- Supply chain tech startup Silo has raised $132 million in new capital.

- Koch Industries’ subsidiary Koch Disruptive Technologies led a $32 million Series C round with participation from Andreessen Horowitz, Haystack Capital, Tribe Capital, Collate Capital and Moore Capital.

- First Citizens Bank will provide an additional $100 million to launch a new financial product from Silo called Cash Advance.

- Series C funding will go towards building out Silo’s SaaS and financial services products, including potentially adding a logistics component.

The ‘supply chain in a box’

Silo’s platform — made up of a cloud-based workflow automation tool and a fintech platform — has evolved over time to meet the changing needs of the produce growers, shippers, wholesales and distributors it serves, says Ashton Braun, CEO and co-founder of Silo.

“We’ve seen a lot of change in the last several years, from labor, supply chain visibility, forecasting and disruption to the supply chains,” he tells AgFunder News. “We’ve spent a lot of time with those stakeholders and many years trying to understand what are the problems for these business to grow and how we can provide those solutions.”

In the last few years, labor costs and shortages, inflation, changing consumer demand and a fragile economy have added more volatility to a food supply chain that was already on its knees thanks to the Covid-19 pandemic.

A recent report from Ernst&Young notes that “the race is on for digital enablement and automation” of the supply chain and that “cloud-based platforms for collaboration among suppliers and supply chain orchestration” has also increased.

Founded in 2018 as a SaaS platform that automates supply chain-related activities, San Francisco-based Silo is somewhat ahead of the curve here.

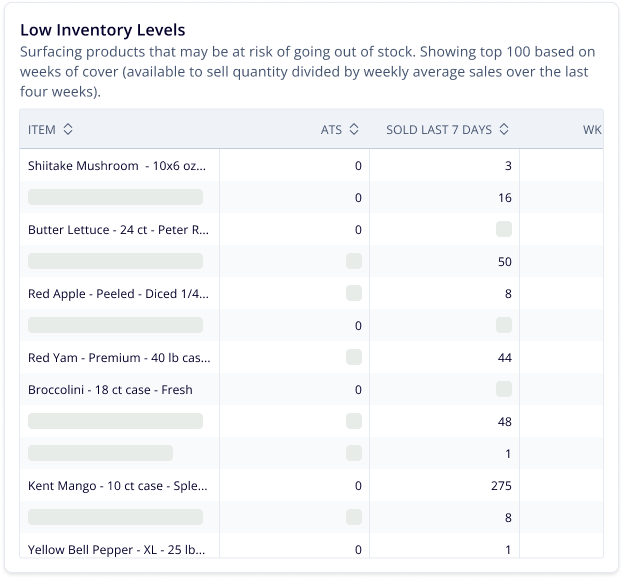

The Silo platform allows growers, shippers, wholesales and distributors to consolidate the various parts of their businesses — purchasing, selling, inventory, accounting, payments — into a single interface.

“When you talk to an owner of any of these businesses, they’ll talk to you about warehouse management, workflow, working capital, etc.,” says Braun. “From our perspective, tech has gotten to a place where you can provide a ‘supply chain in a box.’ That’s resonated with our users who are looking for more modern solutions.”

Advancing consistent cashflow for fresh produce

The SaaS platform is only one piece of Silo’s offering.

In 2022, Silo secured a $100 million investment from financial services company Jeffries to launch its Instant Pay product, which accelerates cashflow owed to businesses.

Thanks to the partnership with First Citizens Bank, Silo has now launched another financial product, Cash Advance.

“Cash Advance is like a forecasting of all your future payments and future sales,” explains Braun. “We get a lot of historical data, so we can forecast seasonality.

“We’re forecasting future sales in 90 to 180 day increments. It’s based on payments, so over the next 180 days, Silo takes a small percentage of the payments that come in to repay that cash advance. If you got a $1,000 check, you’re still getting the majority of that — a small amount goes back to paying the cash advance.”

The two products, Instant Pay and Cash Advance, complement one another, says Braun.

For example, a grower during a busy season can rely on Instant Pay to cover the gap between when customers pay them (e.g., 21–30 days) and when they must pay vendors (e.g., 15–21 days). Braun says this enables growers and shippers to sell more to their customers while simultaneously strengthening relationships with vendors.

In the off season, when there aren’t a ton of sales to push through Instant Pay, Silo customers can fall back in Cash Advance, he adds.

‘A critical part of the economy’

Braun says Silo has been working on the deal with First Citizens Bank for about a year.

“We started small and have since developed the program. We’ve got a good fintech network from our investors so that’s helped us. It’s also a testament to the partnership we have with the users and in the industry, where we proved out a lot of these things in small scale and showed performance, then started to get the attention of banks.”

He adds that the banks “also look at Silo and this industry as a pretty resilient and critical part of the economy.”

Meanwhile, the Series C funding will in part go towards scaling the financial services side of the business and “developing additional financial services,” says Braun. Without delving into too much detail, he says Silo has been “doing some light experimentation on logistical services.”

Series C funding will also go towards continued development of Silo’s workflow automation platform.

“There’s some really unique things we can do with the combination of removing the financial risk, the software piece and logistical components to provide a lot of automation that a lot of these business are looking for,” says Braun.