Monsanto has made the first move towards building a centralized and open digital platform for farmers to access agronomic data and analysis from a range of providers through its subsidiary The Climate Corporation.

Much like how Apple opened up the iPhone to independent application providers, Monsanto wants to provide a hub for all agtech providers to essentially sell their wares, at the same time capturing their data and integrating it into the FieldView platform. This integrated platform will give farmers the ability to track their operations from several different angles, from soil moisture sensing to satellite imagery to weather data, to better make predictions and decisions on how their operations are faring.

A lofty goal, this plan will take several months and years to play out, according to Mark Young, chief technology officer for Climate Corporation.

“We don’t want to build an open platform in a vacuum, but in one to two years’ time we will have all of this sealed and there will be a self-service portal and well-defined APIs enabling developers to sign up and get a developer key to build products for the platform,” he said.

There are a lot of moving parts that make this announcement both exciting and complicated for the industry and the farmers it’s trying to serve. Below we’ve tried to lay out how the platform will evolve, how Monsanto stands to benefit from it, and what it means for farmers and the agtech industry overall.

What is Monsanto’s digital plan?

The first step in this plan is building an in-field sensor network, and this week Monsanto announced a partnership with Veris Technologies, a sensing technology that’s pulled across fields to create soil maps. It also revealed that it had acquired nutrient-detecting sensor manufacturer SupraSensor as part of this sensor network build out.

The data that Veris captures will be integrated into the FieldView platform for farmers to access alongside existing Climate Corp data streams, which range from weather data to satellite imagery, farmers’ manually entered data, and Monsanto’s in-house research.

As part of this partnership, which Young called a beta partnership, Veris will work with Climate Corp to develop its soil data API. “They are an early partner to help us prove out that part of the platform ahead of others joining later,” said Young.

Young expects to bring on several more beta partners over the next two quarters and is currently evaluating nitrogen, moisture and weather sensors to add to this network, again with the aim of proving out the specific data segment they’re related to. “There is not one silver bullet when it comes to data,” he told AgFunderNews. “We need a network of providers to provide value to farmers.”

The terms of the deal with Veris were not disclosed and Young says it’s still unclear how the partnerships will work with regards to distribution, but he envisages some data providers will be fully integrated into FieldView, like Veris, whereas others will be an add-on that farmers can choose to purchase. This would be particularly relevant to hyperlocal data providers, said Young.

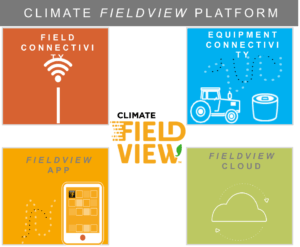

The in-field sensor network is just one part of a four-pronged strategy to build out an open digital ag platform: the other parts of the chain include in-cab connectivity, which hardware manufacturers can integrate with to provide visualizations through the FieldView cab monitor; integration of all the software applications themselves; and what Young called ‘FieldView Cloud,’ which is the back-end system that already has an announced API and some existing partnerships.

How will Monsanto monetize this?

Young laid out four main ways that Monsanto will monetize the open platform.

- Subscriptions through FieldView, which will increase in price as integrated technologies, like Veris, add more value.

- Revenue share agreements with data providers.

- Potential movement into new verticals, such as animal agriculture, through a platform licensing agreement.

- Selling information, particularly weather data, into other industries, through API call agreements.

Monsanto could also use the data it’s capturing and insights it’s giving farmers to boost its traditional seed and chemical products business. By providing agronomic tools, Climate Corp, and other data-driven digital ag providers, are standing to disrupt farmers’ traditional relationships with their retail agronomists; agronomists that are often the the point of sale for ag products, according Matt Bell, principal at agtech venture capital firm Cultivian Sandbox and a former agronomist.

“I think, and it’s just my opinion, that companies like Monsanto and DuPont could be thinking about how disruptive online sales could eventually become and how companies could use it to communicate more directly with growers and to capture more margin from within the overall supply chain,” he told AgFunderNews.

Why is Monsanto doing this now?

Monsanto’s commitment to building a digital ag product has cost it over $1 billion in investment, not least its $930 million acquisition of Climate Corp in 2013, and they’ve made it clear that they see new value coming from being a data company. So this week’s announcement is in line with those plans and Monsanto’s traditional approach to market dominance, argued Tim Koide, cofounder of HarvestPort and formerly at Mitsubishi Corporation.

“They will take what they think they need to build a complete solution and own it,” he said.

Monsanto also announced this week that Climate FieldView services have reached 92 million acres, of which 14 million are paid for. It is now targeting 25 million paid acres in 2017 and by 2025 wants to have reached 300-400 million paid acres, according to a press release.

Building up the platform through partnerships is not a new concept and partnerships between agtech startups have been slowly picking up pace in recent months as companies realize they cannot penetrate the ag market alone. Agtech adoption has been a huge challenge for the majority of agtech startups. Distribution channels are still largely relationship based, and many technologies require a behavior change from farmers, as well as a good deal of time and understanding to implement them correctly.

“There is no sense to keep the system closed. It was interesting the level of frustration I noticed folks had at the Forbes AgTech Conference in Salinas in June about how to reach customers with their sensor or robot and become profitable businesses,” said Young. “We feel we’ve got that distribution piece solved and momentum so it’s a good time to parlay that.”

Partnerships also clearly add benefits to the quality of the information agtech companies provide farmers.

“This move from Monsanto fits really well with how I see the sector going,” says Cultivian’s Bell. “I think we are going to see each company attempt to add a new value proposition on an annual basis and see companies start to play nice with each other. There is now more interest in trying to get data to flow across different platforms, and less interest in controlling that data over time.”

What does all of this mean for the industry?

Creating a centralized dashboard for farmers to integrate all of their incoming data is what farmers have been calling out for. Of course, Climate Corp isn’t the only one trying to offer this. There are several farm management software platforms that are working with farmers to integrate their various data streams into one place, with varying degrees of success. A recent report said this part of the market would be worth over $4 billion in six years’ time.

Some of these own their own sensor companies, which they deploy on the farm as part of the service, and others are starting by offering ERP systems for farmers with the eventual aim of opening up for integration with third party data companies, like Climate Corp is doing.

While still at the early stages, data standardization initiatives like AgGateway’s SPADE project in the US and AgroIT in Europe stand to help these startups integrate with other data providers, to create competing platforms with Climate Corp.

Climate Corp is planning to explore integration with other software providers, and has already been contacted by businesses with ERP systems they want to integrate, according to Young. These partnerships, and those with sensor companies, will likely be a precursor to best-in-class technologies emerging, and consolidation among the rest that fail to gain meaningful market share.

Where Climate Corp really differs from the other options on the market is in its other revenue streams. It makes complete sense for Monsanto to use the intelligence it will gather from its network to better serve its customers on the products side. But farmers might balk this connection and be resistant to disrupting their existing relationships by using the platform. Partners and farmers might also question how else their data will be used by Monsanto.

And this might present Monsanto and Climate Corp’s biggest challenge in this new endeavor.

“There are material technical challenges in building an open platform with robust partner integrations, an app ecosystem and a single pane view into FieldView, but possibly the greater challenge is still customer adoption and trust in aligning with a large agribusiness that might have other motivations,” said Mike Betts, director of investments at AgFunder. “Ag software startups will likely try to integrate with the platform because there are a scarce number of open platforms to partner with today. But there is a lot of risk for Monsanto on the technology and adoption side before it sees an ROI purely from the platform. It may be more likely that the majority of value Monsanto gets from investment in this technology platform accrues to its existing seed and chemical sales.”

What do you think? We want to hear from you! Email [email protected]