Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

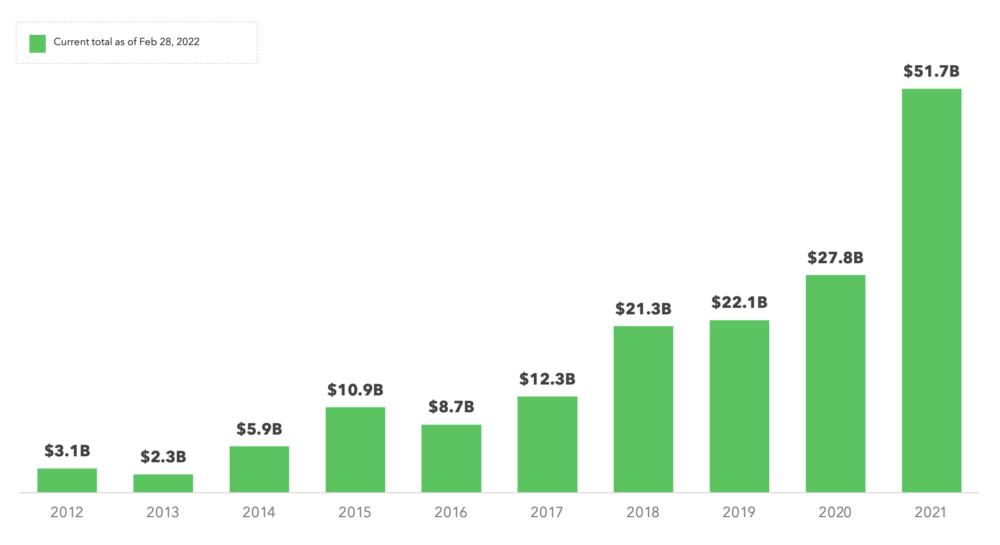

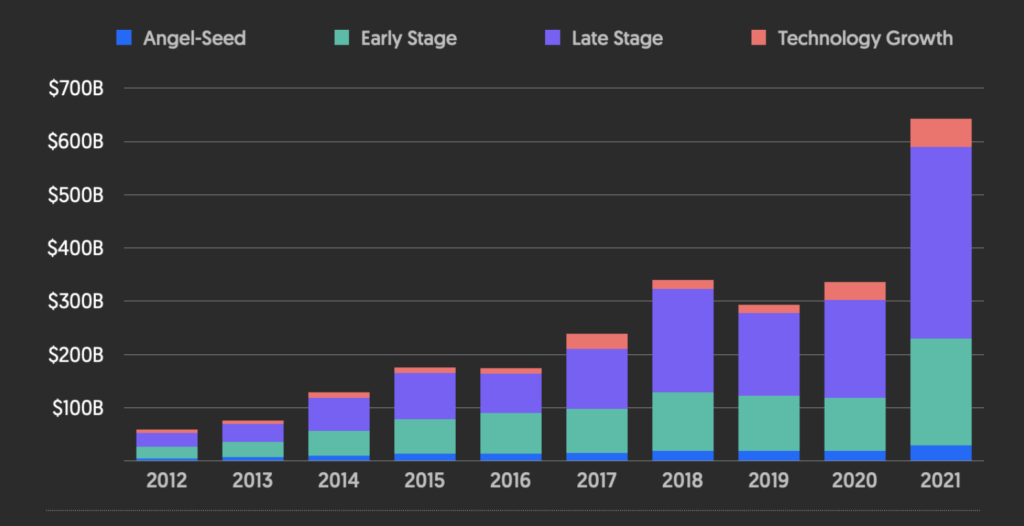

Global venture funding across all sectors reached an all-time high in FY 2021, hitting $643 billion in total – nearly double FY 2020’s $335 billion and 10x the total a decade ago, according to Crunchbase.

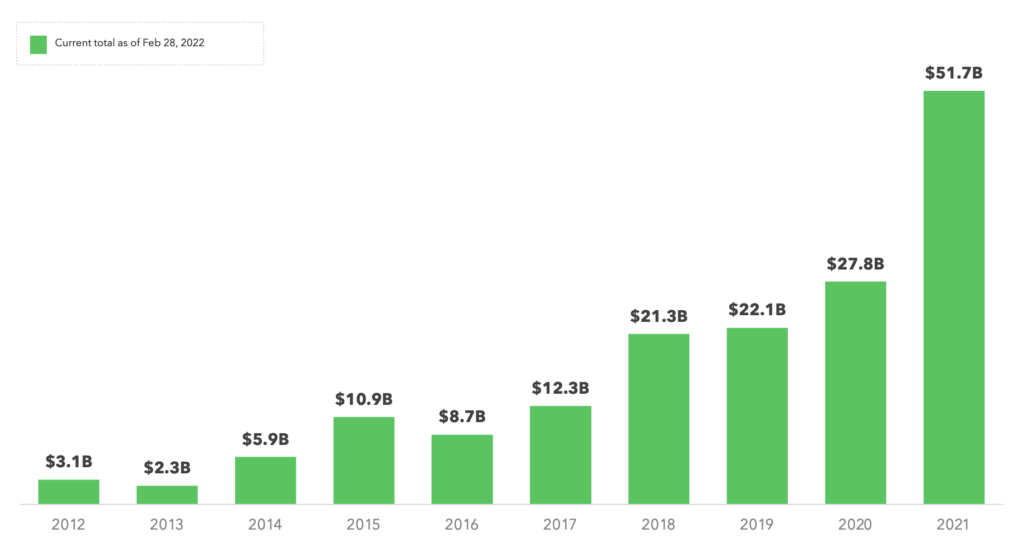

Looking specifically at agtech and foodtech, the doubling trend was pretty much the same: AgFunder’s latest annual Agrifoodtech Investment Report recorded $51.7 billion in total worldwide venture funding for startups in these segments in FY 2021, up 85% from $27.8 billion in FY 2020.

Inputting both figures, agrifoodtech ventures secured just over 8% of total VC funding in FY 2021 – a few points shy of the 8.3% share it enjoyed in FY 2020.

Global venture funding (all sectors) 2012-2021

Agrifoodtech’s share grows over time

Back in 2012, total VC funding across all industries fell just shy of $59 billion.

Also in 2012 — which happened to be the first year for which AgFunder began collecting data — total agrifoodtech venture funding stood at $3.1 billion.

That’s just 5.25% of overall VC investment, compared to over 8% today – indicating how agtech and foodtech have increasingly gained investor interest over the past decade.

Driving factors

All categories within agrifoodtech posted investment gains in FY 2021. The AgFunder-defined eGrocery category raised the most of all, registering 188% year-on-year (YOY) growth thanks largely to four 10-figure rounds.

The fastest-growing categories outside of eGrocery were Innovative Food (103% YOY growth), Online Restaurants & Mealkits (102%), and Cloud Retail Infrastructure (97.5%). Growth in these sectors was in large part driven by consumer and investor responses to the Covid-19 pandemic, as society sought ‘contactless’ solutions to grocery shopping and convenient dining – as well as alternate options amid stricken supply chains and concerns about zoonotic disease.

Global venture funding (agrifoodtech) 2012-2021

Slowdown on the horizon?

But Q1 2022 data from Crunchbase and other sources suggest that the wheels may be beginning to fall off the VC merry-go-round.

The first three months of this year saw VCs invest a total of $160 billion across ventures in all sectors. That’s still a tidy sum, to say the least — and is actually 7% higher than what was raised in Q1 a year earlier — but it represented a 13% decrease on the previous quarter (Q4 2021 – which at $184 billion was, to be clear, the biggest-ever quarter for VC funding on record.)

That’s the first time in at least two years that VC funding has dropped quarter-over-quarter.

Will the same trend play out in agrifoodtech?