Data snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Smallholder farmers dominate African agriculture, producing 70% of the continent’s food supply on an estimated 33 million farms. With agriculture becoming increasingly vulnerable to climate change, accelerated land degradation and declining farming land due to population growth, these groups need more smart farming solutions.

Yet adoption of smart farming and livestock management solutions, and on-farm and remote sensors, remains extremely low across African agriculture — leading to low productivity and perennial food insecurity.

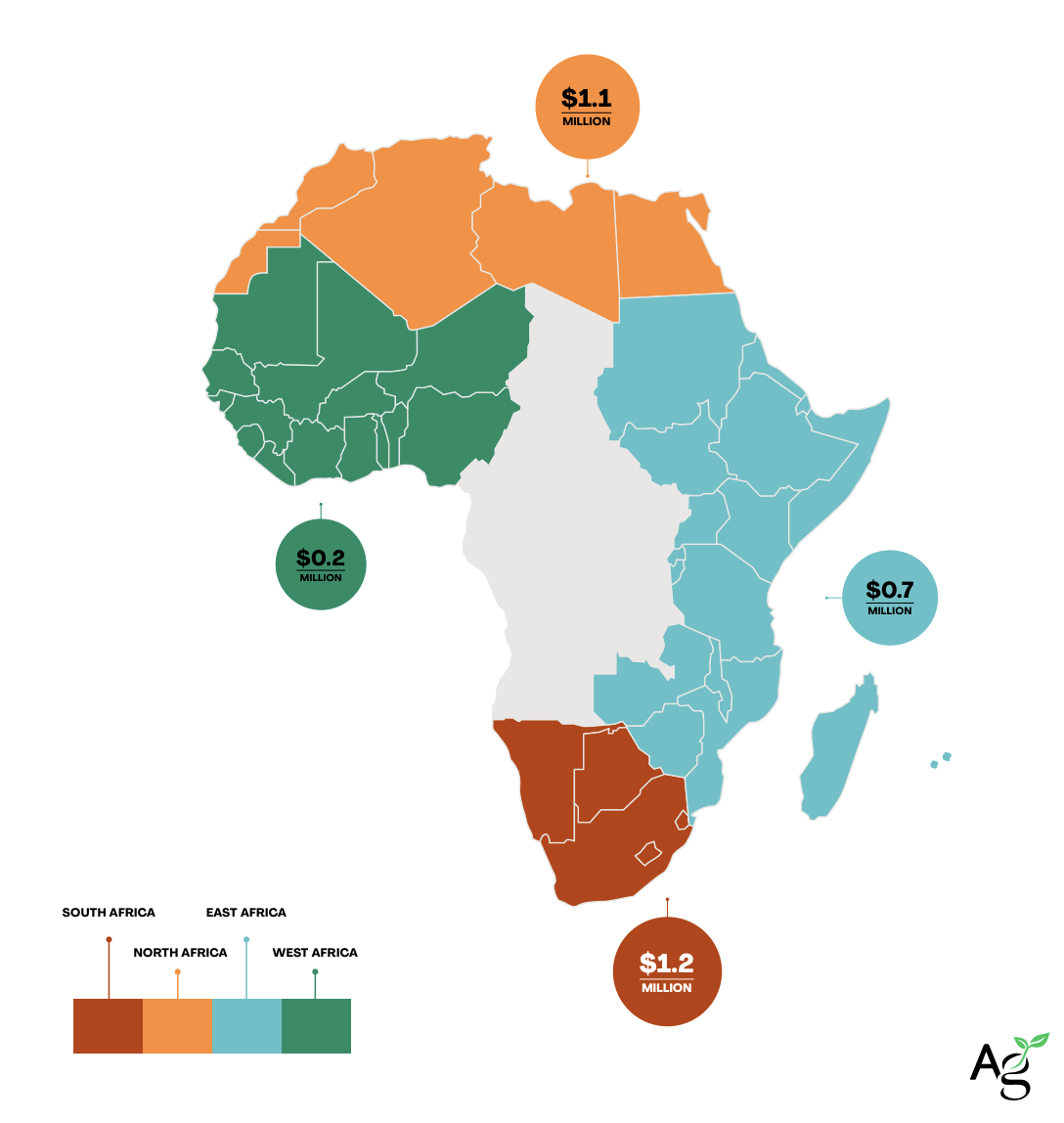

In 2022, venture capitalists pumped a paltry $3.2 million in farm management software & sensing internet of things (IoT), according to AgFunder’s new Africa AgriFoodTech Investment Report produced in collaboration with the Bill & Melinda Gates Foundation, FMO Ventures Program, and Mercy Corps Ventures.

However, this number is up from the previous year, which saw startups in the category raise just $335,000.

South Africa and Egypt, two countries that have made strides in modernizing agriculture, attracted over 80% of the funding.

What’s behind the lag?

“Viable deals in startups offering technologically-advanced solutions are hard to come by for investors in Africa,” states the report.

Undoubtedly, the category has the ability to transform African agriculture through tools such as weather advisories, soil composition, crop growth progress, presence of diseases and pests, prices and buy offers from traders, and monitoring post-harvest storage, among many others.

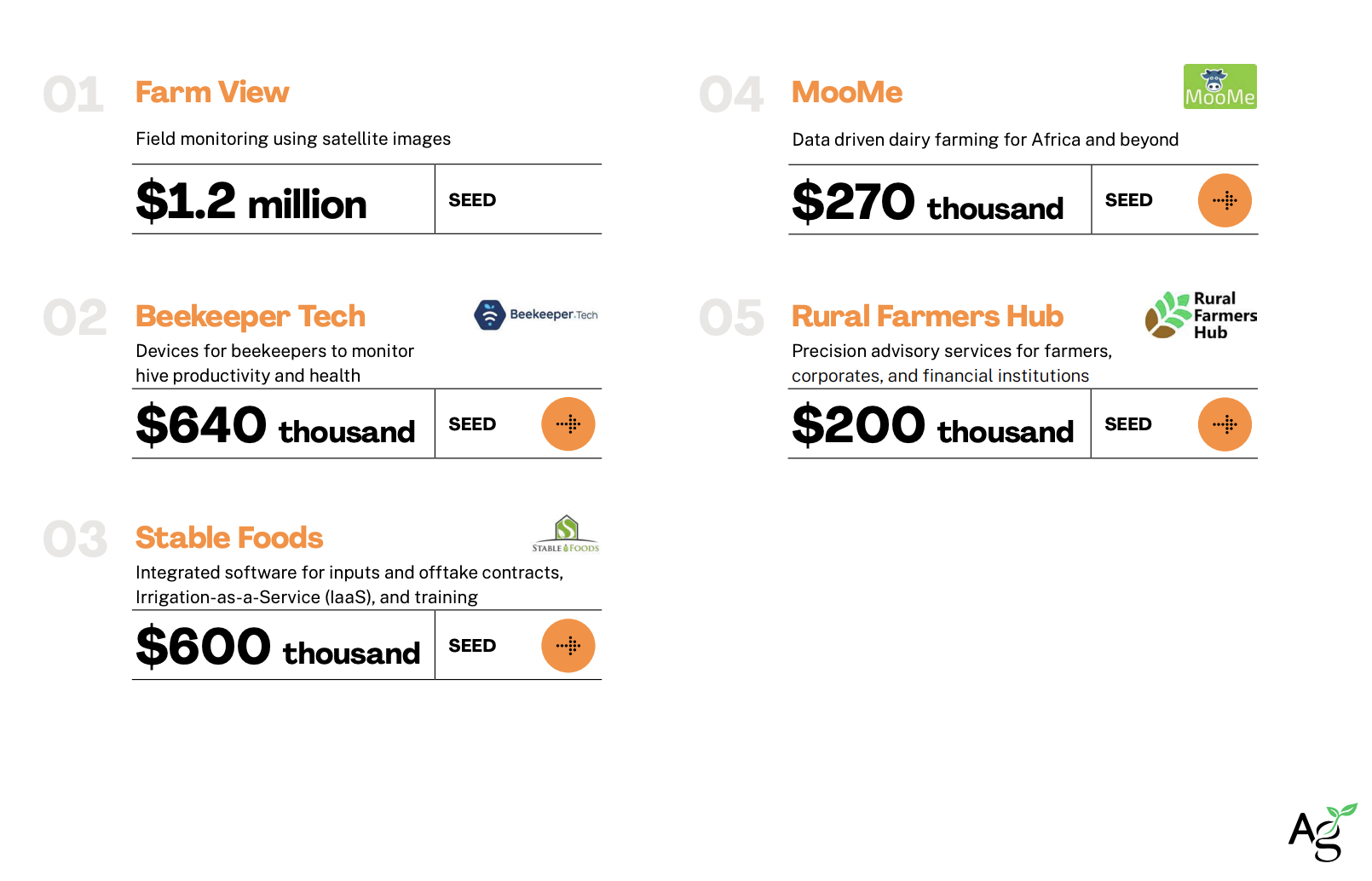

The common factor in 2022 farm management software & sensing IoTs funding was that all the deals were in seed stage and extremely low in terms of value. This indicates a sense of caution by investors.

It also points to the uncertainty of the technologies in terms of scale up owing to the challenge of bringing on board a larger number of fragmented smallholder farmers who lack deep understanding on the complexities of the solutions and also due to affordability.

Top deals for farmtech

In 2022, South Africa’s Farm View attracted 59% of total funding of the top five fundraising deals. The startup has developed a field monitoring app based on satellite images for smart agriculture. The solution helps farmers track crop productivity, record factors affecting production, compare fields and get alerts and weather forecasts.

Kenyan startup Staple Foods, which raised $600,000 in seed funding last year and which has developed integrated smart farming solutions including irrigation-as-a-service, has acknowledged that cost is a big factor that is constraining irrigation-led farming in Africa. Currently, fewer than 3% of smallholder farmers access irrigation.

For agritech innovators in Africa, the high costs of developing farm management software & sensing IoTs solutions remains a major impediment. The situation is compounded by lack of internet access in rural areas; just 30% of the adult population has access, and mobile broadband is limited to 2G and 3G speed.

Though venture capitals are slowly stepping in to support African agriculture’s adoption of smart farming on the continent, consensus suggests governments must spearhead a complete transition through increased funding — not only for research and development but also for necessary infrastructures.