- New VC firm FLORA Ventures has made a $50 million first close of an $80 million fund for early-stage agrifoodtech startups.

- The Israel-based firm will invest in companies working across the agrifood value chain in Europe and Israel.

- A key anchor investor to the fund is the Sadot Kibbutzim co-op.

- Other anchor investors include fertilizer and plant nutrition company Haifa Group, and Harel Group, one of Israel’s largest institutional investors.

‘We took a different approach to fundraising’

One of the key anchor investors to FLORA’s new fund is the Kibbutzim, a community unique to Israel that has traditionally been based in agriculture, FLORA founding partner Gil Horsky tells AgFunderNews.

For himself and co-founder Esther Barak-Landes, this was a natural fit.

“It’s the first fund they’ve [backed] as a total group,” he says. More than 185 Kibbutzim (of an estimated 250 in existence) came together as a single investor for the FLORA fund. As a whole, the group has an agricultural output of more than $3 billion exported to over 100 countries, according to FLORA.

Ag’s original innovators

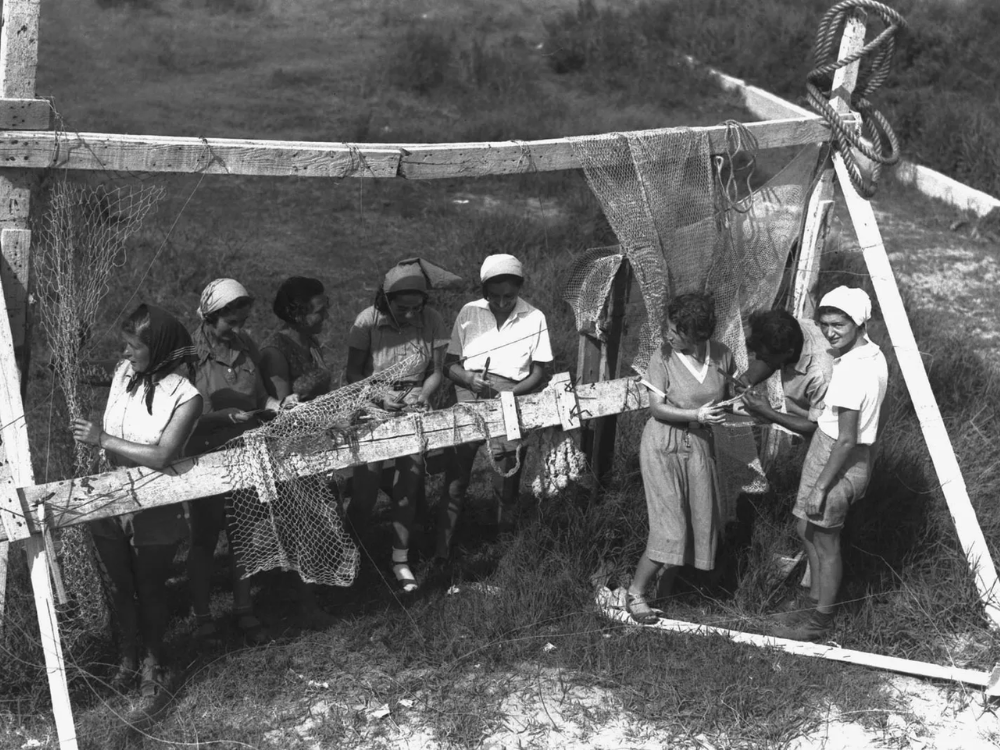

The first Kibbutz (from “kvutza,” the Hebrew word for group) was established nearly a century ago in what is now Israel. The community has traditionally been based primarily on agriculture — including crops, dairy and fish farming — along with concepts of collectivism and shared wealth.

The Kibbutzim have from the outset been ag innovators by necessity, suggests Horsky. Israel’s geography is a mix of mountains, sea and desert; the latter, in particular, is especially unsuitable for farming.

“Out of that problem, the Kibbutzim invented a lot of very large companies in agriculture,” says Horsky.

For example, Israel invented drip irrigation as we know it, leading to the creation of Netafim, one of the world’s largest companies offering irrigation systems and solutions.

Along the way, the Kibbutzim began to invest in startups. “The first path they chose was agriculture and food because that’s where their heritage came from,” says Horsky.

But while the Kibbutzim “put a significant amount of money” into the fund, the community will provide much more than finances to FLORA and its portfolio.

“They’re using FLORA as a way to merge older [agricultural] practices with technology,” notes Horsky. “They were always very innovative, but now they understand the need to adapt it to this new world of foodtech and agtech: autonomous tractors or biotech or green fertilizer.”

Design partners

For its part, FLORA gets the ultimate partner when it comes to due diligence.

“We’re looking to invest in companies and proof test them with the Kibbutzim as a design partner,” says Horsky. “Once they have the proof of concept on a small scale with the right Kibbutzim, then we help them scale globally.”

By way of example, he mentions a dairy-focused startup on which the FLORA team has been conducting due diligence.

“All the Kibbutzim today have 40 dairy farms, which we can call to get answers. Then, if we decide to invest, we have 40 dairy farms we can choose from to be the design partner to test the technology and be the first customer.”

This setup benefits the startups too. “When you are a young startup with an early stage technology, you’re actually much better set working with a smaller, agile design partner than a conglomerate.”

Himself a former Mondelēz executive and corporate venture investor, Horsky understands the challenges of integrating startups with huge companies. “With a conglomerate like Nestlé or Mondelēz, [startups] immediately have to scale and everything has to work perfect. But you actually want to do your mistakes or your fine tuning with a small design partner before you go to the big ones.”

Investing in tomorrow’s tech

The FLORA fund invests in pre-seed to series A startups, according to Horsky. Check size falls between $1 million and $4 million based on the stage of the company.

For now, FLORA is investing mainly in startups from Europe and Israel with the goal of helping them eventually scale to the US.

“We believe that good companies in these regions need to scale to the US,” he says. “That’s where the growth funding is, that’s where the big market is and the M&A.”

While the fund’s high-level thesis is to invest across the agrifood value chain, FLORA has zeroed in on “emerging spaces” as a focus area.

“Food as medicine” is one such area, says Horsky.

“We believe that in the coming years, that’s going to become a big investment thesis. We’re seeing more and more entrepreneurs coming from biotech, and the lines are morphing between over-the-counter drugs, functional foods, and even supplements. It’s not a big space yet. But that’s a space we want to serve and are betting on now because it’s just before an inflection point.”

Regenerative agriculture is another such emerging space: “Everybody’s talking about it. But we’re just starting to see now the first companies that are starting to crack the business model.”

Higher-level buckets listed on the FLORA Fund website include food security, digitization, personalized food and nutrition, and the circular economy.

The first company to join the FLORA portfolio is a stealth-mode startup called Arrakis Bio. Coming out of Tel Aviv University, the company has “a very disruptive technology in the space of collagen and gelatin,” according to Horsky.

He adds that FLORA, which is just a few months old, has already looked at around 400 companies and has another two or three startups holding a lot of promise.

“I believe that by the end of the year, we’ll make at least two more investments if not three,” he says.