Israeli sensor and data analysis startup Phytech closed an undisclosed Series A round of funding last week after getting commitments from new investor Syngenta Ventures and existing investor Mitsui Co Europe, the trading conglomerate.

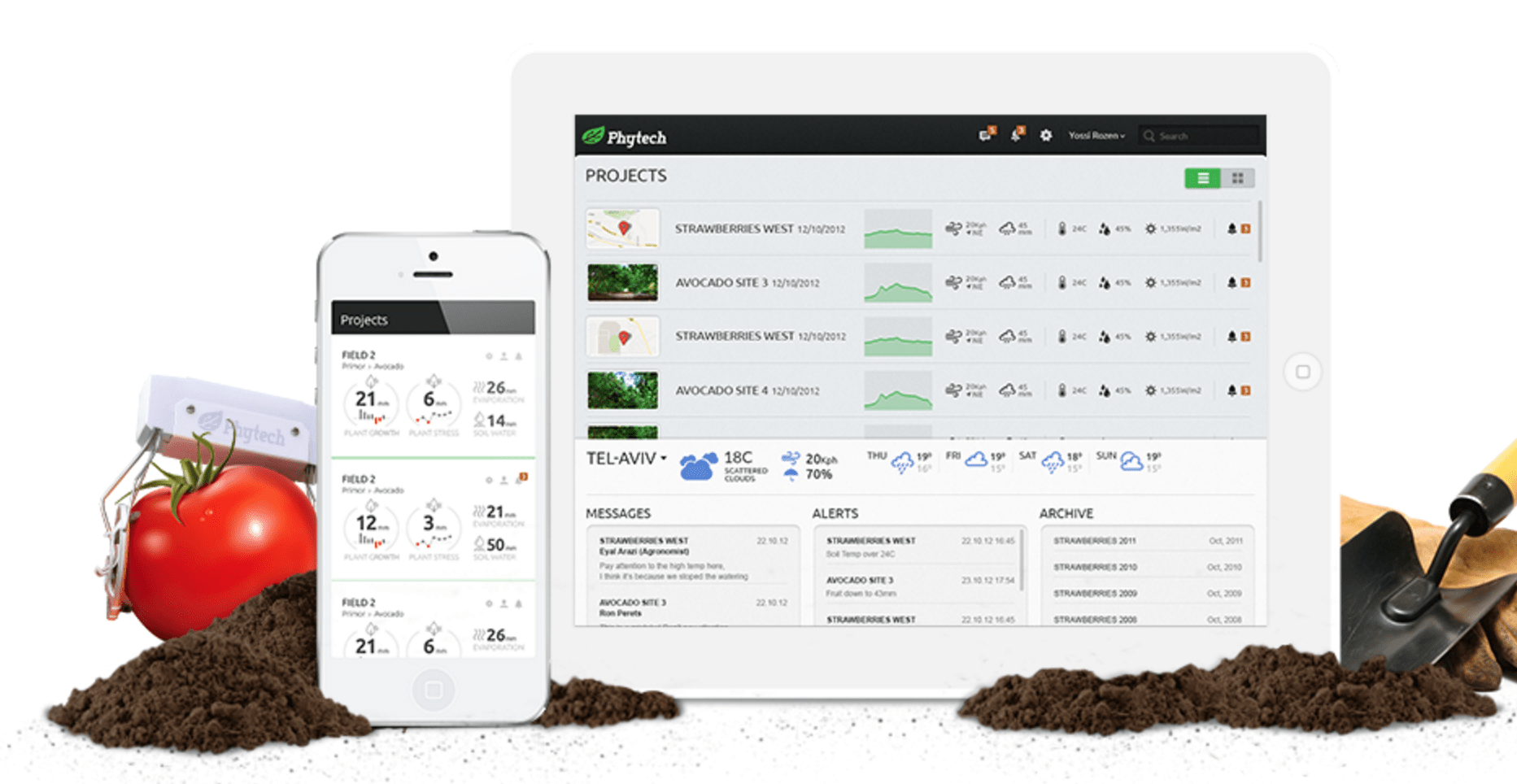

Phytech’s unique devices monitor individual plants, using the company’s patented phytomonitoring technology. Phytech’s PlantBeat platform combines the data they collect with data from soil moisture and microclimate sensors, and spatial imaging, to give farmers a view of water stress conditions in the field. This data is analyzed using Phytech algorithms and communicated to farmers through their phones or tablets, offering real-time feedback and decision support to help them reduce costs and improve yields, according to its website.

Phytech also aims to enable data sharing between farmers and other relevant contributors such as researchers, consultants, suppliers, and consultants, through its cloud-based platform.

Syngenta, which is an existing user of Phytech’s sensors on some of its land, was attracted to Phytech for a variety of reasons. They include its distribution strategy, use of dendrometers (see photo), and its combination of sensor hardware and decision support software, according to Michael Lee, managing director at Syngenta Ventures.

“We’ve looked at a few similar companies, but Phytech is one of the few that use dendrometers to measure continuously the water stress of plants; it’s the FitBit for irrigated crops,” he told AgFunderNews. “It’s measuring water stress directly on an individual plant basis, and not an indirect measure of what’s going on with a plant like soil moisture sensing. And it’s telling farmers this on a continuous basis, on their phone, or tablet, to help them review their entire farm quickly, and decide which to visit or which to irrigate.”

Lee was also impressed by Phytech’s commercial collaboration with two crop protection products companies — ADAMA Agricultural Solutions and Nufarm — as part of its go-to-market strategy. Finding a suitable route to market and distribution channel is one of the agtech industry’s biggest challenges that many startups need to solve before they are successful. But Phytech has made some important steps forward with these agreements, argued Lee.

Phytech is primarily useful for perennial crops such as fruits and nuts, but it is also being used for cotton production in Israel, according to Lee. While Israel has been Phytech’s “laboratory”, Lee would like to see Phytech used on larger farms globally.

“Israel has lots of farms that are around 250 acres in size, and Phytech has worked with many of these growers to perfect their algorithms for each crop,” he said. “What will make Phytech succeed commercially is to scale this with large farms. I’d like Phytech to crack larger farms and solve a deeply profound problem -– maintain or increase yields while minimizing water usage.”

Phytech could be more cost efficient on larger farms too, Lee added. The funding will go towards expanding Phytech’s technology platform and supporting continued global commercialization beyond Israel.

An IPO or trade sale is the most likely exit route for Phytech, according to Lee, who argues that an acquisition by Syngenta or another seed and chemicals-focused agribusiness would be unlikely to make sense.

In a statement, Masato Hisamune, SVP & DOO of Innovation and Corporate Development Division at Mitsui & Co. Europe said: “Investing in Phytech meets our consistent strategy for innovative technology and new business development. We would like to provide Phytech with services and solutions that meet their diverse needs, optimizing Mitsui’s global marketing networks and extensive business experience.”

Syngenta Ventures’ portfolio is split relatively evenly between US and European (inc Israel) agtech investments, according to Lee.

Have news or tips? Email [email protected]