Rebecca Bauer is head of public relations and communication at FarmTogether, based in San Francisco, US. The views expressed in this guest article are the author’s own and do not necessarily represent those AFN.

For many investors, farmland was not on the radar as an investable asset class until earlier this year, when it was revealed that the largest owners of US farmland were none other than Bill and Melinda Gates.

Many were speculating about Gates’ motivation for the acquisitions – was it part of his larger sustainability strategy? As it happens, Gates says these investments are, in fact, not connected to climate. This might have surprised some – even the most savvy investors. But to those familiar with farmland, it’s easy to see why this asset class is so attractive for investors.

Institutional investors are hungry for farmland

For many years, farmland was not a common asset class among financial investors. Even after alternative investments became widespread, few funds looked carefully at the sector. Numerous barriers to entry stood in the way, including a highly fragmented market in which most farmland was family-owned; and a lack of investment professionals with the knowledge to value farmland investments.

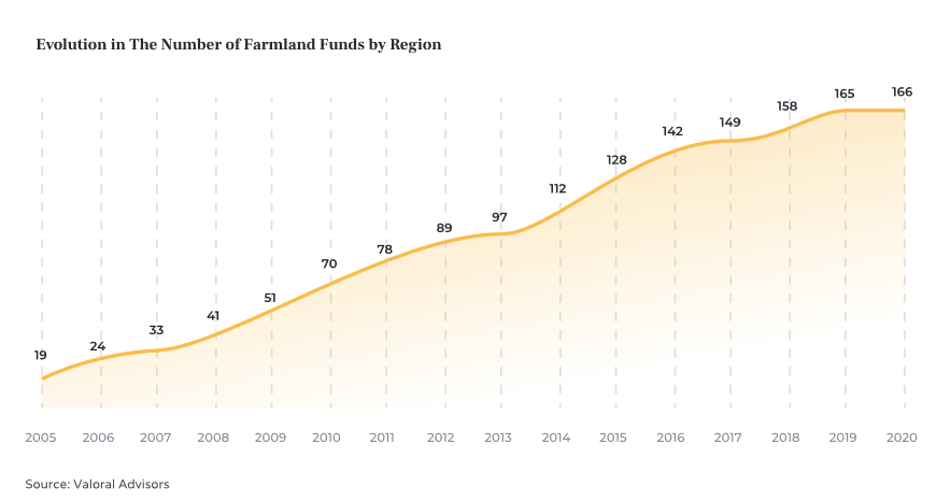

The tide began to shift in the early 2000s, when institutional investors began to give farmland a closer look. Momentum accelerated during the 2008-2009 Great Financial Crisis, when investors grew desperate for alternatives to traditional safe haven investments like bonds and gold. In this short period of time, there was a proliferation in funds that were specifically focused on farmland investing. In 2020, there were 166 such funds globally, nearly a 9x increase from only 19 in 2005.

The Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, for example, holds $1.2 trillion in farmland assets through its asset management arm, Nuveen.

Bill Gates’ investments in farmland can be seen as part of this trend. The Gates’ have been quietly acquiring farmland through their investment manager, Cascade Investment, for over 10 years. When the fund was profiled by The Wall Street Journal in 2014, it was already a significant farmland investor, with “at least 100,000 acres of farmland in California, Illinois, Iowa, Louisiana, and other states.”

Following that profile, Cascade has made several other large farmland investments. In 2017, they paid the Canadian Pension Plan Investment Board (CPPIB) $520 million for a portfolio of farmland that had previously been owned by the Agricultural Company of America (AgCoA). When CPPIB acquired AgCoA’s portfolio in 2013, it was one of the largest institutional investors in row crop farmland in the US. Another notable acquisition was Cascade’s $170 million purchase of 14,500 acres of farmland in Washington state from John Hancock Life Insurance in 2018.

Today, Bill Gates owns 242,000 acres of farmland in 19 states. In addition, he owns 25,750 acres of transitional land and 1,234 acres of recreational land for total land holdings of 268,984 acres. His largest holding is in Louisiana (69,071 acres), followed by Arkansas (47,927 acres) and Arizona (25,750 acres).

Farmland delivers solid returns to investors

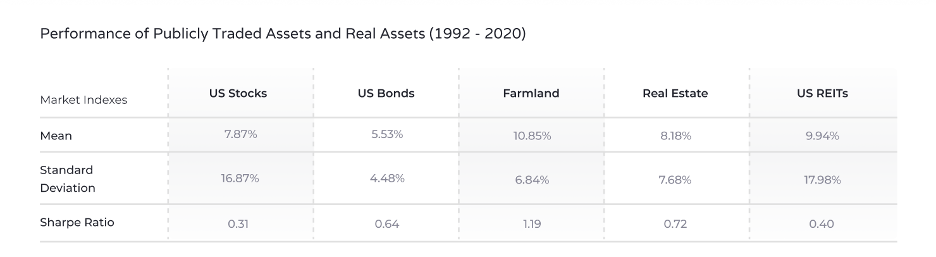

Farmland has historically delivered strong real returns from two distinct sources: rental and crop payments, and appreciation when the underlying asset is sold. Between 1992 and 2020, the average annual return from farmland was 10.9%, compared to 7.87% for the stock market and 6% for gold. In addition, farmland is an extremely low-volatility asset class. In this same time period, the volatility for farmland was 6.84% while the volatility of the stock market was 16.9% and gold was 14.8%.

Farmland also adds diversification to a portfolio, which is crucial for building long-term wealth. Investors achieve diversification through investing in multiple uncorrelated asset classes. Farmland is uncorrelated with other major asset classes including stocks, bonds, and gold, meaning that it is not impacted by shocks which affect the price of other assets. For example, during the Covid-19 pandemic, the stock market decreased by 19.8% between Q4 2019 and Q1 2020. In contrast, farmland decreased by 0.1% – only its second negative quarter since 1992.

Farmland is a sustainable asset class

Despite sustainable agricultural development being one of the key focus areas for his nonprofit Gates Foundation, the Microsoft co-founder claims that his farmland investments are not tied to climate. But while Gates might be solely focused on returns, one should not overlook farmland investing’s potential to drive sustainability on a massive scale.

Bill and Melinda Gates can create world’s biggest agrifoodtech testbed – but they need to win over farmers first. Read more here

High-tech and sustainable approaches are needed to ensure that farmers will be capable of meeting the agricultural needs of the 21st century and the planet’s growing population, amid a changing climate and increasingly scarce resources. These sustainable and productivity-enhancing improvements include organic or nature-based farming methods, water conservation, and other agronomic innovations to improve the efficiency of farms. Despite these methods gaining popularity, however, many of the transitions are prohibitively costly for farmers.

It’s here that investments play a crucial role. By providing an injection of cash, farmland investors are facilitating much-needed capital improvements and increasing the sustainability of farms long-term.

Plus, sustainably managed farmland will reinforce the land’s value overtime. Farms with healthy soils, ample water, and efficient infrastructure are worth more, and this will be more true in a future where high-quality farmland is increasingly scarce.

You no longer need Gates levels of wealth to reap the benefits of farmland

For too long, farmland investing has been restricted to a handful of institutional investors and ultra-high net worth individuals like the Gates’ due to high barriers to entry – including opaque markets and large minimum investments. Fortunately, this is no longer the case.

Crowdfunding investment platforms, for example, allow accredited investors to own a portion of farmland with low minimums starting at just $15,000. These platforms eliminate many of the barriers to investing in farmland and offer access to a selection of investment opportunities, ranging from apples to nuts and citrus.

Another way to invest in farmland, although not direct, is to invest in real estate investment trusts (REITs) such as Farmland Partners, or ag commodity ETFs. While these funds expose investors to a few of the benefits of farmland, they are ultimately tied to the stock market and its unpredictable swings.

The potential reasons behind Gates’ farmland investments are broad. From its vital role in the global food supply to its historically strong financial performance, farmland can play a significant role in any portfolio. Now, it’s easier than ever to invest – even without being one of the richest men on the planet.