Editor’s Note: Ricky Ashenfelter is CEO & cofounder of Spoiler Alert, a software platform that helps food businesses manage unsold inventory. Here he offers AgFunderNews readers an exclusive preview of a new free eBook the startup has published – A Strategic Guide for Using Data to Drive Food Loss and Waste Reductions.

Food waste is a hot topic today, and rightfully so. According to USDA estimates, about one-third of the US food supply goes to waste. But instead of discussing the problem, I want to talk about the opportunity that wasted food holds for the world’s largest food businesses — the manufacturers, wholesale distributors, and grocery retailers — that have the ability to impact the greatest volume of food through their direct operations and supply chains.

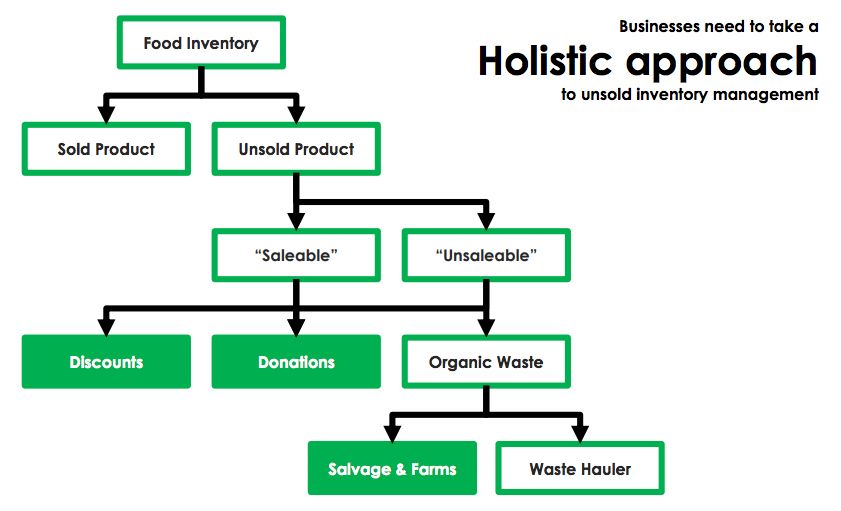

At these establishments, food waste occurs when unsold inventory is sent to landfill or other outlets whereby its value is greatly diminished. Circumstances that lead to unsold inventory are often outside of a company’s control, such as extreme weather (which we were reminded of by Hurricanes Harvey and Irma), customer demand fluctuation, or other operational complexities. These products are usually safe and edible, but lacking a market. Consequently, it is important to recognize that not all unsold inventory is unsaleable and that not all unsaleable product or byproduct needs to end up as waste.

How businesses go about managing unsold inventory greatly impacts their ability to capture value from these products and reduce the volume of food sent to landfill. At Spoiler Alert, we believe a holistic food waste management strategy is the most effective and impactful solution, and implementing one requires tangible operational and financial data.

Data and unsold inventory management

For businesses seeking to reduce financial losses or recover value from unsold food inventory, two common options are liquidation (discounted sales) and donation. Incremental revenue, enhanced tax deductions resulting from food donations, and reduced waste disposal fees provide strong incentives for businesses to recover as much food as possible.

But most major food businesses either don’t have the standard operating procedures (SOPs) in place – carried out consistently across a portfolio of facilities – to manage a network of outlets effectively, or they lack the real-time responsiveness to the changing quantity of their food.

Making matters more challenging, food waste is a complex topic that touches many functional areas of a business. Aligning departmental stakeholders can be challenging, as each role has its own unique performance metrics and motivations for engaging. Sales and Merchandising personnel typically don’t care about a company’s landfill costs, just like Inventory Control and Food Safety teams aren’t compensated by tax deductions. What each does care about is their own job performance metrics. And the universal metric that translates from function to function is dollars (specifically, its influence on the company bottom line).

So how can a food business overcome these issues? Data, coupled with translating everything into financial impacts. We believe a better understanding of data enables greater optimization of outlets for unsold inventory. And businesses that take advantage of data will be better positioned to more clearly articulate what is at stake and what the potential return on investment (ROI) will be to reduce, recover, and redistribute.

Building the business case, calculating an ROI

In our new eBook, we are aiming to 1) educate food manufacturers, wholesale distributors, and grocery retailers on how to leverage relevant financial and operational data to capture value from unsold inventory, and 2) provide a simple set of formulae and methodologies to support investment in a food recovery or waste diversion program.

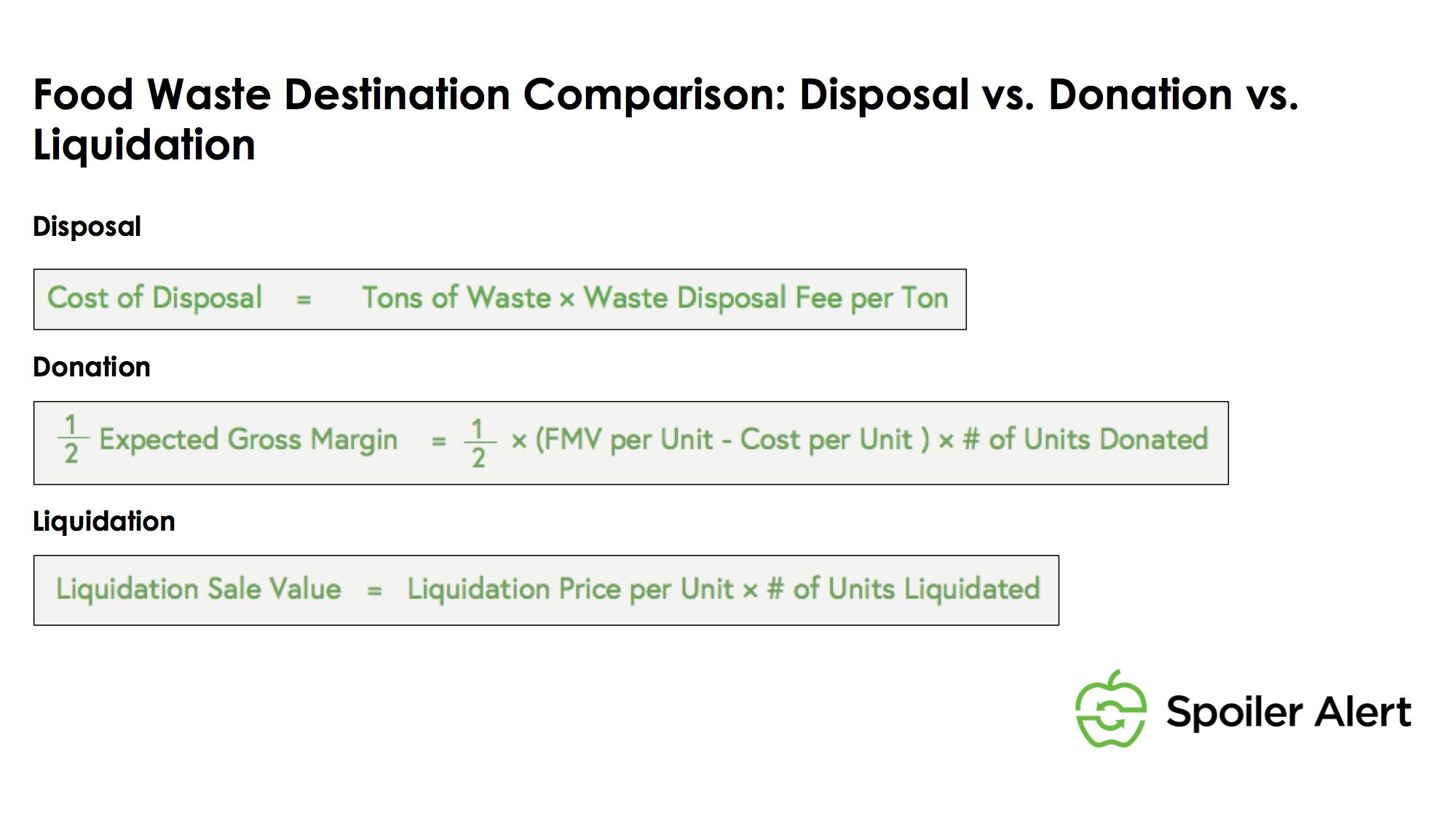

We emphasize that there are three tangible, financial benefits – measured in real dollars and cents – that businesses can use to build this business case:

1. Enhanced tax deductions from donating food to qualified non-profits. Businesses can capture half the gross margin of product as additional deductions, above and beyond the normal cost of goods write-off.

2. Lower waste disposal fees from volume reductions, regardless of whether food is sent to compost, landfill, or another final destination. From 2016-2017, average costs associated with municipal solid waste disposal increased in certain geographic areas due to limited landfill capacity.

3. Incremental revenue achieved through liquidation markets, selling product at a discount to discount retailers, dollar stores, and/or nonprofits (among others).

These ‘dollars’, however, are not comparable on a 1:1:1 basis. Tax deductions do not equal cash; lowering operating expenses is not pure profit; new top line revenue is not the same as bottom line impact. So as not to bring back nightmares from Accounting 101, we present a simple set of equations that can be used to compare these benefits (apples-to-apples, as they say… pun intended) and determine the most optimal financial outcomes.

Additional commentary on these equations, as well as an explanation of how this translates on an income statement, are included in the guide. Our hope is to convey that businesses should have no excuses for showing how effective (or ineffective) food waste management can impact their bottom lines and profit margins. And by communicating these impacts through the lens of the income statement or a company’s P&L, CFOs and finance teams will be better positioned to grasp the true impacts of food loss and waste.

It is time for food businesses to be proactive, not reactive, and discover the business case buried underneath all of that waste. Data should be used to set a clear path for improvement and achieve company-wide benefits.

You can download the free eBook here.

Using Data to Unlock Opportunity from Food Waste

September 25, 2017

Ricky Ashenfelter

Editor’s Note: Ricky Ashenfelter is CEO & cofounder of Spoiler Alert, a software platform that helps food businesses manage unsold inventory. Here he offers AgFunderNews readers an exclusive preview of a new free eBook the startup has published – A Strategic Guide for Using Data to Drive Food Loss and Waste Reductions.

Food waste is a hot topic today, and rightfully so. According to USDA estimates, about one-third of the US food supply goes to waste. But instead of discussing the problem, I want to talk about the opportunity that wasted food holds for the world’s largest food businesses — the manufacturers, wholesale distributors, and grocery retailers — that have the ability to impact the greatest volume of food through their direct operations and supply chains.

At these establishments, food waste occurs when unsold inventory is sent to landfill or other outlets whereby its value is greatly diminished. Circumstances that lead to unsold inventory are often outside of a company’s control, such as extreme weather (which we were reminded of by Hurricanes Harvey and Irma), customer demand fluctuation, or other operational complexities. These products are usually safe and edible, but lacking a market. Consequently, it is important to recognize that not all unsold inventory is unsaleable and that not all unsaleable product or byproduct needs to end up as waste.

How businesses go about managing unsold inventory greatly impacts their ability to capture value from these products and reduce the volume of food sent to landfill. At Spoiler Alert, we believe a holistic food waste management strategy is the most effective and impactful solution, and implementing one requires tangible operational and financial data.

Data and unsold inventory management

For businesses seeking to reduce financial losses or recover value from unsold food inventory, two common options are liquidation (discounted sales) and donation. Incremental revenue, enhanced tax deductions resulting from food donations, and reduced waste disposal fees provide strong incentives for businesses to recover as much food as possible.

But most major food businesses either don’t have the standard operating procedures (SOPs) in place – carried out consistently across a portfolio of facilities – to manage a network of outlets effectively, or they lack the real-time responsiveness to the changing quantity of their food.

Making matters more challenging, food waste is a complex topic that touches many functional areas of a business. Aligning departmental stakeholders can be challenging, as each role has its own unique performance metrics and motivations for engaging. Sales and Merchandising personnel typically don’t care about a company’s landfill costs, just like Inventory Control and Food Safety teams aren’t compensated by tax deductions. What each does care about is their own job performance metrics. And the universal metric that translates from function to function is dollars (specifically, its influence on the company bottom line).

So how can a food business overcome these issues? Data, coupled with translating everything into financial impacts. We believe a better understanding of data enables greater optimization of outlets for unsold inventory. And businesses that take advantage of data will be better positioned to more clearly articulate what is at stake and what the potential return on investment (ROI) will be to reduce, recover, and redistribute.

Building the business case, calculating an ROI

In our new eBook, we are aiming to 1) educate food manufacturers, wholesale distributors, and grocery retailers on how to leverage relevant financial and operational data to capture value from unsold inventory, and 2) provide a simple set of formulae and methodologies to support investment in a food recovery or waste diversion program.

We emphasize that there are three tangible, financial benefits – measured in real dollars and cents – that businesses can use to build this business case:

1. Enhanced tax deductions from donating food to qualified non-profits. Businesses can capture half the gross margin of product as additional deductions, above and beyond the normal cost of goods write-off.

2. Lower waste disposal fees from volume reductions, regardless of whether food is sent to compost, landfill, or another final destination. From 2016-2017, average costs associated with municipal solid waste disposal increased in certain geographic areas due to limited landfill capacity.

3. Incremental revenue achieved through liquidation markets, selling product at a discount to discount retailers, dollar stores, and/or nonprofits (among others).

These ‘dollars’, however, are not comparable on a 1:1:1 basis. Tax deductions do not equal cash; lowering operating expenses is not pure profit; new top line revenue is not the same as bottom line impact. So as not to bring back nightmares from Accounting 101, we present a simple set of equations that can be used to compare these benefits (apples-to-apples, as they say… pun intended) and determine the most optimal financial outcomes.

Additional commentary on these equations, as well as an explanation of how this translates on an income statement, are included in the guide. Our hope is to convey that businesses should have no excuses for showing how effective (or ineffective) food waste management can impact their bottom lines and profit margins. And by communicating these impacts through the lens of the income statement or a company’s P&L, CFOs and finance teams will be better positioned to grasp the true impacts of food loss and waste.

It is time for food businesses to be proactive, not reactive, and discover the business case buried underneath all of that waste. Data should be used to set a clear path for improvement and achieve company-wide benefits.

You can download the free eBook here.

Join the Newsletter

Get the latest news & research from AFN and AgFunder in your inbox.

Related Stories

Notes from the food-health nexus: how can we get consumer pull for nutrient density?

From food scraps to shrooms: Afterlife Ag builds circular solution for restaurant waste

Utah-based startup Prism helps restaurants tackle food waste with novel storage tech

Ripelocker strikes deal with global berry producer Agrovision to roll out shelf-life extension tech

Get the latest news and research from AFN & AgFunder in your inbox.

Follow us:

Sponsored Content

Sponsored

Sponsored post: The innovator’s dilemma: why agbioscience innovation must focus on the farmer first

Editor's Pick

‘Four more years of chaos’ or a ‘historic opportunity’? Food & ag organizations respond to Trump victory

Frankly Speaking

Trump’s tariffs won’t help US agrifood industry, says ex-Congressman Charlie Dent: ‘There are no winners’

Data Snapshot

From novelty to necessity? The evolution of insect farming

Investor Insight

🎥Foodtech investing: ‘You can’t escape the fundamentals. You have to produce something that adds significant value’

Meet the Founder

BioDefense seeks to disrupt seafood market with ‘tasteless, odorless, and invisible’ coating that can boost shelf life 2-3x

Research & Data

NEW REPORT: Asia-Pacific agrifoodtech funding recovers with 38% YoY increase to $4.2bn so far in 2024