Temasek is setting up a dedicated agrifood vehicle to drive and manage investment into food and agriculture-related businesses, including tech startups.

The Singapore sovereign fund’s managing director for agribusiness, Anuj Maheshwari, told Bloomberg the new platform will help its agrifood portfolio companies build operational capabilities, ramp up manufacturing, and enhance availability of their products in the marketplace.

“The startups […] have realised there are products that customers can accept, but they need to be scaled up – and that’s where capital will be required. The platform will probably have a role to play in that,” he said.

It isn’t yet clear if the new vehicle will be wholly or partly owned by Temasek, or if it will take over the fund’s existing stakes in agrifood businesses.

However, it wouldn’t be the first time the Singaporean outfit has created specialist platforms to manage its investments.

It launched Pavilion Energy in 2013 to focus on liquefied natural gas and joint venture O2 Power to run its Indian renewable energy businesses earlier this year.

In August, it teamed up with Bayer to form Unfold, a company focused on developing seed varieties for controlled environment agriculture.

Read more about Unfold CEO John Purcell’s views on tech convergence, startup culture, and seed science here

Recently, the sovereign fund has also linked up with Singapore’s Agency for Science, Technology, and Research (A*STAR) to establish a new foodtech innovation center in the city-state.

Speaking at an event on the sidelines of last week’s online Asia-Pacific Agrifood Innovation Summit, Maheshwari said that the two parties had signed a memorandum of understanding to “explore” the creation of a foodtech R&D center.

“It will include [bioreactors,] test kitchens, and other kinds of shared resources. The goal is to bring promising technologies to market as quickly as possible, and also to bring investors from around the world to Singapore,” he said.

$5bn in agrifood investments

During the event, Maheshwari gave an overview of Temasek’s growing and by-now formidable portfolio in agrifood.

The fund has invested close to $5 billion in the sector over the past five years, backing around 40 companies ranging from cutting-edge, deep-tech startups like Pivot Bio and Tropic Biosciences, to the new wave of alt-protein brands like Impossible Foods and Perfect Day – as well as established global agribusinesses such as Bayer and Olam.

The onset of Covid-19 and subsequent supply chain disruption encouraged Temasek to look at its agrifood strategy differently, Maheshwari explained.

“2020 has of course been a strange year. But I think it has also thrown open a lot of challenges as well as insights about humanity and how we have lived on our planet over the centuries and millennia,” he said.

“One area where we’ve seen the vulnerability of our existence is the food system, and how we feed ourselves in the face of the challenges ahead of us.”

Temasek now views its agrifood business through “a broader lens of not just being an investor and generating shareholder returns. We look at purpose too,” Maheshwari said.

The fund’s investment strategy is built around four “core themes” when it comes to technology: sustainable proteins, supply chain resilience, affordable nutrition, and urban food systems.

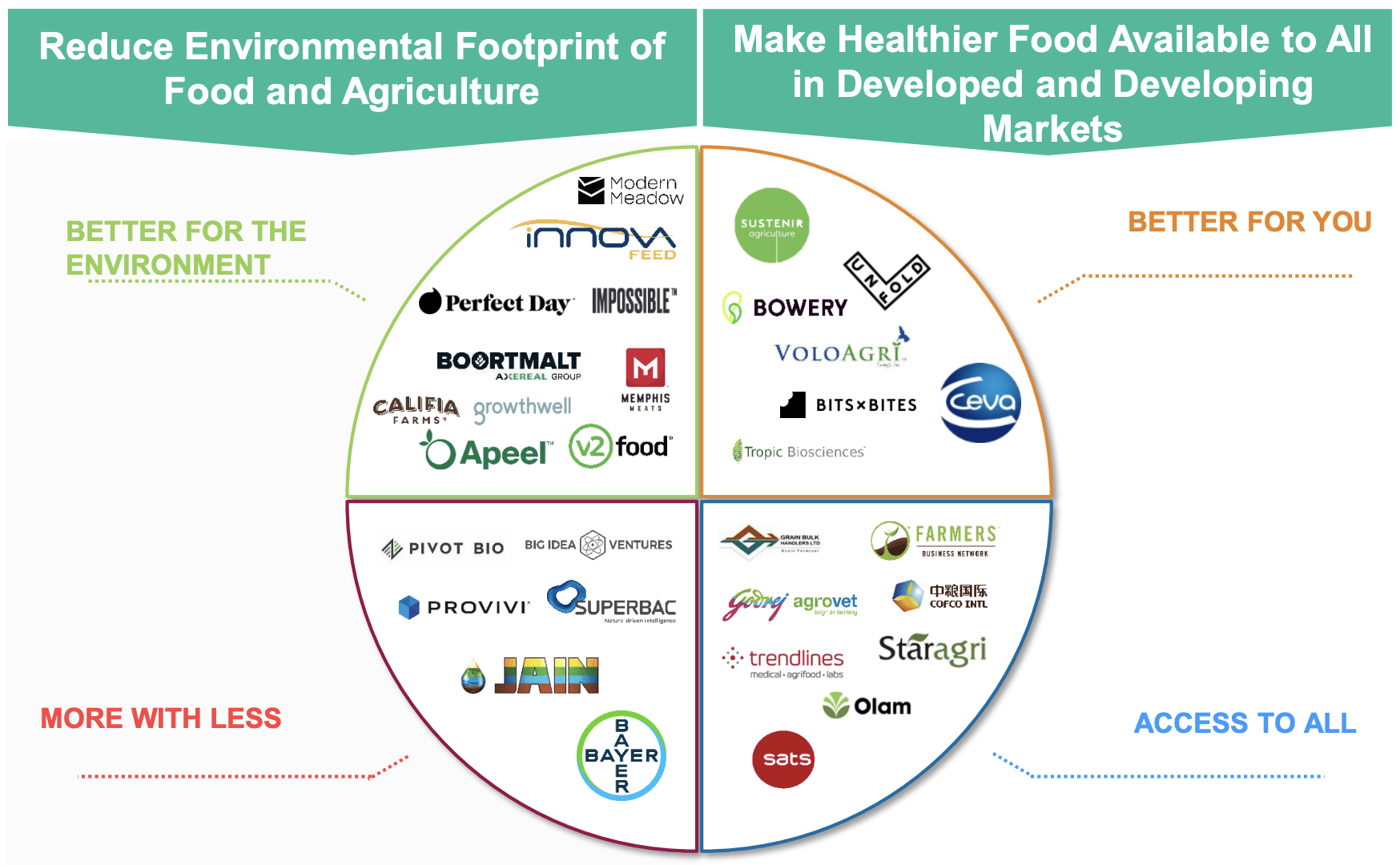

It also views its investments as fitting into one of four interrelated “aspects” directed towards societal impact.

Two of these aspects are targeted at reducing the environmental footprint of food production (‘Better for the environment,’ which includes alt-proteins and food waste reduction tech; and ‘More with less’ which covers technologies bringing greater efficiency to agriculture.)

The other two are aimed at increasing access to nutrition (‘Better for you,’ covering production of fresher, healthier, and more nutritious foods; and ‘Access to all,’ which includes agribusiness, agri-commodities trading, and logistics.)

‘A strange year’

Referring to the last of these aspects, Maheshwari said that resiliency has been Temasek’s byword.

“One particular way in which I believe very strongly this can be achieved is digitalization, the digital enablement of the food system – our ability to move quickly between demand and supply, to give us information which can be [an] additional buffer and [allows us] to move fast when hit by unexpected events like Covid-19,” he said.

“Secondly, our agricultural system should start following the population growth and demographic changes we’re seeing. A hundred years ago the world [population] was largely rural. Today, it’s largely urban, everything is condensed – however that dependence on a vast, rural agriculture system stays.”

The experience of Covid-19 will create an “acceleration towards” urbanized agrifood systems, such as tech-enabled vertical and indoor farming, Maheshwari said.

“The pandemic is a reminder of the vulnerability of global supply chains, especially when borders close up,” said Yeoh Keat Chean, Temasek’s senior director for enterprise development, also speaking at the event.

“That ability to produce on a city-by-city basis, track and trace where food comes from, [and] developments in terms of food manufacturing — for instance, alternative proteins — really creates an exciting opportunity for [a city like] Singapore to produce actually more than it needs,” he said.

“In other industries like aerospace and manufacturing, Singapore provides vital components for other countries. There’s no reason we can’t do the same for alt-proteins,” Yeoh said, adding that precision fermentation and production of plant-based proteins would be the initial focal points for the fund’s foodtech collaboration with A*STAR.

Singapore led ASEAN with $177 million funding for agrifoodtech startups last year. Read more here

Nevertheless, most of the companies in Temasek’s agrifood portfolio come from outside of Asia Pacific.

“[Our] investments so far are where the opportunities have been – which happens to be in Western countries. But we’re starting to see more opportunities in Asia,” said Yeoh.

“It takes time to build up a pipeline; that’s why we’ve invested in accelerators. The innovation center [with A*STAR] will help with that.”

Singapore’s “very forward-looking” regulatory environment should also help speed up the development of local and regional players while also attracting outsiders to set up shop in the city-state, Yeoh said, adding that the Singapore Food Agency was the first food watchdog in Asia to approve Impossible Foods’ products.

Got a news tip? Email me at [email protected] or find me on Twitter at @jacknwellis