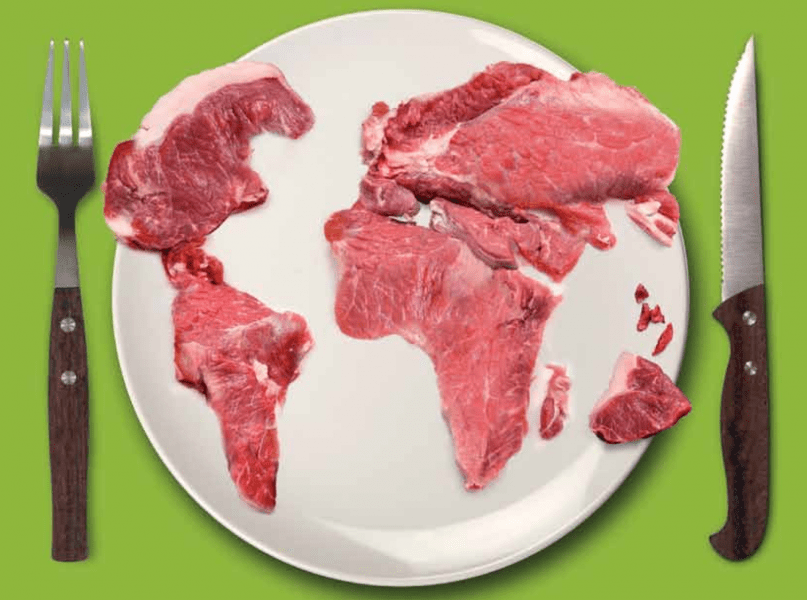

When it comes to the meat industry, a lot of us know the basics—demand is increasing, especially in developing countries, and resources are decreasing. But what are the deets? Who will benefit, what will the industry look like in 10 years, and most important for investors, where are the opportunities? One report has a lot of the answers.

The Meat Atlas, a report released this month by Heinrich Böll Foundation and Friends of the Earth, details meat market demand, production and suggests what might be in store for the next 10 years. If you have time, it’s an interesting read. If not, here’s a run down on what the report had to say.

Meat production is the largest segment of US agriculture. It has the retail equivalent value of $85 billion. One-third of the world’s 14 billion hectares of cultivated land is used to grow one billion tons of feed. Even more astounding, 70 percent of all ag land is dedicated to raising livestock.

“In the industrialized world, it’s easier to grab a burger than a salad,” the report said. The demand for meat in Europe and North America is saturated. In fact, there’s been a 9 percent drop in consumption of meat between 2007 and 2012 in the US.

Industrialized countries are demanding less meat, but better quality. And that’s where significant opportunities arise. Startups focused on providing better quality meals are cropping up everywhere and are competing with the mega-meat industry that had reign over mass meat production since the 1950s. (Check out some of those startups here.)

But for less industrialized countries, meat demand continues to rise. In Asia, poultry demand is expected to increase sevenfold by 2050. The biggest reason for this dramatic increase is largely thanks to India, where consumption is expected to rise by nearly tenfold.

BRICS (Brazil, Russia, India, China and South Africa) too, is another huge demand factor, as it accounts for 40 percent of the world’s population. Between 2003 and 2012, BRICS’s meat consumption rose by 6.3 percent a year, and is expected to rise by another 2.5 percent a year between 2013 and 2022.

This shifting demand and production means there are new opportunities. The United States is the world’s largest producer of meat, producing about 26 billion pounds of beef per year, but it looks like that’s about to change. (In fact, it’s already changing. Production decreased by as much as 6 percent in 2013, and it is expected to continue the decline.)

Because beef is much more expensive to raise, due to the demands of more land, feed and water, industrial poultry is the fastest growing sector. The report wrote that poultry consumption will make uphalf of the world’s consumption by 2022.

And it’s not the US that is going to be leading the production of all that meat. China is expected to take the lead, increasing its current production by 37 percent. Brazil won’t be far behind, growing by 28 percent. By 2020, the global production is estimated to be 124 million tons. (That’s an increase of 25 percent in just 10 years!)

So, where’s all the money going?

JBS. (Or, at least significantly.) JBS is the world’s largest meat producer and in 2013, when it acquired Seara Brasil, the world’s largest chicken producer, it took hold of the cleaver. The company’s food sales totaled $38.7 billion dollars in 2012.

This mega-company is indicative of the bigger picture: it’s only a handful of huge commercial companies that run the majority of the world’s meat production. According to the Meat Atlas, “Four firms account for 97 percent of poultry R&D…. Two companies control an estimated 94 percent of the breeding stock of commercial layers. Two companies supply virtually all of the commercial turkey genetics.”

And to cut through the report’s eloquent language, that’s just not good. With just 30 species dominating the world’s consumption, there are significant health, environmental and financial risks. It’s hard to ignore that mass production brings down costs, causing tension between the consumer wanting lower prices, yet better quality, and the producer looking at their own bottom line. But no matter how you slice it, the mega-meat producers own the market.

“It is virtually impossible for the consolidated industry to coexist with small producers,” the report said. “Multinational structures both wipe out a critical source of income for the global poor, and they radically diminish consumer choices. Through economies of scale, concentration offers greater profit potential for stockholders and financiers; for other stakeholders, however, it increases risks to human health (including antibiotic resistance), food safety, animal welfare, the environment, water security, labour security and innovation.”

But with a shifting demographic demand, this could change significantly and provide new opportunities for smaller industry, especially within relatively new sectors. Aquaculture is a prime example, and is the fastest growing sector in ag.

There are also signs that many startups are taking creative steps to compete with large-scale commercial farming. Startups such as Henlight are taking steps to develop better methods of poultry production for small-scale farmers. And then there are those like Dr. Mark Post, who’s backed by Sergey Brin and has made lab-grown beef.

Last but certainly not least are those startups that are providing what they’d call superior products. That is, products that are like meat, but aren’t.

Startups such as Beyond Meat, Modern Meadow, and Hampton Creek Foods, all food companies focused on substitute meat products, have taken off. For example, Hampton Creek Foods, a Bill Gates-backed venture that has successfully developed egg-substitute from plant-based products, has raised $3M in seed money from Khosla Ventures and Founders Fund. Modern Meadow is a company developing alternative meat, and is backed by mega-investor Peter Thiel’s Breakout Labs.

Competing with the big commercial meat producers is ambitious, but clearly profitable. These are the types of ventures US investors are looking towards as the US meat demand and production wane, and as the only demand rising is that for innovation.

Featured photo and graphics come from the Meat Atlas Report.