Data Snapshot is a regular AgFunderNews feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research.

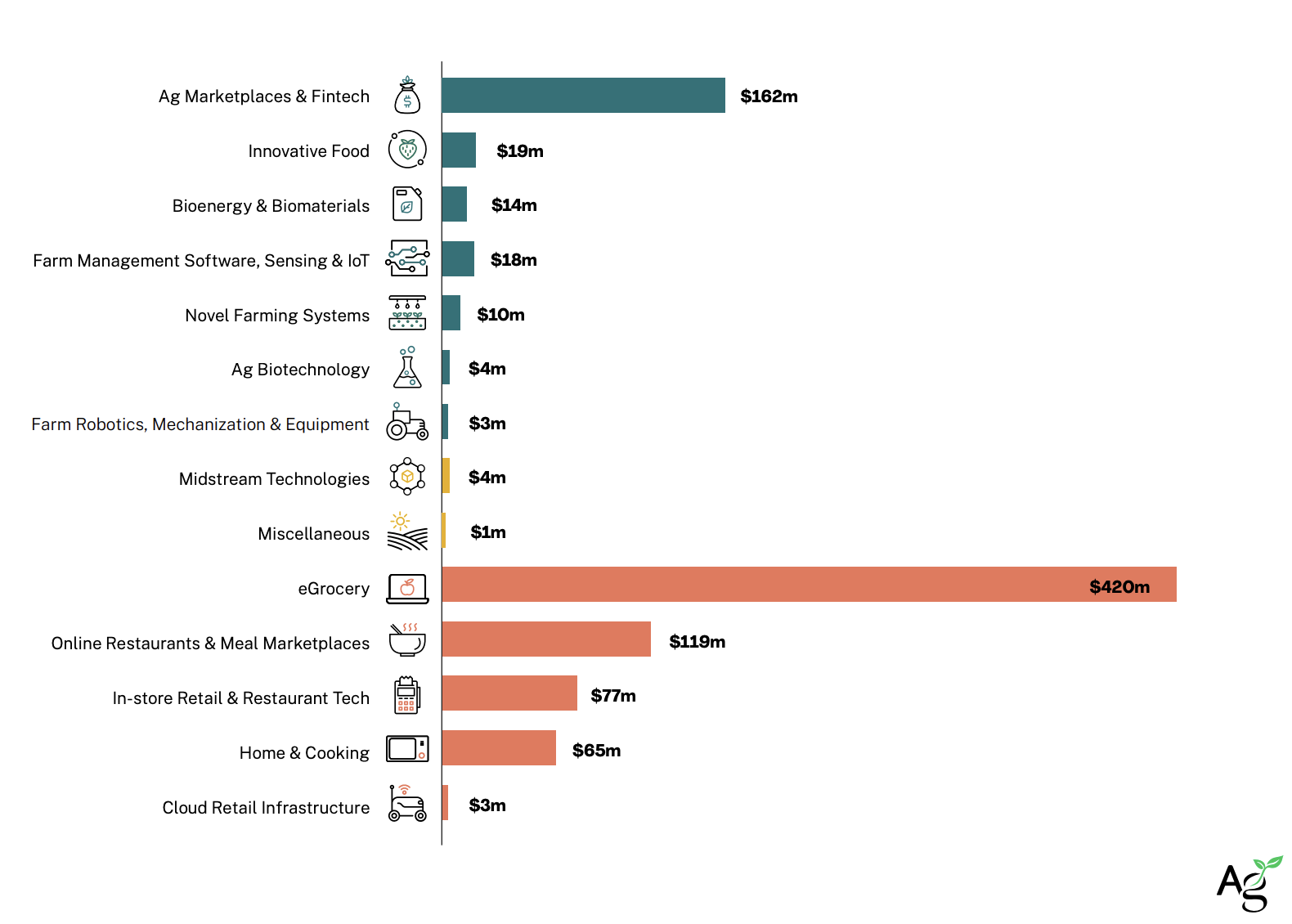

Startups in the eGrocery and Agribusiness Marketplaces & Fintech categories continue to dominate funding in India. The two categories accounted for 62% of the country’s total agrifoodtech funding in 2023, according to AgFunder’s India AgriFoodTech Investment report created in partnership with VC firm Omnivore.

This is a repeat from 2022, when the two categories combined took roughly half of all Indian agrifoodtech investment, according to the AgFunder/Omnivore investment report from that year.

The major difference this year — one that’s in keeping with global investment trends in and beyond agrifoodtech — is the sharp decline in funding faced by both sectors.

While eGrocery was still the most funded category, it saw a 46% year-over-year drop to $420 million. However, deal count, which was flatter in India versus other parts of the world, increased for eGrocery in 2023 vs 2022.

Agribusiness Marketplaces & Fintech startups raised $162 million in 2023. While that’s a hefty 62% decline from $428 million in 2022, the category was still the most-funded upstream one for India last year.

Other food-delivery-related categories such as Online Restaurants & Meal Marketplaces, and In-store Retail & Restaurant Tech, were also among the top-funded areas of Indian agrifoodtech in 2023.

Those aren’t surprising numbers, since food delivery in general has been a major business in India since Covid-19 lockdowns.

Arguably more interesting, however is the blurring of boundaries between agrifood and other segments, like fintech, biomaterials, and diet-related healthcare for Indian agrifoodtech. This is reflected in the growth of fintech marketplaces in the country as well as the emergence of Bioenergy & Biomaterials as a highly funded category.

India shoulders the climate burden more heavily than in other parts of the world. Within its borders, some 150 million-plus smallholder farmers still grapple with inefficient supply chains and lack of access to technologies that would boost the region’s agrifood space. Acknowledging the inherent connection between agriculture, food and other industries could bring more value (and money) to the former and reinforce the concept of holistic, planetary health.

Startup spotlight: altM talks Bioenergy & Biomaterials

Indian startups in the Bioenergy & Biomaterials category raised $14 million in 2023.

The category includes everything from renewable forms of energy to next-generation materials that could replace plastics and other synthetics harmful to the planet.

Bangalore-based altM uses post-harvest crop residue as raw material for biochemicals and biomaterials. The company’s goal is to unlock new income streams for farmers by monetizing crop residues that would otherwise be burnt or under utilized.

AgFunderNews (AFN): What agrifood challenges are you trying to solve and how?

altM: Using post-harvest crop residue as our primary raw material, altM creates highvalue biochemicals and biomaterials. This approach unlocks an additional income stream for farmers by monetizing crop residues that would otherwise be burnt or underutilized. altM contributes to the ecosystem by improving farmer sustenance and livelihoods.

AFN: How have you weathered the current venture capital downturn?

altM: [We] prioritize innovation, supply chain, and scalability in its quest to advance high-value biochemicals research and manufacturing. With this philosophy, we have stitched together our value chain that is well-positioned to achieve sustainable and scalable business metrics. This has helped us in attracting the right technical talent and investors despite the current capital downturn.

AFN: What does 2024 have in store for you?

altM: With our R&D facility fully commissioned and staffed through last year, 2024 will be about incrementally installing production capacity, maturing our product pipelines, and executing commercial trials with our customers.

We’ll additionally establish our IP portfolio and expand the team within all our primary workstreams – R&D, supply chain, engineering, ops, and sales.

AFN: What has your experience fundraising been like in the current climate?

altM: With the right technical talent and business vision, altM was able to attract the right VC capital and strategic investor base to realize its mission of accelerating the world’s transition to sustainable materials. altM raised a $3.5 million round in 2023, led by Omnivore.