Aerial imagery and agronomic intelligence platform Intelinair has closed a $20 million Series B round of funding in its second-ever external round of funding, AFN can exclusively reveal.

Data-focused growth-stage investor Regulator Group invested alongside biosciences firm Scientia Ventures, farmland-owning family office Takiff, and Canada’s SDMC Ag. Various senior executives from the ag and artificial intelligence industries, including the ex-CEO of Dow AgroSciences (now Corteva) Tim Hassinger, who is on the startup’s board, also invested.

The news comes on the heels of Intelinair’s relocation of its headquarters to Indianapolis from California as it continues to focus its growth on Midwest farming and retailer clients.

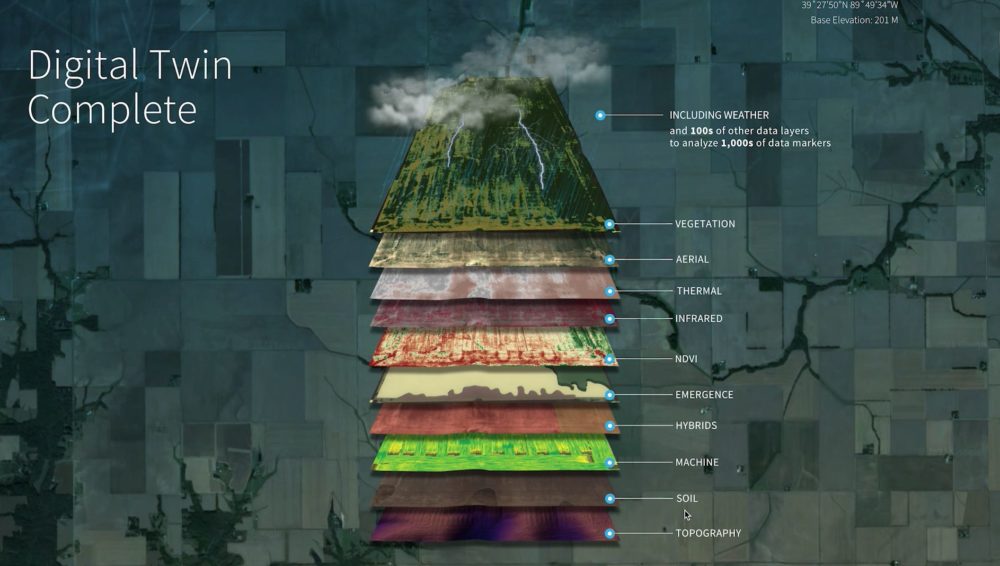

Intelinair’s main product is AGMRI, an agronomic insights platform using a variety of datasets but centered on imagery captured from airplanes, which the startup arranges for clients. Using machine learning and artificial intelligence, AGMRI promises to “find issues before they become problems” by giving farmers alerts throughout the growing season. These alerts cover things like crop emergence problems that may require replanting, the identification of herbicide-resistant weeds or nutrient-deficient crops, and drydown rates that may impact harvest timing. The tool can also help farmers respond to those issues by sending detailed instructions to their machinery – such as a precise herbicide prescription to the sprayer to respond to disease outbreaks.

Intelinair plans to use part of the Series B proceeds to further expand its team; it says it has already added six “experienced leaders” in the past six months, and plans to appoint at least three more before the end of the year, according to a press release.

It’s also using the funding to further develop its tech capabilities, including through partnerships that will increase the resolution of the aerial imagery it ingests.

How the digitization of ag will increase food’s sustainability, with IntelinAir’s Al Eisaian – listen to the podcast here

The Hassinger effect

Hassinger told AFN that during his due diligence calls with customers before joining Intelinair, the feedback he received was that AGMRI’s ability to pinpoint issues is valuable not just for mitigating yield loss but also for increasing farm productivity.

“A large farming client that manages a very large area of land told me that they start each day looking at the results of AGMRI to determine where their agronomists should go that day, which results in many miles of driving saved,” he said.

Hassinger added that because the technology is already proven, the next phase is about growing the company further – which interested him personally as somewhere he could bring value.

Intelinair’s current footprint is not to be sniffed at. The company brings in millions of dollars in revenues, according to CEO Eisaian, across nearly 5 million acres. It expects to increase this to over 8 million next year.

However, Hassinger’s involvement since March has resulted in a complete overhaul of Intelinair’s positioning, messaging, and sales processes for the better.

“In the last three months, the quality of our business development and partnership conversations has been an order of magnitude better than before,” Eisaian told AFN.

“[Compared to me, Hassinger] has the depth of ag knowledge to understand where the opportunity sets exist and how to win business. I’m a software guy, versus an ag guy. Those qualitative relationships are changing the nature of our deals and the scaling of the company.”

One specific nugget that Eisaian and his team learned from Hassinger is that the selling season for US farmers starts right at harvest and that by January, when Intelinair previously tended to start its sales process, they will have already spent most of their money for the new growing season.

“That should double our revenues,” said Eisaian.

The carbon question

While Eisaian and Hassinger expect AGMRI will continue to drive the business — and they plan to keep adding new capabilities to it — there are another two pillars that they plan to scale.

These include a carbon measurement and farming practices verification tool to meet the increasing clamor around carbon sequestration. The other is a broader aggerated data intelligence tool for non-farmer clients, such as traders and governments, that want high-level information about the impact of climate change and other events on the global supply of commodity crops. Eisaian said Intelinair could be “the back office” for startups offering a similar service — like New York’s Gro Intelligence — and would not necessary be deemed their competitor.

On the carbon topic, Eisaian said Intelinair will be cautious about dedicating too many resources while “the jury is still out.”

“We won’t be a carbon marketplace; we could be the analytics and insights company that powers other companies,” he said.

“Given the granular nature of what we capture and the volume of the stuff we capture, we know a lot about what a farmer did – and we’re also talking to people doing soil sampling efficiently and how we could combine with them. But [that] is not solidified yet.”

Hassinger added that carbon farming has “exciting potential” but lacks “clarity of direction and value to businesses.”

As such, Intelinair sees its agronomy offering as its primary focus, he continued. “As time goes on and as we are exploring and participating on projects in the carbon space, our clarity will get better going forward – and then we can discover our role.”

To get there, “policy will be essential,” Hassinger added.

“The analogy I like to use is that of how the organic industry evolved in the US; there used to be so many different definitions that suppliers had a hard time knowing how to approach it. When the USDA came out with a certification, it added clarity to it; carbon will need to go through something similar so people know the rules of the game.”