Data snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Agrifoodtech funding in Africa may be on a decline, but startups tackling the stubborn challenges in the middle of the supply chain remain resilient.

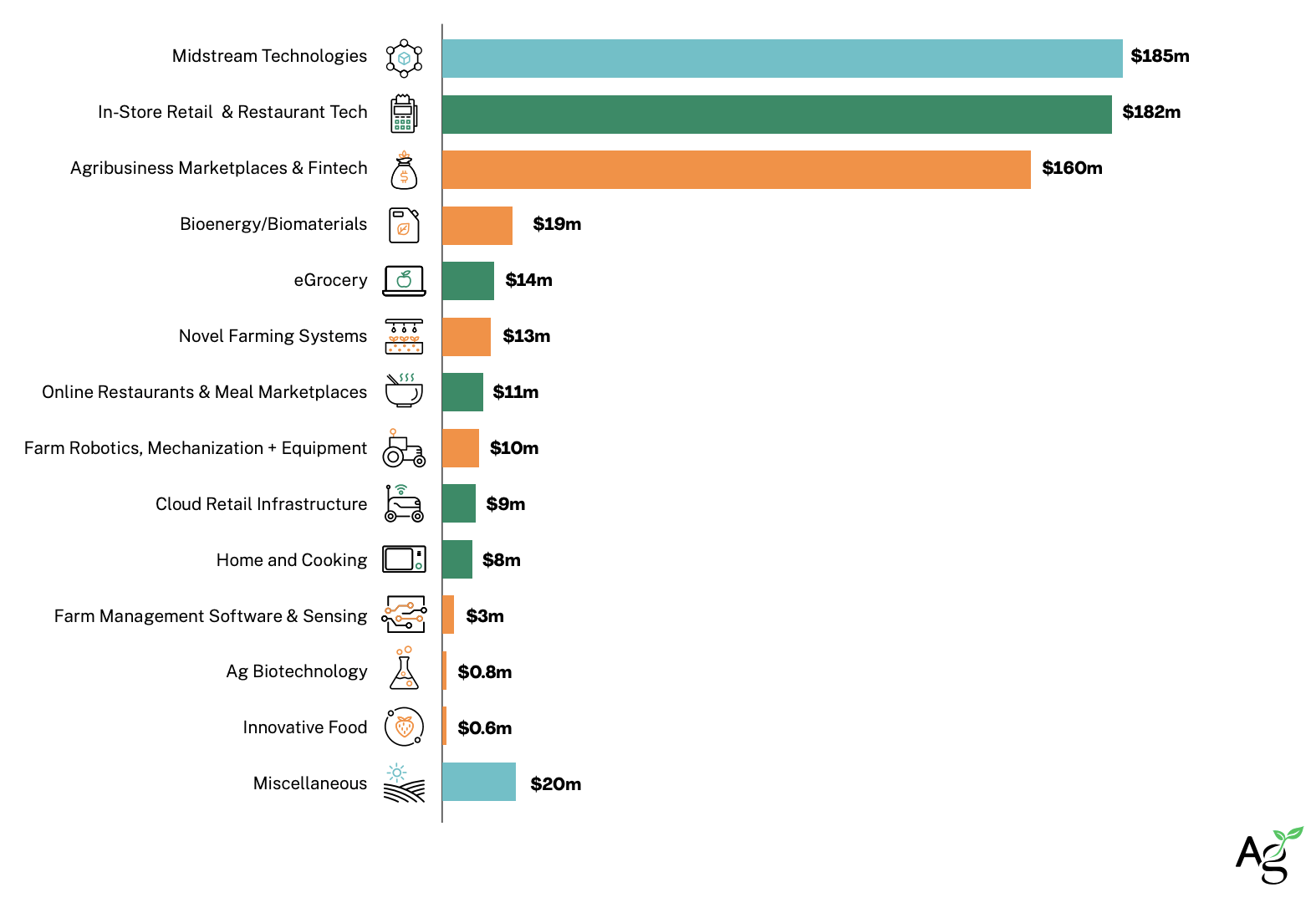

Midstream Technologies was Africa’s best-funded category of 2022, raising $184.8 million, according to AgFunder’s new Africa AgriFoodTech Investment Report produced in collaboration with the Bill & Melinda Gates Foundation, FMO Ventures Program, and Mercy Corps Ventures.

Midstream Technologies are those related to food safety and traceability, and food processing, amongst other areas.

Supply chain challenges in Africa

Africa’s food supply chain is riddled with challenges and complications, from climate events that disrupt distribution to poor access to both financing and customers for farmers.

Stemming from these problems, post-harvest losses in African agriculture are estimated to be around 40%, according to AgFunder’s report, while over 20% of the continent’s population is undernourished.

“It is imperative to secure funding for technical assistance to support businesses in mapping farm plots and establishing traceability from farm to port,” Meridia, an agtech company specializing in high-quality field data solutions for smallholder-heavy supply chains, noted in the report.

“The acceleration and facilitation of these processes are crucial to ensure that no farmers are left behind and to prevent supply chain disruptions, penalties, and damage to the reputation of end-buyers.”

Tools that create direct links between producers and consumers, as well as those addressing access to financing and logistical bottlenecks continue to attract funding.

Top Midstream Tech deals in Africa

Startups here offer tangible solutions such as cold storage, logistics, last mile delivery, procurement, and traceability. Though overall midstream technologies funding declined year-over-year, the critical role of these startups is projected by the high value of the deals.

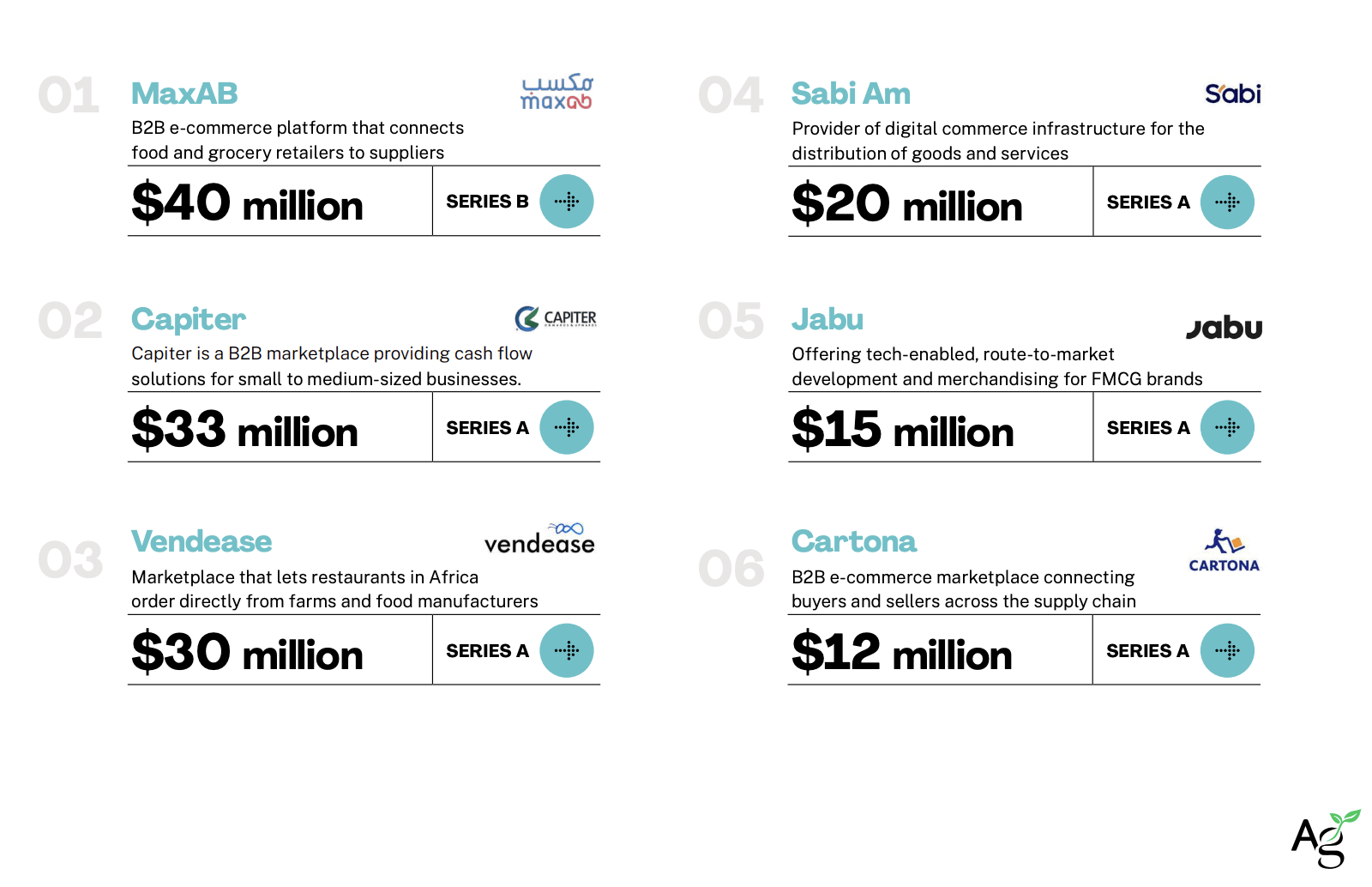

B2B marketplaces that connect producers directly to retailers took several of the top funding spots in 2022, including Egypt’s MaxAB, Vendease, which has a presence in Nigeria and Ghana, and another Egyptian startup, Cartona.

Midstream Tech startups aren’t immune to broader macroeconomic challenges, however. For example, while Egyptian B2B marketplace Capiter had the second-highest round of 2022, the company had essentially collapsed by the end of the year amid money mismanagement and a founders-versus-board battle.

AgFunder’s report notes that Midstream startups, while still resilient, could face further headwinds in the coming years. After recording a 750% increase in funding between 2018 and 2022, last year they recorded a 45% drop in funding.

Download AgFunder’s full report HERE.