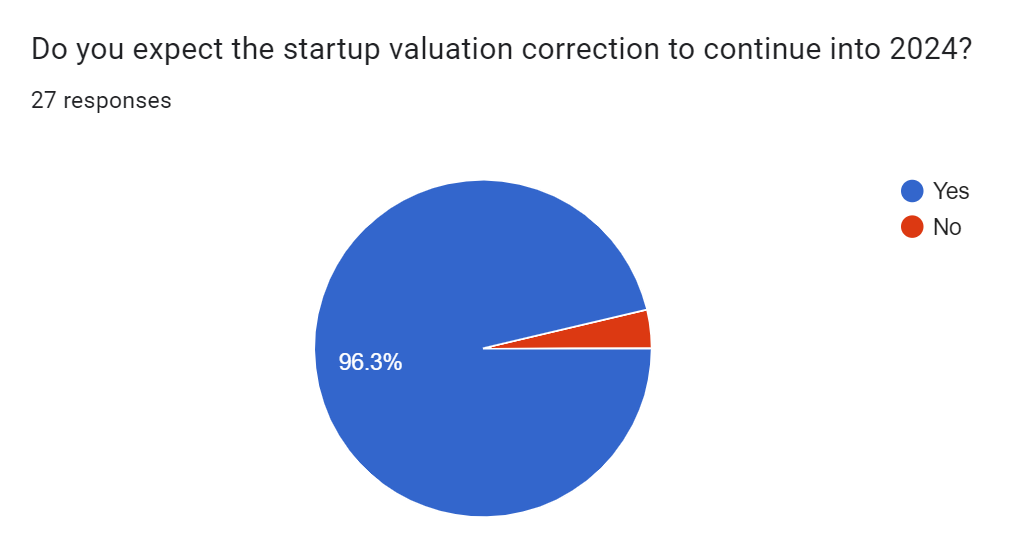

The market correction for startup valuations in agrifoodtech, which is taking place across tech industries too, will continue into 2024, according to all but one agrifoodtech venture capital investor surveyed by AgFunderNews.

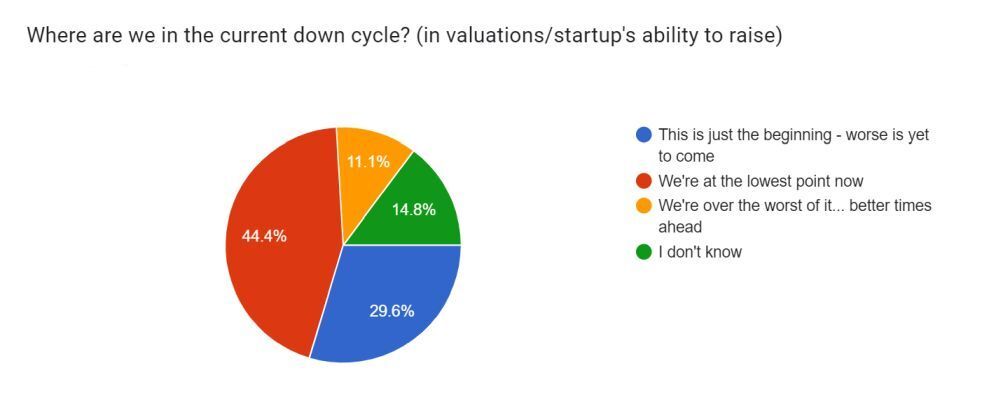

And 30% of the 28 leading agrifoodtech investors who responded believe the worst is yet to come for startups trying to raise capital. Some 44% were more positive, believing we’re at the lowest point now for startup valuations, while 11% believe we are “over the worst of it,” with “better times ahead.” The remainder said they didn’t know where we were in the cycle.

Despite the overwhelming agreement that startups will continue to face significant challenges in raising funds next year, some investors expressed surprise about the extent of failures and down-rounds in 2023, particularly in the alternative protein and vertical farming categories. These categories more than most in agrifoodtech have been supported by the entrance of generalist venture funds, but 2023 saw many of those funds run for cover, frustrating some agrifoodtech investors

Gil Horsky, partner of the recently closed Flora VC, said he was surprised at “how quickly the generalist funds left the segment once things got tough.”

Erin VanLanduit from Cargill‘s ventures team was also annoyed at the quick exit of investors in the wake of a challenging environment, but said she was surprised there weren’t more valuation re-sets on her portfolio in favor of “many many bridge convertible notes!”

Rob Leclerc, founding partner of AgFunder (AgFunderNews’ parent company) was surprised “that more companies made it through than I expected.”

Where are the roll-ups?

Last year, Antony Yousefian, partner at The First Thirty Ventures, predicted 2023 would be a year of “bust-ups, roll-ups and M&A.”

He wasn’t wrong, but a few of the survey respondents were surprised there hasn’t been more consolidation in the wake of the market tightening and the wealth of failing companies at attractive valuations.

“I would have expected corporations to be buying up more technology, given startups have short runways and valuations are correcting, coupled with investors who want to show distributions to LPs in a time of scarcity,” said Mark Durno of Rockstart AgriFood

Over-correction?

Yoni Glickman, managing director of FoodSparks, PeakBridge’s seed fund, thinks the industry, especially alternative protein, moved from “a cycle of overhype” between 2020 and 2022 into an “over-correction.”

“Too many people celebrated failures rather than learning from them, and in the end, we – the planet, humanity – actually need to be collectively successful. Perhaps a more controversial take is on founders, who are still not realistic about valuations,” he said.

2023’s pet peeves

AgFunder partners Leclerc and Tom Shields both complained that valuations were still too high and that founders would not be happy with where they could raise next year. “Many VCs and most founders are not willing to rip off the bandaid,” said Leclerc.

In a similar vein, Rockstart’s Durno said he saw bad habits from “operators and founders who will not accept the reality of the market, try and scale too early and then expect VCs to deploy ever-more venture capital to solve issues relating to the business.”

David Pierson from Syngenta Ventures was annoyed by “CEOs who were either slow or refused to adjust burn rates to extend runway in the face of an obvious meltdown in the fundraising landscape.”

Jaap Strengers from Future Food Fund said he was frustrated that there had been “too little focus on fundamentals of food and agtech businesses, where – in my view – many held up to a large extent, versus far too much drama around headline numbers on drop in VC funding (wasn’t a lot of money wasted on fundamentally not sound businesses after all?)”

Seana Day from Culterra Capital agrees, saying her pet peeve in 2023 was “entrepreneurs who haven’t realized the importance of focusing on business fundamentals versus focusing on raising VC. They still have blind optimism that VC will keep the business going.”

Mark Kahn, partner at Omnivore said his pet peeve were the “endless bridge rounds, forestalling the inevitable.”