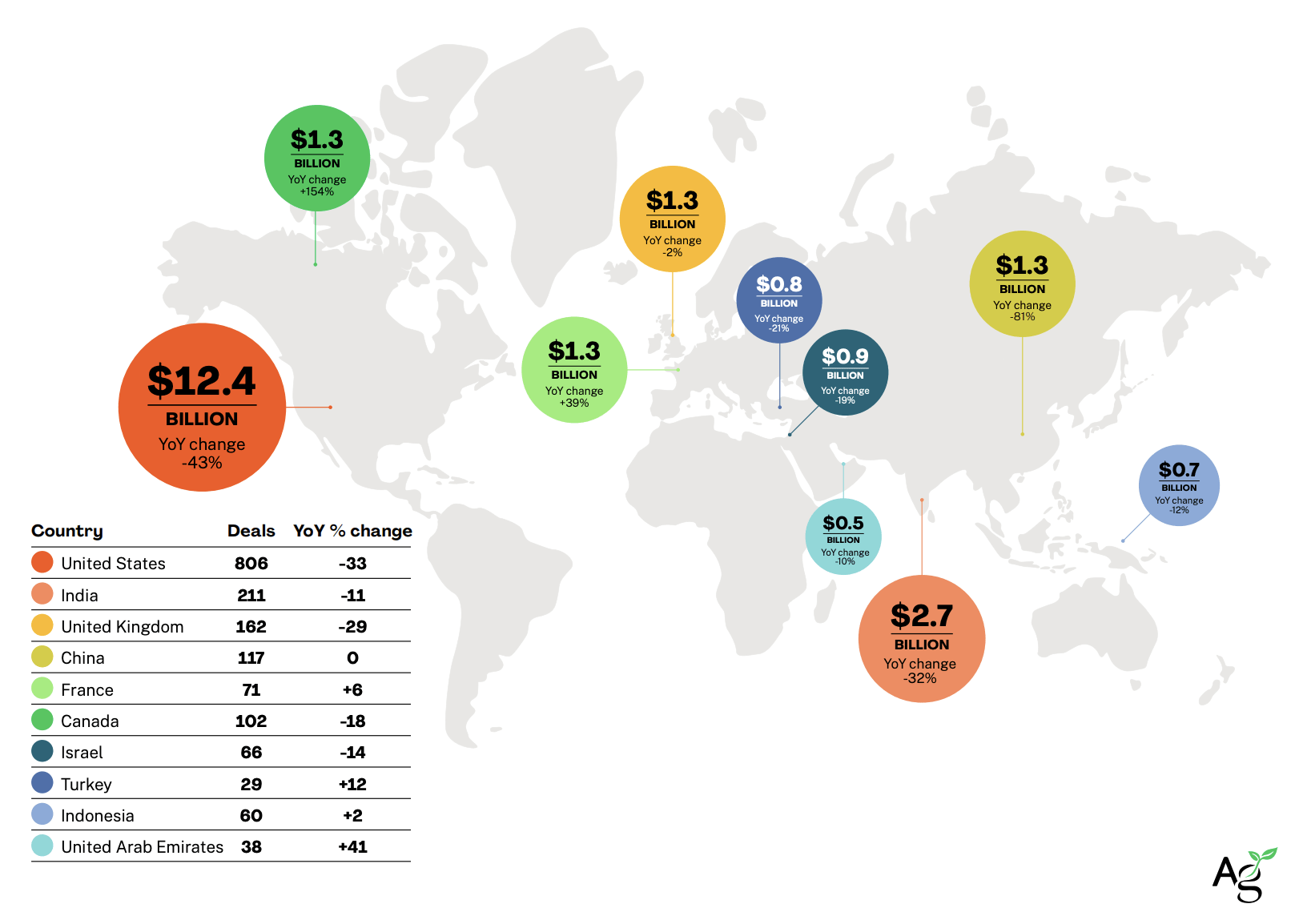

US startups raised $12.4 billion in funding last year; California startups took $5.3 billion of that capital, a figure almost twice as big as the second-largest global market, India.

California’s dominance shouldn’t surprise too much, given its deep roots both in agriculture and tech. The Golden State produces more than 400 commodities including dairy, rice and cattle in addition to more than one third of the country’s vegetables and three quarters of US fruits and nuts.

The San Francisco Bay Area, meanwhile, is home to agrifoodtech startups including Upside Foods, NotCo, Plenty and many others. Several of these startups raised some of the country’s top funding rounds in 2022.

Top California deals in 2022

Upside Foods (formerly Memphis Meats) bagged cultivated meat’s largest round last to date in 2022 with its $400 million Series C. The Bay Area-based company also scored the world’s first FDA approval for cultivated meat, though that is one step in the larger regulatory process.

Wildtype, a cultivated fish startup, completed a successful Series B round in 2022, and foodtech company NotCo landed $70 million for its plant-based meat and dairy substitutes.

Outside of alternative protein, Plenty raised $400 million for its vertical farming operation and two ag biotech startups, Sound Agriculture and Brightseed, made the top 15 for early-stage deals.

Worth noting is that 2021 was an outlier year for agrifoodtech investment. Fueled by temporary changes to consumer behaviors during the height of Covid-19, investors poured hundreds of millions into downstream categories such as eGrocery and In Store Retail & Restaurant Tech.

Those categories have since deflated drastically, and what funding there is at the moment has swam back upstream to companies closer to the farm and lab.

Case in point: Grocery startup Weee! raised $425 million at the start of 2022, before the sector went belly up.

| Company | Category | Series | Amount |

| Weee! | eGrocer | E | $425 million |

| Upside Foods | Innovative Food | C | $400 million |

| Plenty | Novel Farming Systems | Late | $400 million |

| Xpansiv | Ag Marketplaces & Fintech | Debt | $400 million |

| SpotOn | In-store Retail & Restaurant Tech | Late | $300 million |

| MycoWorks | Bioenergy & Biomaterials | C | $125 million |

| GrubMarket | eGrocer | Late | $120 million |

| Afresh | In-store Retail & Restaurant Tech | B | $115 million |

| Wildtype | Innovative Food | B | $100 million |

| Kitchen United | Cloud Retail Infrastructure | C | $100 million |

| Capella Space | Farm Mgmt SW, Sensing & IoT | C | $97 million |

| Bear Robotics | In-store Retail & Restaurant Tech | B | $81 million |

| Sound Agriculture | Ag Biotechnology | D | $75 million |

| NotCo | Innovative Food | D | $70 million |

| Brightseed | Ag Biotechnology | B | $68 million |

Other states:

Other states in the US also drew in significant totals, such as New York, which beat other leading tech centers like the UK, China and France, with $1.7 billion raised.

Massachussetts and Illinois were on par with Israel at just under $1 billion.