Editor’s Note: This article first appeared on Forbes.com, entitled How Sustainable Is The Agritech Venture Ecosystem?

There’s no doubt that agriculture technology, as a sector of innovation, is having a moment. Agritech investment has surged in recent years, topping $4.6 billion in 2015 up almost 10X from 2012. During the first half of this year, there has been a cooling in agritech investment alongside the pullback in global venture capital markets. The agritech sector recorded $1.8 billion across 307 deals in H1-2016 compared to $2.2 billion and 285 deals in H1-2015 according to AgFunder’s newly-released Mid-Year AgTech Investing Report.

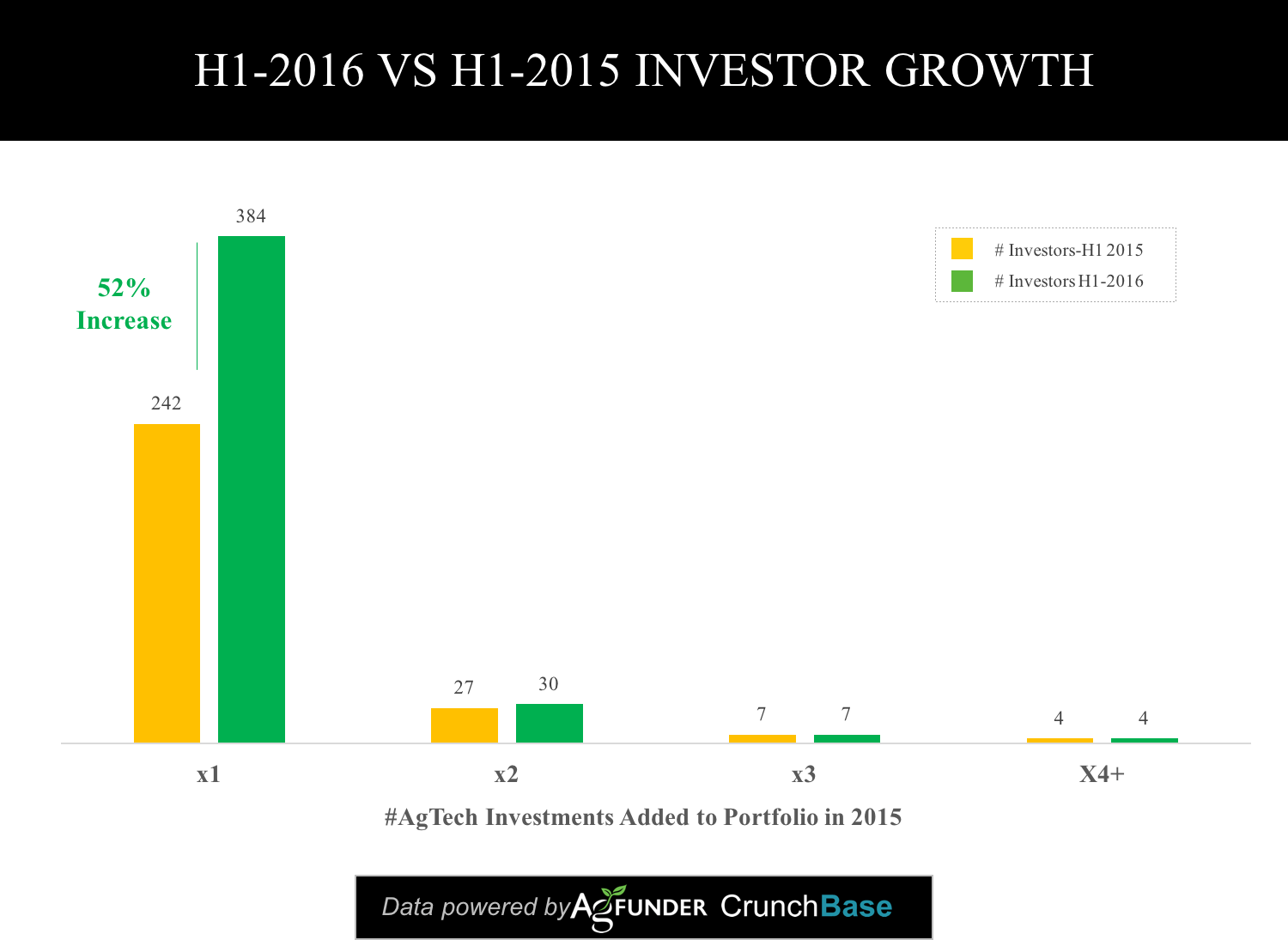

With signs of a slight rebound in the global VC market in the second quarter of this year, we don’t expect the pullback in agritech investment to last long, particularly given the number of new agritech specific funds (7) and accelerators (12) that launched in H1. During the first half of 2016, the number of other investors coming to agritech also increased, with 52% more unique investors recorded compared to the first half of 2015.

While this is a positive sign for the sector, the agritech investment ecosystem is still immature. Like other niche sectors, agritech has a small group of core investors. In recent years, that number has increased. Several new venture stage funds have launched providing a skeleton for the fledgling agritech funding market, but there are still funding gaps, particularly at the seed and growth stages.

Some of these gaps are beginning to be filled, particularly at the earliest stages, but there is still some way to go before agritech startups have a sustainable, healthy funding ecosystem in which to mature.

So, with continually positive expectations about the potential for agritech startups to transform the world’s oldest and least digitized industry, the question now is: how exactly will funding come into the sector?

The growth of agritech venture capital

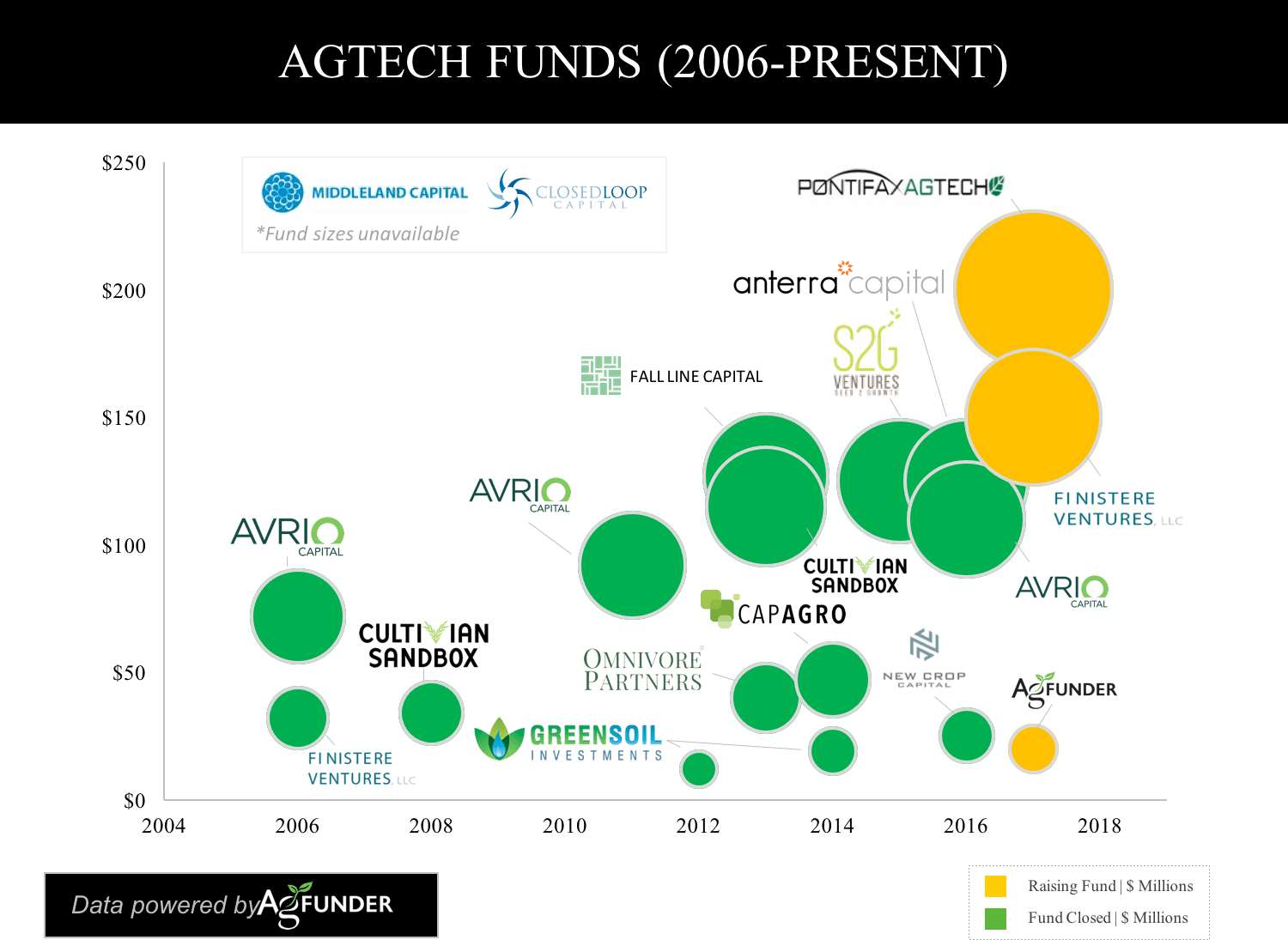

The first main wave of agritech investment funds launched in 2006 and by our count, today there are now 13 core firms that have raised funds totaling $1 billion. Even in such a small group, they spread across Canada, US, Europe, Israel and India and not all of the funds to-date have focused exclusively on food and agriculture; some have emerged from life sciences or healthcare funds.

The first agriculture venture capital funds focused on biotech with agriculture one of the sectors served; Canada-based Avrio Capital raised $75 million and California-based Finistere Ventures raised a smaller fund of $32 million.

One of the only other funds to launch before 2011 was Cultivian Ventures, started by ex-Dow AgroSciences veteran Ron Meeusen and life science veteran Andy Ziolkowski, which closed a $34m fund in 2008. “It was pretty lonely out there for a while,” says Cultivian’s Ron Meeusen.

Then change happened. Between 2011 and 2015, seven new firms entered the space globally and three firms raised follow-on funds, including Cultivian’s Fund II which is $114 million. This year alone has seen a wave of fundraising activity, with three firms announcing fund closures: Anterra’ Capital closed its first fund on $125 million, which is the largest agritech investment fund on record (alongside S2G Ventures); Avrio’s third fund closed on $110 million, and alternative protein-focused New Crop Capital closed on $25 million. In addition, Pontifax Food and Agriculture Technology Fund (Pontifax AgTech) announced the first close of its fund targeting $200 million; Finistere held the first close on its second fund; and we at AgFunder are launching a new agritech fund, initially targeting $20m, which we expect to close in Q4 of this year.

Outside of the US, China-based Tsing Capital announced plans to raise a $500 million food and agritech fund focused on Australia; India-based Omnivore Partners is raising its second fund later this year targeting $70 million. There are others on the US agritech investment scene that are focused on food but have an overlap with ag, such as the newly-launched Powerplant Ventures.

All of this excludes fund activity by governments, corporates and corporate venture arms, private-public partnerships and smaller regional funds.

Who is backing these agritech investment funds?

The money for these funds needs to come from somewhere and the fund LPs to-date are largely from the agriculture industry, including large agribusinesses looking to augment their R&D via VCs and families with links to agriculture looking to build their wealth along the value chain. We’ve also seen family offices with impact and sustainability agendas come into the market.

Two of the earliest agritech investment firms — Cultivian Ventures and Finistere Ventures — were backed by Monsanto and Bayer, respectively, as those agribusinesses’ first forays into the startup space. Anterra Capital’s LPs are Rabobank and Eight Roads — part of the Fidelity Group, and Middleland Capital and Closed Loop Capital are both backed by family offices.

Some of these large strategics went ahead and created their own in-house corporate venturing arms, straddling the line between corporate and VC. Syngenta was the first, dating back to 2006, with Monsanto joining in 2011 with the creation of Monsanto Growth Ventures (MGV). MGV and Syngenta Ventures are by far the most active, but their peers BASF, DuPont, Bayer have started agritech investing initiatives too.

Smaller agriculture companies are also joining the ecosystem either by making investments into these managed funds, through their own dedicated corporate venture arms or through direct investments. The Andersons, for example, created Maumee Ventures in 2015 — which has now been put on hold amid personnel change — and ag-retail firm Wilbur-Ellis is now creating a corporate venturing arm. Food companies are also joining the fray, such as Campbell’s Soup, which recently invested in Acre Venture Partners as its sole LP. The motivation and priorities of these corporate venturing arms often differ from independent venture firms, not least in the time frame they have to hold investments and their thematic focus.

To date, few of the agritech investment funds have raised funding from the more mainstream pension funds and large institutional LPs that are still on the sidelines looking in. These larger LPs are typically more conservative in nature and often don’t invest in new or emerging managers or sectors.

Generalists have played in agritech investment for a while, but are they enough?

Mainstream investors have supported the agritech sector through direct investment from the beginning. This support can be sporadic, however, which casts some concern on how reliable a funding source they are.

In 2010, the Wall Street Journal reported 11 agritech deals closed in 2009 up from 5 in 2000, giving the sector an average of 6 deals per year over that time frame. With very few agritech VCs in the market, it was a broader array of investors funding these deals, from venture capital funds, to family offices and other financial investors. A few of the more traditional tech venture capital firms, namely Kleiner Perkins Caufield & Byers (KPCB), Khosla Ventures and Andreessen Horowitz were funding more of the tech-centric plays, while some of the life science VCs backed agricultural biotech deals, but overall it was mostly opportunistic investors funding the space.

Fast forward to today and that has continued; there is now a long tail of investors who are placing tangential bets on agritech by making investments in drones, sensors, satellite imagery and more.

Early stage gap is closing

There’s been a particular surge of interest in the earlier stages of agritech innovation. With new technologies that are now economically viable for the sector and a large amount of scientific research not commercialized, many folks around the world see that they have unique assets to contribute.

In the first half of this year, at least 12 new agritech startup accelerator programs have launched globally and that’s just part of the 70-plus startup resources that are dedicated to agritech – from venture development organizations and incubators to grants and business competitions.

Universities and research institutions are still struggling to get up-to-date with tech transfer to help their graduates commercialize their discoveries, but some of these new resources are hoping to change that, such as the Ag Innovation Development Group out of Tennessee, AgTech Accelerator at Research Triangle Park and AgStart near UC Davis.

Even generalist accelerators, or those from other industries, have stepped in to bridge the early stage funding gap with some playing a vital role. During the first half of this year, the self-dubbed “Accelerator VC” SOSV invested in 26 agritech startups through its IndieBio and Food-X accelerators in San Francisco, Ireland and New York. This one VC represented 16% of seed stage deal activity.

It’s still unclear how all of this will play out among early stage agritech participants or how impactful these resources will be, but it’s recognized that agriculture’s unique and complicated characteristics merit help at the earlier stages.

Today’s challenge: funding the later stages

The existing agritech VCs welcome the increasing presence of new investors, saying that the market is still a long way from being competitive. “It’s good that we’re attracting core investors into the sector. It’s critical to the success of the whole area for more investors to come in,” says Meeusen.

Agritech VCs find mainstream investors particularly helpful in later stage funding where their resources are more limited and most of them are partnering with a range of generalist VCs.

Cultivian Sandbox, for example, works with around 30 different generalist venture firms and investors to help portfolio companies get later stage funding. The firm mentioned ARCH Venture Partners, TPG Capital, UTIMCO as three examples, but also emphasized the involvement of family offices, sustainability groups and corporate venture arms.

“Agtech entrepreneurs have various options today for early stage funding, but growth equity in agtech is undercapitalized with little competition today,” says Ben Belldegrun, founding partner at Pontifax AgTech.

Belldegrun is right. During the first half, agritech VCs participated in deals worth just 9.5% of the $964 million in Series B-D funding. They were in 8 deals totaling $92 million and of these, only two of them led the funding rounds — Finistere Ventures led the small-ish $5.3 million B round for genetic seed company ZeaKal and the corporate VC Monsanto Growth Ventures (MGV) led the $11 million Series B for Canadian ag imagery analytics startup Resson.

Corporate venturing arms like MGV are a clear candidate to fill this funding gap, but there’s only so many of them to go around. Of the independent agritech VCs, only Anterra and Pontifax AgTech have raised funding specifically for growth stage investing. A new venture firm Willow Hill Ventures is also hoping to raise a later stage agritech fund, but their success in growth stage funding depends on how much they can raise for the fund.

“We are at the beginning of agritech proving itself to be a distinct investment class,” says Philip Austin, partner at Anterra Capital. “Specialist funds are just at the beginning of delivering the consistently strong returns required to scale and a number of them are now entering the $100 million to $200 million size range where an individual fund could put $15 million to $30 million into any given company and take it through multiple value inflection points.”

How the funding ecosystem could play out

Specialist and generalist firms will coexist going forward and generalists will probably come and go.

Specialist firms are arguably needed more at the earlier stages, though outside investors can add important value at this stage too. Tech-centric VCs will improve technical due diligence in the software category, while the same can be said for life sciences in the biotech space.

At a later stage, the value of specific agricultural domain knowledge may become less important. “Once a company gets revenues, an investor can look at spreadsheets, cash flows and cap tables, which can tell you much more of the story,” says Cultivian’s Ziolkowski. “And, while they might not have the market adoption understanding, they will know how to evaluate parts of the technology.”

This does leave agritech startups exposed given that generalist VCs are not always reliable, however.

“Our main concern is that many generalists are dabbling in agritech with limited knowledge of the complex markets they are playing in and with expectations of growth profiles that are unlikely to happen quickly in such conservative markets,” says Anterra’s Austin. “There is a risk that the agritech portion of any generalist portfolio underperforms their investments in more traditional venture sectors in the short term. This will lead to perfectly solid agtech companies being starved of capital within mixed portfolios.”

Khosla Ventures, for example, invested in 10 funding rounds for eight different companies in 2014, but in 2015 it made just three agritech investments, and so far in 2016, it’s made one. Kleiner Perkins was another top 5 active investor in 2014 with five agritech investments, but this year has just re-upped on existing portfolio company Farmer’s Edge.

This pullback from these funds doesn’t mean agritech is out of favor with them but reflects the fact that fund priorities ebb and flow along with innovation and industry development.

“While the agriculture sector is poised for incredible change in the coming decade, resulting from converging technology and consumer trends, the reality is that there will likely be a limited number of large winners,” Brook Porter, partner at KPCB tells us. “Some of our early bets are still playing out, while other industry trends have yet to mature to the point where we feel compelled to invest – but the long-term opportunity is still very compelling.”

This will perhaps never be fixed, especially not in the short term as there’s uncertainty around the return potential of the industry, but the additional capital is helping the sector become more self-sustainable and may help with the return profile as well.

We still need more capital and investors coming into agritech and it’s not just a matter of pairing agritech VCs with later stage investors. Agriculture is a global industry, so a globally diverse investor base will be key to help agritech companies scale.

We produced the images with data from AgFunder’s AgTech MidYear Investing Report 2016, which can be found here.