- SLC Agricola, the largest agricultural producer in Brazil, is investing in vertical farming startup Pink Farms through its SLC Ventures arm.

- Financial terms of the investment, which is part of Pink Farms’ current Series A, are undisclosed at this time.

- Funding will help Pink Farms grow its production capacity in order to meet the demand for vertically grown produce in Brazil and Latin America.

Pink Farms at a glance:

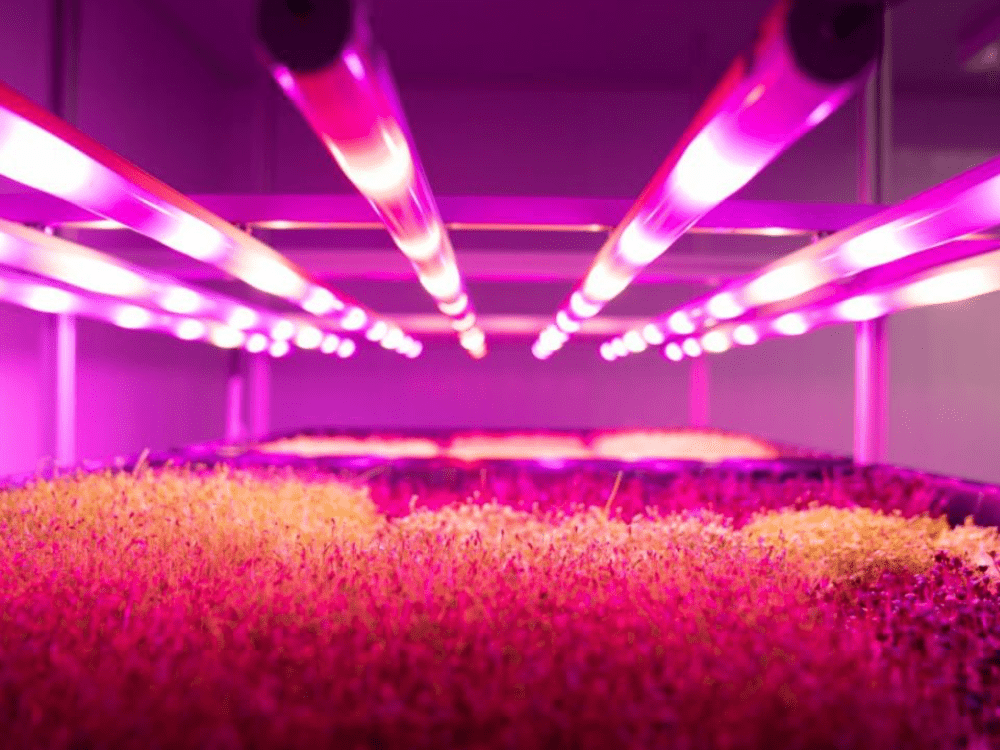

São Paulo, Brazil-based Pink Farms claims to be the largest urban vertical farm in Latin America. Co-founder and CEO Geraldo Maia tells AFN that despite this status, current operations are on “a very small scale.” It aims to change this thanks to the SLC investment.

Pink Farms grows roughly 6,000 pounds of leafy greens per month its 750 square-meter controlled-environment vertical farm in São Paulo. The company sells its products through a subscription service as well as at retailers like Carrefour.

Currently, Pink Farms is finalizing its Series A round, which Maia expects will reach its target of R$15 million (around $3 million).

He says the company plans for 10x growth over the next year, and to increase production from 30 SKUs to 75.

“We’re going to start developing strawberries and other berries, mushrooms, tomatoes, peppers,” he adds. “Our aim in the next five years is to have at least 400 SKUs.”

Why it matters:

SLC’s investment is major nod from Big Ag to both Pink Farms and vertical farming in Latin America.

SLC is widely considered one of the most efficient conventional farming operators in the Brazil. It operates on over 640,000 hectares (more than 1.5 million acres), focusing primarily on soybeans, cotton and corn.

It’s massive,” says Maia. “They are the best operation for the grains and some fibers that we have in Latin America.”

An investment from a company of that scale is a vote of confidence in Pink Farms’ business. Maia also suggests SLC is investing in its own future.

“We see them as a future operational partner in the sense that we’re probably going to implement for them some of the technologies that we do for vertical farming,” he says.

“We aim to provide some part of our technology or maybe the full solution to the grain and fiber production in the next 10 years, so I think that we and SLC saw that it is a plausible and that they will need to be ahead of the curve on this new farming method.”

He acknowledges that right now, vertical farming isn’t economically viable for every crop. “But I do believe we can start with some type of grain or fiber to better understand it in controlled environments so we can continue to grow our technology and understanding of the plants,” he adds.

Why it matters for Latin America:

Brazil is one of the world’s largest industrial agriculture producers, but it isn’t especially known for leafy greens and other delicate produce. “It’s too hot and humid,” Maia says of many places in the country.

Nor are there glass greenhouses like those found in the Netherlands, Belgium or the US, which Maia says offer higher yields but also higher costs that producers in Brazil can’t recoup.

Costs are a barrier in vertical farming too. “We understand that we’re going to need another big evolution in terms of lighting efficiency,” he says.

The cost of lighting has come down in recent years, but it’s still one of the biggest operational challenges vertical farms face. Maia says further down the line, something like artificial photosynthesis might be another option.

Funding is an additional challenge. He says Pink Farms has struggled in the last few years to raise capital due to the small size of the VC market in Brazil. Most of the funding also goes to late-stage companies.

SLC’s investment in Pink Farms’ early-stage round will, he adds, “help create a sense of security that traditional farming understands what we are doing and believes we can reach what we say we want to reach.”

“That will enable not only us, but other players in this market to increase their funding, increase their operations, so we can start to make a dent in this market in the Latin American space.”