Bharat Vasan is a partner and COO at The Production Board, a San Francisco-based venture capital firm and business foundry. Vasan has more than 20 years of experience at early-stage technology businesses and Fortune 100 companies. Reach him via twitter @bharatvasan.

The views expressed in this guest article are the author’s own and do not necessarily represent those of AgFunderNews.

I’ve spent my entire career building and investing in emerging technologies – but no amount of computing power or artificial intelligence could solve my most stubborn and shameful problem: My weight.

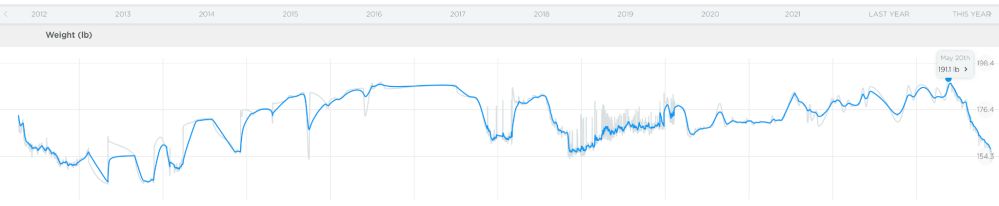

A decade of data shows constant yo-yoing:

2023 was the toughest year in at least a decade for business founders and investors. By June, I was working extreme hours, had no time to work out, and tipped the scales at the heaviest weight of my life. My doctor prescribed statins for high cholesterol. I needed to lose 20% of my body weight – a daunting, seemingly impossible task.

I threw in my lot with millions of people taking the new generation of weight-loss drugs such as Ozempic, Mounjaro, and Zepbound. These drugs already represent almost 8% of all scripts written in the US – and, according to Google trends, interest in the category is surging 500% annually, cutting across red and blue states and demographic lines.

The results of taking Ozempic stunned me.

Even before the weight rolled off, I discovered a previously unfathomable superpower – the willpower to resist food. These drugs mimic a naturally occurring hormone called GLP-1. As GLP-1 levels rise, your brain tells you you’re full. The drugs also slow digestion, so you simply don’t want to keep eating.

Deleting my cravings felt nearly as good as shedding pounds. The space in my brain usually spent ruminating about what to eat? Gone. I used the extra bandwidth to think more clearly, work out, and read.

Over four months, I lost nearly 40 lbs – a result I could not have achieved simply by diet and exercise. People noticed the change; I began to carry myself more confidently.

Even better: I was able to make lasting changes to my diet and exercise regimen and avoid the dreaded weight bounceback once I came off the drug. And I’ve kept the pounds off so far, even over the holidays.

My shrinking appetite changed my relationship with food: I eat smaller portions, more protein, more fiber (including leafy greens), and less greasy food. My Doordash habit evaporated. I stopped mindlessly grazing on snacks at the office and eating dessert at home.

GLP-1 could transform public health

But not everyone liked my transformation:

“You’re taking a shortcut.” “You’ll gain it all back.” “You’ll get addicted.” I heard this frequently – usually from people who have never struggled with their weight.

I quickly understood why so many semaglutide users are reluctant to discuss their weekly injections. It’s like plastic surgery or botox – widely accepted, yet discussed only in whispers.

But the power of GLP-1 is vastly more consequential than cosmetic surgery. It could transform public health as we know it, eradicating the most prevalent diseases in the industrial West: diabetes, pre-diabetes, obesity and other aspects of “metabolic syndrome.”

My prediction: The “Ozempic tidal wave” will be the largest consumer health trend of 2024 and will overhaul the US food system within five years. I believe as many as 100 million people will be on GLP-1 drugs by 2030 as costs drop and friendlier delivery mechanisms proliferate (pills debut later this year for people who dislike injections).

Being on Ozempic also forced me to revisit investment strategies in the food and consumer tech spaces. As a technologist and investor, I see several important trends emerging:

A new category of truly functional foods

GLP-1 drugs enable people to resist cravings and reduce the amount of food they eat. I cut my daily calorie consumption in half – and I never felt deprived. But to maintain health and prevent muscle wasting while eating less, I make every calorie count: I pivoted to protein-dense, greener, lighter options in moderate portions.

As a significant percentage of Americans go on GLP-1-boosting drugs, the broader food industry will likewise pivot toward nutrient-dense options across the spectrum – from snacks to restaurants to retailers. Walmart President Jeff Furner said just last quarter that the world’s largest retailer has already experienced “a slight pullback” on food spending from customers on weight loss drugs.

This new category of truly functional foods will overhaul the $500bn snack aisle, displacing nutritionally vapid junk foods and providing a healthy combination of fiber, protein and other nutrients. These foods may work alongside drugs or help people sustainably get off drugs.

Additionally, people coming off drugs will look for foods and ingredients that naturally mimic some of the effects of the drugs to avoid the dreaded “bounce-back.” Food companies will add satiety-boosting, all-natural ingredients such as resistant starch, oat beta glucans, and Korean pine nut oil into everyday foods. (Disclaimer: I’m an investor in Supergut, the only gut-health superfood clinically validated to diminish cravings and boost GLP-1 hormones – and the company has experienced record sales as people seek out GLP-1-boosting ingredients.)

My prediction: Functional foods that cater to GLP-1 users will become the fastest-growing segment of the US food market within the next half-decade. Even as food consumption per capita plunges for millions of GLP-1 users, this new category represents an unprecedented opportunity for food conglomerates and retailers – Pepsi, Nabsico, Walmart, 7-Eleven, etc. – which must pivot or lose market share and brand affinity.

Rise of GLP-1 services

Controversial take: GLP-1 drugs will become a constant or occasional staple in our lives. Many people will take the drugs weekly for the rest of their lives; others will go on and off GLP-1 drugs as needed – for instance, to slim down after challenging periods (such as work stress, pregnancy, surgery, hormonal changes in middle age, etc.), when diet and exercise alone fail.

This viewpoint presumes the drugs are proven safe over time, similar to statins. But unlike high cholesterol – a “silent” killer – weight is an ever-present factor that, for many people, correlates with confidence, mood, energy levels, and ability to move and participate in life.

The $250bn weight loss industry is quickly evolving to help people navigate a lifetime relationship with GLP-1 drugs. Consumer-facing companies such as Ro, Hims, Weight Watchers and Noom are rushing to add GLP-1 services – but these offerings remain shallow.

I predict that sophisticated, digital tools will incorporate biometric data and perhaps multimodal AI to qualify diet, to help subscribers stay healthy based on a full spectrum of metrics – age, current and past body mass index, allergies, food preferences (vegan, vegetarian, Mediterranean diet, etc.), and medical history (from cholesterol level to muscle mass to autoimmune disorders). We will also see these services partner with insurance providers, similar to how mental health services have evolved.

‘Pharm to table’

GLP-1 drugs represent one of the greatest post-pandemic opportunities in the pharma space. Novo Nordisk and Eli’s stocks have soared as adoption surges – and we haven’t scratched the surface of the US market.

Drug companies are already focused on improving access and lowering costs. Costs will come down through competition, insurance coverage and savings cards.

Eli Lilly recently launched LillyDirect, a direct-to-consumer digital healthcare platform, which connects consumers to pharmacies, telehealth providers and in-person counselors. Such efforts position Big Pharma as a node for more comprehensive care around GLP-1 use – and a badly needed opportunity to address the public’s deep distrust of Big Pharma in wake of its center role in the opioid epidemic, which has claimed hundreds of thousands of lives.

Perhaps tackling obesity could at least partially redeem the sector and generate a new ecosystem of physicians and service providers for responsible GLP-1 drug use. A big win for consumers would be for Big Pharma to push Big Food to reform the US food system, prioritizing nutrition above high-profit junk food.

Diabetes, pre-diabetes and obesity affect nearly 50% of all Americans. We should be appropriately skeptical about GLP-1s until they’re proven safe – but, as a serial entrepreneur and investor in consumer health and technology, I’m optimistic about a future in which market forces diminish our most prevalent and preventable diseases, and our food system becomes more nutritious. The future looks healthy.