Editor’s Note: Mike Betts is director of investments at AgFunder, where he is responsible for sourcing and working with many of the investment opportunities on the online investment platform. He attended Fish 2.0 last week at Stanford and here he shares his key takeaways from the event and his thoughts on the growing aquaculture sector.

Last week, I attended Fish 2.0, a biennial business competition event for innovation in seafood with a focus on aquaculture at Stanford University. I came home babbling to my friends about the first day, to which their response was, what is aquaculture? So to take a small step back, the Food and Agriculture Organization (FAO) describes aquaculture — as opposed to capture fisheries — as:

“The farming of aquatic organisms, including fish, molluscs, crustaceans and aquatic plants. Farming implies some form of intervention in the rearing process to enhance production, such as regular stocking, feeding, protection from predators, etc.”

However, Wikipedia draws my favorite parallel — “the relation of aquaculture to [capture] fisheries is analogous to the relation of agriculture to hunting and gathering.”

In 2013, aquaculture production for fish was 70 million metric tons which represented just 43 percent of total fish production in the world, according to the FAO. When you think about the global environmental/ecological problems resulting from the seafood industry, climate change, and population growth — overfishing, acidification of the ocean, and mass extinction of species in the oceans to name a few — you might call our approach to fish production quite primitive in relation to land-based food production systems.

To be fair, aquaculture has come a long way. In 1970, the industry was practically non-existent. Today, it is one of the fastest-growing food producing sectors. Nearly all of the global growth in seafood production in the last 30 years has come from aquaculture. But it hasn’t come from the US. 90 percent of total food fish aquaculture production is in Asia and less than 1 percent in the US. While the US arguably leads the way in innovation for large-scale, land-based agriculture, it’s a complete laggard when it comes to aquaculture, meanwhile one of the largest importers of fish.

Enter Fish 2.0

So back to the Fish 2.0 event. In its second year, 170 companies from around the world entered the competition — more than twice the 83 entries in 2013 — and 37 finalists and runners-up were invited to pitch at the final event. The event’s aim was to bring together entrepreneurs and investors to help solve the global challenges facing seafood today, and it’s one of few initiatives aiming to bridge the wide gap between the investment market and this sector; very few venture capital and private equity firms have touched the space.

Earlier this year Monica Jain, the founder of Fish 2.0, told AgFunderNews, “The investors I speak to tell me they don’t see enough deals each year. The deals they do see come in piecemeal, but also they don’t have the knowledge to make decisions.” On the flip side, some emerging seafood companies that Jain has come across do not have business plans and models that are investment ready. “There is this gap between the two”, she said.

And she’s right. A massive capital gap exists. But it exists alongside two other glaring gaps: one of technology and innovation and one of knowledge.

The Technology and Innovation Gap

Name a piece of the fish value chain and it is ripe for innovation. As I listened to the presentations and pitches, the entrepreneur in me was going crazy. The amount of opportunity in this space to make a world-altering impact is as vast as the oceans themselves. Feed, hardware, software, biotech, traceability, supply chain — you name it, aquaculture needs it.

“I’ve been in food industry supply chains for 25 years, and seafood for three-and-a-half, and by far, it’s the most antiquated,” Mark Barnekow, CEO of BluWrap, a seafood packaging and logistics technology company, told the audience.

One category, in particular, need for innovation is fish feed as the single largest variable cost for most aquaculture operations.

According to Fish 2.0 research, “46 percent of farmed fish require some form of feed to grow while the remainder subsists on natural food sources. Fish feed production must increase 8 percent to 10 percent annually to keep pace with aquaculture, but in reality it’s declining,” and “vital feed inputs, traditionally sourced from small, wild fish, are diminishing due to overfishing and climate change.”

As aquaculture production goes up and fish feed production goes down, you don’t need a degree in economics to know that the cost of fish production is only going one way. This is both a challenge for producers, and an opportunity for entrepreneurs.

One area of promise is in novel fish feed ingredient sources such as algae and insects, although both still need further development and scale to kick in before they are cost-effective and practical. Two finalists are working on these problems.

One of 6 winners, SabrTech, based in Nova Scotia, Canada has developed The RiverBox, a modular, scalable system for the production of algae biomass. The technology creates a sustainable closed loop system that processes waste and produces algae, an optimal replacement for fishmeal protein. The system mimics the natural processes that take place in every aquatic ecosystem to allow for zero-waste aquaculture farms that are not restricted to coastal regions or salt water.

A second finalist, ENTOFOOD, is a Malaysian producer of insect protein through a bioconversion process of organic waste. This protein — black soldier fly larvae — meets the quality, quantity, and price demands of the aquaculture compound feed market. It is sustainable and free from fishmeal, which are both important criteria for end consumers.

These were the only two presenting companies, out of the total 37, that were offering pure play technological solutions to address the fish feed supply problem; the burden seems to largely fall on the producers themselves, such as New Mexico Shrimp Company, a supplier of fresh, chemical-free, locally grown shrimp, and a runner-up at the event.

In addition to being a producer, the company also licenses its technology and processes including a formulated feed made from high protein cottonseed and the software to manage decisions and track inputs and expenses.

Producing seafood and building aquaculture systems is hard enough. It would be nice to see more pure play fish feed innovators building solutions to this global problem, particularly those that can be co-located or integrated on-site with production systems. Investors await.

The Knowledge Gap

Consumers are waking up to how their food is produced on the land. You see big business committing to change recently, whether it be antibiotic-free foods or more controversially with GMOs. But this is driven by consumer demand. Without consumer pull, nothing can change.

One hurdle is education. It’s hard enough to wrap a city dweller’s head around how a chicken got on their plate, let alone the complexities and diversity of fish production and the supply chain. What is sustainable fish production? Pollution, labor practices, feed production, disease management, overfishing, etc — we need a better way to close the knowledge gap for consumers.

At the same time, the concentration of power down the chain is largely in the hands of retailers. There seemed to be a consensus among the Fish 2.0 audience that a) retail needed to demand more sustainable fishing and farming practices if the industry was to change and b) the only way retail would change is if consumers become more knowledgeable to demand healthier, sustainably produced seafood. And it’s tough to blame consumers, the information necessary to make a decision at the time of purchase is often obfuscated, greenwashed, incorrect, fraudulent or entirely missing.

Two ways that entrepreneurs and technology are tackling this problem are through education and traceability. In a way, these are two sides of the same coin.

One of the winners, Salty Girl Seafood, is tackling both the education and traceability piece. Their mission is to incentivize change in fishing behavior and management strategies while improving access to sustainable, traceable seafood across the US. The company’s portioned and pre-marinated seafood line makes it easy to cook chef-quality seafood at home and takes the confusion out of buying sustainable seafood in grocery stores. Each package shows the consumer where, how, and by whom their fish was caught.

Manuel Gonzalez, Rabobank‘s west coast head of corporate banking and founder of FoodBytes! said: “There are two reasons why people don’t cook seafood at home — insecurity about selecting seafood at the store, and lack of confidence about how to prepare it. This is why people eat it at a restaurant. All the companies at Fish 2.0 addressed sustainability, as this was the primary theme of the event, but only two focused on the consumer by targeting the reasons why people don’t cook at home — Salty Girl Seafood and Love the Wild. They showed products that addressed freshness, sustainability, and preparation concerns by providing an all-encompassing solution for the consumer.”

On the other side of the coin, better traceability technology is required to enable businesses to provide the education and products that many consumers demand today and more consumers will demand tomorrow as the knowledge gap closes. The knowledge gap is not just at the consumer level, it starts breaking down when the fish leaves the water and even while fish are being raised in aquaculture systems.

“This industry has a total lack of transparency. It’s built on opaqueness,” said BluWrap’s Barnekow.

Pelagic Data Systems was one of the companies tackling traceability. As one of the runners-up and the winner in its track by audience vote, the company brings vessel monitoring and data analytics to the artisanal fishing sector. Its system consists of a network of low-cost, rugged, solar-powered sensors that can monitor fleet location, activity, a storage temperature of the catch, and fishing methods used. Its customers include buyers seeking catch traceability, governments managing fish stocks and enforcing marine spatial zoning, academic researchers, and conservation organizations tackling sustainable seafood issues.

From water to shelf, traceability will continue to be a paramount need for the seafood industry to deliver the product that consumers demand and hold entities accountable throughout the value chain.

The Capital Gap

While we’ve talked about innovation and knowledge, Fish 2.0’s mission at the end of the day is connecting seafood business with investors. The conference started off with a panel on the risk of seafood investment and ended with a town hall format where discussion of the “capital gap” dominated.

The gap is real and the bridge is still to be built. Fish 2.0 has been laying a very good foundation for that.

The main types of capital for seafood companies is no different than any other space — grants, debt, and equity. And for later stage companies, other familiar investment structures such as hybrids and corporate investment can also come in. So, grant funding aside, why does the sector seem so alien and scary for investors?

With debt, lenders are typically wanting to see 3 years of operating history and industry benchmarks. The seafood industry, particularly in newer production aquaculture systems such as Recirculating Aquaculture Systems (RAS), suffers from a wealth of horror stories and lost principle as well as a dearth of solidly profitable data points from thriving business. In short — it’s a bit too risky for most lenders.

Equity is another story, but there’s still not enough capital to fund today’s innovation and tomorrow’s breakthroughs, particularly at the early stage. You have both impact capital and venture capital to work with, but there’s really a shortfall relative to the needs in aquaculture and seafood innovation. On top of that the expected risk/returns for many businesses don’t meet the requirements of LPs in typical VC funds, and quite often government uncertainty and regulation is a huge obstacle as the seafood industry is as global as any industry.

Not every part of the value chain shares the struggle, though. Supply chain technology such as processing and distribution have been able to attract investment. “There are more data points” we heard from one panelist. But on the flip side, production aquaculture is really hit hardest by the funding gap. Upfront capital costs, feed costs and lack of historical models and benchmarks to appropriately make investments, are a few of the main hurdles. And there are the horror stories of catastrophic tech failures and disease in some of these systems.

So where are the positives? Well, global consumption of seafood — and all protein for that matter — is going up, no doubt. The supply is not on a trajectory to meet this demand. And with a growing middle class and more educated consumers, the opportunity should pull entrepreneurs to it, and ultimately the returns should bring in the capital right behind. Sometimes things need to break before they can be fixed.

And just this week there was a vote of confidence in the industry in China by leading global private equity firm KKR which invested into a Chinese upmarket fish feed business.

So here are some of the ideas that speakers and delegates suggested during the event: a Fish 2.0 attendee seeded investment fund; aquaculture incubators/accelerators to help early stage companies move from research to business; more creative hybrid debt/equity financing structures tailored for seafood business models and growth patterns; contract agreements with entities down the chain which often have better cash flow; and the formation of cooperatives with retailers and processors. Some of these are being done today, but it’s clear that the industry could use more creative financing structures.

“What we saw in the room were early-stage venture capital investors and later-stage lenders,” David Tze, co-founder of Aquacopia, the first aquaculture venture capital fund, told me. “The issue is that almost all aquaculture and innovative wild catch companies don’t meet the criteria of the former and don’t get funded to survive and grow into something for the latter. The capital gap, in these cases, could and should be filled by early-stage equity, debt, or loan guarantees from government and foundation sources, or better yet, purpose-specific funds set up by them.”

What next

I left Fish 2.0 with a fundamentally new perspective on aquaculture, both inspired by entrepreneurs and frustrated about the seafood industry. The challenges and opportunities in this space are seemingly limitless. If you’re innovating in seafood, Monica and her colleagues at Fish 2.0 would gladly hear from you and give you support — they worked hard with all of the presenting businesses on their pitches — and if you are raising funding, reach out to us at AgFunder. And, if you’re an entrepreneur thinking about where to build your next business, look no further, the fish need you.

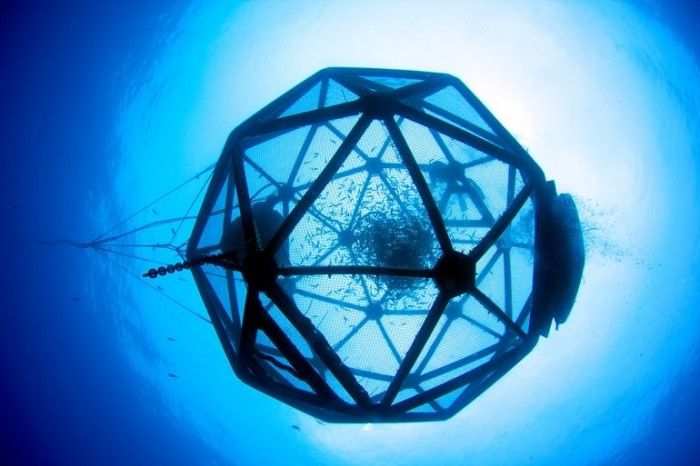

Image: Kampachi Farms, a Hawaii-based mariculture company, and one of Fish 2.0’s winners.

Have news, tips or want to write a guest commentary? Email [email protected]

— Check AgFunder.com for agriculture investment opportunities —