Bushel, a farm relationship management tool for grain elevators, has raised $7 million in funding from a syndicate of individual investors in the agriculture and software industries.

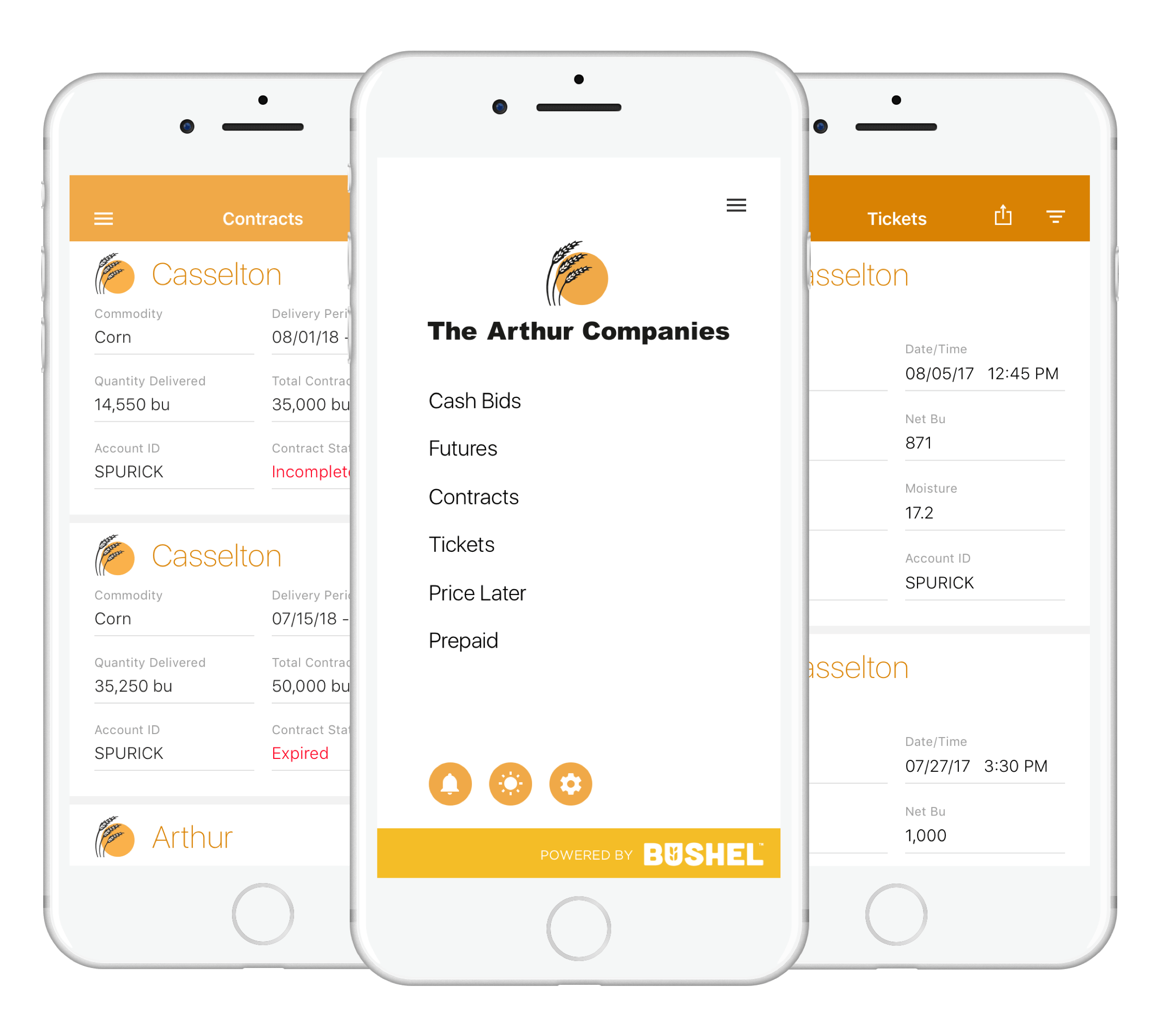

The Bushel mobile app platform integrates into grain elevators’ accounting systems to provide growers access to their contracts, scale tickets, prepays, cash bids, and markets. The tool is offered free to growers as a white-labeled product under the elevator’s brand.

This latest round of funding is most like a Series B in relation to the company’s valuation but is not being labeled such as the company has no venture capital investors, JakeJoraanstad, CEO, told AgFunderNews. The company’s last round of investment was $1.5 million led by Gen7 Investment, a Fargo, North Dakota investment firm.

Bushel was conceived in 2016 by parent company Myriad Mobile, a custom software development company based in Fargo after the business had spent some time working with a range of agricultural clients. Most of the team grew up on farms in Fargo and developed specific expertise after working with clients including Cargill and Conservis on internal and customer-facing software programs.

“Some of our existing clients are very strategically aligned to the objectives of Bushel,” said Joraanstad. “Some share similar customers in its fertilizer business as we do with Bushel, for example, so there’s a healthy overlap there that could help expand the use of Bushel across the industry.”

While Bushel’s clients are the grain elevators, coops, plants and mills, Bushel provides great value to the farmers using it, according to Joraanstad.

“The value to farmers is significant; they are not only able to see bids and markets futures, as well as all of their account information and signed contracts in one place, but they get real-time updates on the delivery of their product,” he said. “This shows them how many bushels they’ve delivered and the quality of their product such as moisture content or bugs.”

Knowing this information in the field helps farmers to make on the spot decisions, such as switching which side of the field it harvests to avoid shipping wet crops and getting a lower price for its offtake. While farmers will pre-sell their grain to elevators far in advance — as much as two years ahead — the quality and quantity of that crop will lead to variations in the price they get.

“Bushel is key to helping farmers understand the overall business they’re doing with an elevator,” added Joraanstad.

Farmers can also execute contracts in the app with a new eSignature feature and the app can also show them how much remaining fertilizer or other crop inputs they have that they haven’t taken delivery of yet.

Nearly a year following its launch in June 2017, Bushel has expanded its footprint from 10 pilot locations in North Dakota to more than 400 elevator and ethanol plant locations throughout the

US and Canada. Clients include Landus Cooperative, Agtegra and Flint Hills Resources. More than 20,000 growers have access to Bushel-powered apps today, according to the company.

Joraanstad says that Bushel is the only platform of its kind for elevators and able to integrate with any elevator system as well as other software platforms. “It’s not just about us being the first, but it’s about being an open ecosystem to partner with other software programs but also with financial institutions such as insurers if farmers want us to share their information,” he added.

The new wave of agribusiness marketplaces could also be potential partners to Bushel as elevators could look to purchase grain from them. These marketplaces that include Farmers Business Network, FarmLead and AgVend are not competitive to Bushel although they are creating some concern among his clients, the elevators, and coops, he added.

“I think it’s fair to say that the elevators are worried about tech adoption in general and being up to speed for their growers in order to capture the next generation of farmers doing business with them,” said Joraanstad. “They are already noticing farmers doing things differently such as texting versus calling, and Bushel hopes to enable these changes for both sides.”

“I think there are relevant concerns that FBN and others will start to disrupt how they do business; we are here to help elevators and coops in their relationships with their farmer clients through technology through the existing infrastructure.”