Editor’s note: Seana Day and Brita Rosenheim are partners at Culterra Capital and venture partners at Better Food Ventures, each with 20-plus years of investment, M&A, and strategy experience in agrifoodtech. Their analyses on the agrifoodtech sector are regularly used by participants in the space to understand the quickly evolving landscape. The views expressed in this guest article do not necessarily represent those of AFN.

We have been covering the foodtech and agtech sectors for the past decade, yet the Covid-19 pandemic thrust the food supply chain into the spotlight like we never could have anticipated.

As we saw scores of pandemic-driven shortages on the shelf supply disruptions, and dislocations in production and distribution, we were left with a complicated question: What does it really take to get data flowing from the farm to your plate?

It was that question that launched our odyssey into food supply chain tech.

The food supply chain differs in some respects from our traditional understanding of foodtech and agtech because it encompasses industries with relatively well-established players and technologies.

Many of these are horizontal software and logistics companies with multi-industry offerings. Due to this, as well as the highly-regulated and labor-intensive nature of the supply chain, it has been a more difficult industry for nimble startups to penetrate.

So while we’ve seen the lion’s share of investment in recent years flowing into the end-points of agtech and foodtech, we believe there is still a tremendous, untapped opportunity for vertical-specific tech companies which are focused on serving the unique needs of the food supply chain.

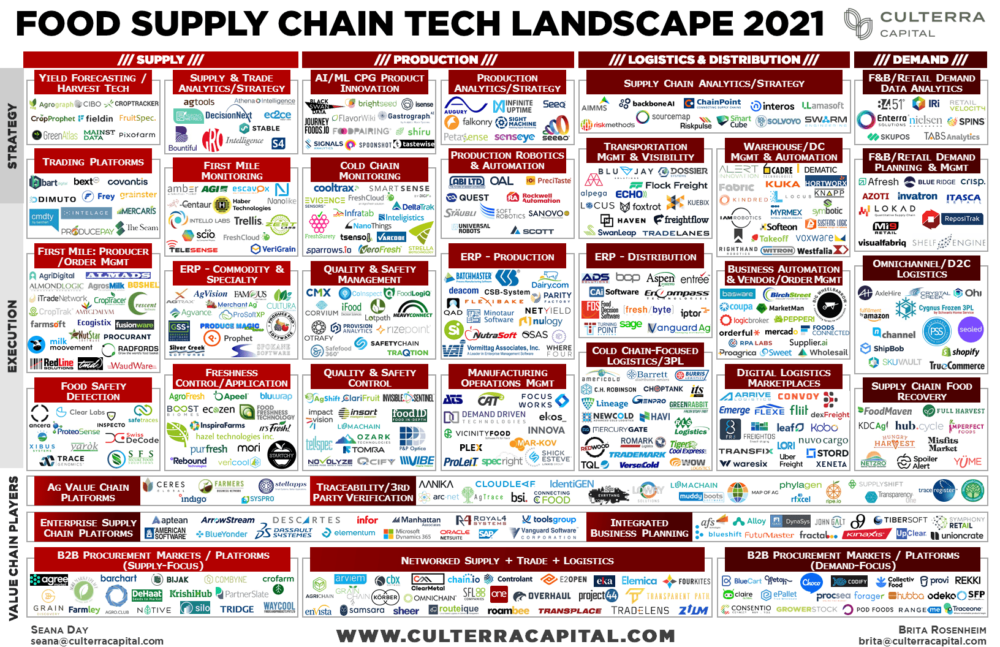

It is with this sense of urgency and optimism that we bring you Culterra Capital’s inaugural 2021 Food Supply Chain Tech Landscape (available to download in high resolution here.)

Delivering the goods

For the purposes of this analysis we have highlighted a handful of predictions for the year to come, as well as emerging themes and key innovation trends that we believe will impact the four supply chain pillars — supply; production; logistics and distribution; demand — in 2021 and beyond.

While we cover a number of digitalization-driven opportunities for food system participants, we will reserve deeper dives into sector-specific areas — and practical adoption obstacles — for later reports.

A little about us: Culterra Capital is an advisory firm focused exclusively on tech-driven innovation across the food system. This Food Supply Chain Tech Industry Landscape and analysis are intended to help operators, entrepreneurs, and investors in the food system to understand the quickly evolving themes and trends impacting the food supply chain. You can find our earlier 2020 Farm Tech and Food Tech Industry Landscapes and analyses at Culterra Capital.

Digitalization will remain a food supply chain catalyst for the next decade

It is well understood across the food industry that modernization, including investment in data infrastructure, is an essential first step towards digitalization.

It’s a first step that many participants still need to take – which is why food and ag still represents the lowest penetration of digitalization relative to every other sector of the global economy.

Digitalization is the key enabler for new business model innovation across food and ag. For farmers and ranchers, it creates the foundation to access new markets, to decommoditize or differentiate their products based on quality and sustainability, to employ new B2B or B2B2C models, or to explore new revenue streams like carbon sequestration.

For example, new carbon marketplaces are popping up almost weekly. But how can carbon credit buyers be confident with the reporting and verification if the infrastructure is not yet in place to reliably track that grain, beef, or hog through the value chain?

With expanded supply chain digitalization, retailers, consumer packaged goods companies (CPGs), and foodservice companies will increasingly be able to leverage real-time demand data. This will help drive real-time planning and visibility, optimized inventory replenishment and ordering, agile omnichannel execution, reduced waste, and better customer experiences.

At the same time, digital supply networks — which connect the physical and digital worlds via online trade, supply, and logistics platforms — will unlock the potential of vast datasets from physical assets and facilities in real time.

For buyers, processors, distributors, and logistics participants, these platforms will help to weather supply chain disruptions via larger trading networks, real-time visibility, and integrated demand planning.

Post-harvest digitalization: The first mile paradox

The activities that occur within the logistical ‘first mile’ — from initial harvest to processing — represent the most important predictors of fresh food quality and shelf life. So it should come as no surprise that there are two major trends which are fundamentally dependent on improving digitalization within the first mile: food waste and traceability.

Pre-harvest planning and yield forecasting; producer management and payments; load logistics and temperature monitoring; grading, sorting and cooling – all the activities involved in the first mile have far-reaching consequences for food quality, safety, and waste.

Yet for all the well-orchestrated logistics — phone calls, texts, dispatchers, print-outs, and Excel schedules — not to mention intensity of labor, it remains the least digitalized pillar of the food supply chain.

We continue to see expanded pressure on fresh and perishable suppliers to adapt to the dynamic demands of buyers. These include increasing the speed of delivery, decreasing waste, real-time inventory visibility, and traceability of products.

However, the widely-used legacy systems of record-keeping (some digital, some not) have struggled to keep pace with advancements in data-sharing through APIs, mobility, and cloud infrastructure.

This is creating openings for startups like Procurant, Bushel, AgroFresh, and Milk Moovement, which are helping their customers digitalize and automate existing workflows – resulting in improved efficiencies, better asset utilization, and increased profitability.

Disrupting inertia: Food production and processing is ripe for digital transformation

They’re not often the subject of innovation fanfare, and sometimes seem to be mostly overlooked by venture capital investors. But food production and processing — primary and secondary — are ripe for Industry 4.0 value drivers like asset utilization, labor automation and management, advanced quality control, and supply-demand matching.

This is especially the case given the magnitude, and likely increasing frequency, of global disruptions. To date, much of the investment in processing innovation has been reactive to regulatory externalities like wastewater treatment, utility consumption, and food safety compliance.

The broader technology landscape is already shifting from a traditional manufacturing automation stack to an ‘industrial internet of things’ (IIoT) stack, which leverages a combination of app development, platform cloud, connectivity, and hardware.

Implementing an intelligent manufacturing stack within the food industry will be central to unlocking the promise of a more agile, visible, and collaborative food supply chain.

Increasing acceptance of IIoT has been paving the way for internal investment by producers and manufacturers. But Covid-19 sharply elevated the importance of investing in automation systems supporting worker safety, which is aligned with longer-term, systemic changes in food production.

We see big potential for ‘computer vision’ systems based on artificial intelligence and machine learning (AI/ML). One example is Lumachain, which can monitor shop floors for worker safety as well as yield improvement and waste reduction.

As core business data combines with IIoT data to power AI/ML applications, we also see predictive technologies becoming an important driver of efficiency and profitability in the processing sector. Companies like Seebo, Seeq, Augury, and Sight Machine have employed some innovative use cases in food production.

Linking demand to the rest of the supply chain

The further demand data gets from the source, the more diluted it becomes. Many CPGs experience a period of virtually zero visibility between the warehouse and point-of-sale. Even farther upstream, most ag producers have very little visibility into the ‘who, when, and where’ of how their raw materials are marketed and sold.

As we have discussed in our agtech and foodtech analyses for several years now, data standardization and interoperability are not only a challenge at the end points (on-farm, retail, and foodservice) but also within the value chain. And while retailers are increasingly able to share more demand data upstream to producers and brokers, they do so in a variety of formats, each with distinct product numbers and degrees of granularity. This requires the collection and harmonization of data that is often spread across multiple unconnected enterprise resource planning, point-of-sale, and logistics systems.

In this case, digitalization alone is not enough. There is a pressing need for well-integrated systems and standardized data layers, which are vital to provide dynamic visibility to inventory, costing, sales, trading, and logistics – as well as better responsiveness to supply-demand fluctuations.

With integrated demand data flowing upstream into the distribution, logistics, production, and supply pillars, companies can better manage overproduction and underproduction. This also allows them to reduce waste, while improving the utilization of their own assets in terms of equipment, labor, utilities, storage, and so on.

The emergence of ag value chain platforms like Indigo, Farmers Business Network, and Stellapps are good examples of business model innovation through integration.

Digital supply networks like AgriChain, Project44, Elemica, and Controlant are showing how real-time trade, inventory management, and logistics data are creating end-to-end visibility in the supply chain.

Startups like Backbone.ai, Gro Intelligence, and Ripe.io are laying the groundwork for integrated supply chain infrastructure.

In discussing this topic with Brian Aoaeh from REFASHIOND Ventures, he offered some strong advice for the next leaders in this space: startups which are able differentiate themselves with proprietary, unique data-cleansing tools have an especially important edge in this category.

Looking ahead to 2021 and beyond

We recognize that each pillar of the supply chain is at a different point in the digitalization journey.

The first mile is lagging significantly behind, yet facing mounting pressure to provide sustainability data in addition to the already complex sharing of origin, quality, and safety data with partners.

Comparatively, the innovators closer to the retailers and CPGs are much further along, with more demand insights and integrated planning capabilities.

The real complexity comes in the middle, where some food processors have advanced enterprise resource planning and manufacturing operations management systems to enable traceability and batch-level insights.

Others, meanwhile, have failed to keep up with the demands of worker welfare, automation, and food safety, and have consequently suffered setbacks during the Covid-19 pandemic. It is the latter that we believe will further struggle unless they begin to prioritize the necessary investments in their management information systems.

We see the capital inflows and large incumbent activities within the digital logistics space becoming a key driver in supply chain efficiencies, load optimization, and dynamic functionality.

While most of the high flyers are not vertically-focused on food and ag — and it’s still difficult to differentiate many of the offerings and value propositions — we expect the well-funded disruptors to begin to look carefully at business model innovation in these sectors.

Reflecting on our inaugural Food Supply Chain Tech analysis, we found that understanding how data moves through the value chain often left more questions than answers.

However, it revealed tangible and compelling investment themes. There is considerably more analysis and insight ahead; but as a 2021 priority, we urge participants up and down the food supply chain to continue to invest in and prioritize increased data infrastructure.

While digitalization alone will not solve our massive issues with food waste, loss, or supply chain disruptions related to climate, trade, geopolitics, and the pandemic, we are certain it will continue to be the food system megatrend of the next decade.

Navigating the food supply chain tech landscape: A primer

-

- ‘Food Supply Chain Tech’ here generally refers to the technologies that enable the processes and movement occuring between the farm gate and the loading dock or back door of the grocery retailer or foodservice provider. Integrated livestock tech solutions are a key enabler of end-to-end production and processing visibility in the food supply chain; however, these companies will be featured in Culterra Capital’s upcoming 2021 LivestockTech Landscape.

- This is a heatmap, not a comprehensive catalog. While clearly not exhaustive, this market map is meant to illustrate the layers and variety of technology solutions, early stage to mature, and primarily enterprise or B2B-focused. We have generally filtered the companies based on their food and ag customer base, and while mainly US-focused, a handful of non-US companies are included. Our FarmTech (inside the farm gate) and Food Tech (retail and food service, direct-to-consumer) landscapes cover the other end points of the food system.

- IT-driven focus. This landscape focuses predominantly on software-based and digital tech-related companies. Although hardware is (mostly) unplugged from this landscape, there is a strong recognition that it’s an essential part of it, especially as it relates to key trends around Industry 4.0 and networked equipment.

In order for us to drive down and understand the many, extraordinarily complex functions involved in the supply chain, we have organized the market around four key pillars of activity:

- First Mile (Supply): Harvest forecasting, logistics, producer order management, monitoring, quality and safety control, B2B procurement, trade analytics;

- Food Production & Processing (primary & secondary): CPG product innovation, enterprise resource planning, manufacturing automation and robotics, manufacturing operations management;

- Distribution & Logistics: supply chain analytics, cold chain logistics, third-party logistics, warehouse automation, vendor order management, logistics marketplaces, transportation management, visibility technologies; and

- Retail, Food Service & D2C (Demand): food and beverage demand data analytics, demand planning and management, omnichannel D2C logistics, B2B procurement, food recovery technologies.

And finally, across the bottom of the Food Supply Chain Tech Industry Landscape, we have included the variety of value chain players which integrate across multiple pillars including: ag value chain platforms, enterprise supply chain platforms, traceability, integrated business planning, and networked supply, trade, and logistics platforms (otherwise known as digital supply networks.)