Dutch ag biotech startup Hudson River Biotechnology (HRB) has raised €5 million ($5.94 million) in Series A funding, AFN can exclusively reveal.

Half of the round — which was led by UK-based investment firm Bridford Group — consists of non-dilutive funding, according to the startup.

Named for the river passing through New York City where its co-founders met, HRB started out gene-editing crop varieties to enhance their performance. And following its Series A fundraise, the Wageningen, Netherlands-based startup has a new offering up its sleeve.

“In short, we’re an agricultural biotech company focused mainly on CRISPR-based genome editing in plants,” co-founder and chief scientific officer Ferdinand Los tells AFN.

“Now, with this investment round, we’re also focusing more on the application of agrochemicals [and other inputs] using our nanotech delivery platform, for in-field applications in plants.”

A sole focus on organic farming will not get us where we need to be – read more here

The startup takes a non-transgenic approach to CRISPR; in other words, it does not add any DNA from other species into the plants it is working on. This allows it to operate within EU regulatory guidelines with regards to genetically modified organisms, according to Los.

HRB’s editing tech has been used for both row crops and greenhouse varieties, as well as ornamentals including cut flowers and pot plants. It has also been used on algae, with a view to producing biologically or pharmaceutically useful compounds. The startup’s customers include plant-breeding and seed companies, family-owned ornamental businesses, and — increasingly — larger agribusiness corporates. They’re mostly located in Europe and North America – though Los reports growing interest from Asia and South America.

He describes HRB’s revenue model as being non-standardized and “tailored” to the customers it partners with.

“Generally speaking, we have a system where we capture the end value of the product in the market. That can be a royalty setup, sometimes a license – it depends on the partner,” he says.

“We have to be flexible. In the row crops segment it will be very different from how it works in ornamental cutting flowers, and very different again from pharmaceutical applications of plants. So we tailor the details of the deals we make to what is normal in the field for the customers.”

Launching in 2015 off the back of an EU grant, the HRB team initially applied CRISPR to marigold plants with the aim of increasing their lutein content. Lutein is a compound which gives marigold flowers their vivid yellow-orange colorings, and it has numerous applications in the pharmaceutical and food industries.

“Around 2017 we found interest in the market for the application of CRISPR in ag was really growing rapidly. That first business case had much less interest, so we pivoted the focus of the company to work specifically on the application of CRISPR in plant breeding,” Los says.

That change in direction landed HRB its seed round in 2018, allowing it to further develop its “workflow” for making genome-edited crops into a commercial reality.

“As for CRISPR itself, everyone has access to it. Where the magic is, is on the technical side,” Los explains.

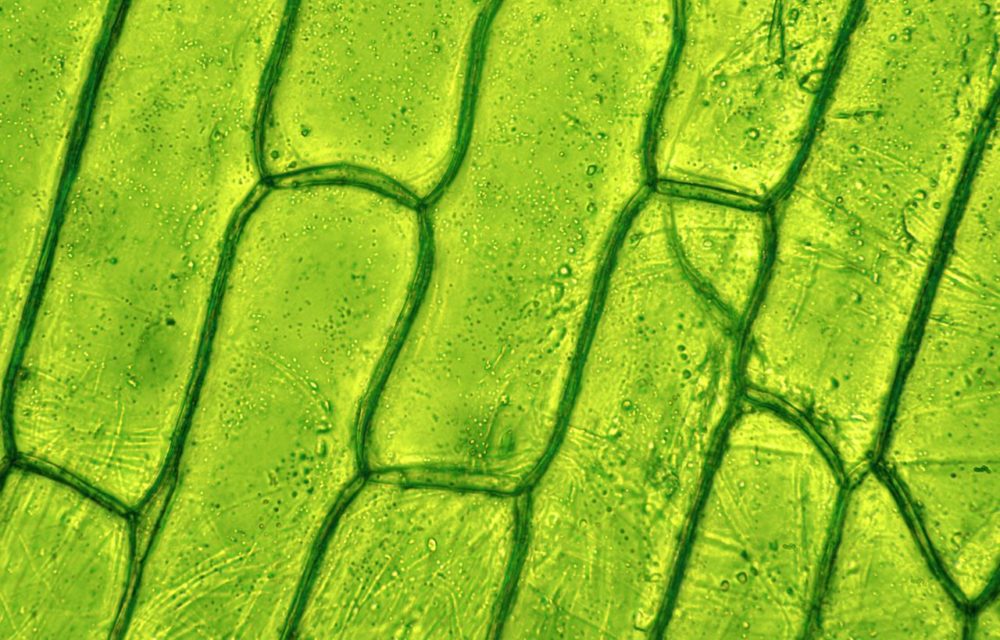

“We’re addressing the two main bottlenecks in applying CRISPR to plants. Making the CRISPR enzyme is not the difficult part; the difficult parts are knowing where to make edits, delivering the CRISPR ‘machinery’ inside the plant, and […] plant regeneration – getting it from the lab in an in vitro situation back to a real plant that can go in a field or greenhouse.”

HRB is hiring – check out AFN Jobs for more details on the openings, and for roles at other companies

It’s that “delivery” element which has led HRB into exploring its latest new business case. The startup has been working on nanoparticles that allow it to bypass plant cell walls in order to introduce CRISPR enzymes – but now it’s eyeing potential alternative uses for this teeny-tiny technology.

“It’s actually highly scalable – most nanotechnology is very expensive, but we have one that has the right kind of source material to work with to start delivering [inputs] on an entire field,” Los says, without giving away too much detail since patent applications around the system are pending.

“The uniqueness is in the delivery, and there are two directions we can take this in. One is that we can encapsulate existing compounds or molecules to improve bioavailability and reduce the amounts [of agrochemicals] you need to spray on fields. The other is that we enable the delivery of new types [of inputs] – for example, biological agents.”

Los says that HRB will use its Series A capital to further develop its nanotech offering and explore market opportunities, as well as scaling up its core crop-breeding business.