With all the talk these days of “sustainable food systems,” “regenerative agriculture,” and “climate-smart farming,” it’s tempting to imagine that the end of chemical pesticides, fertilizers and other inputs is just around the corner.

It isn’t.

Chemical crop inputs — think Haber Bosch-produced fertilizer and chemically synthesized herbicides — will be part of agriculture for many years go come, even as demand for biological alternatives grows. Instead of simply replacing chemicals, biologicals will, for at least the near term, change the way we use them.

While the category still lacks a standard definition (legally and casually), biologicals can be loosely described as crop protection tools derived from natural materials or naturally occurring processes. While they aren’t new, the rate of new products has increased dramatically in the last several years in response to climate change, consumer demand for “sustainable” food, as well as bringing economic benefits back to growers.

Biologicals’ relationship to chemical inputs, and how the two can work together rather than being mutually exclusive, was the major message at last week’s Salinas Biological Summit in California. Attendees threw the phrase “systems approach” around liberally to illustrate that biologicals are a single tool inside a larger box we must use to make agriculture more sustainable.

Takeaways from Salinas Biological Summit

Over the following two days, they unpacked what “making ag more sustainable” actually means, and where biologicals fit in.

Cue discussions around distribution models, regulatory timelines, the dangers of “bathtub brew,” the role of indigenous land management, farmer adoption (or lack thereof), the challenges of venture capital investment, and integration with rather than replacement of chemical inputs. In the words of event speaker Secretary Karen Ross of the California Department of Food and Agriculture, “we’ve barely scratched the surface” when it comes to how we develop, distribute and use biologicals.

Here are some of the biggest takeaways from the Salinas Biological Summit, which was co-hosted by the Western Growers Association and New Zealand agtech consultancy Wharf42.

It goes without saying this is not exhaustive — far from it, in fact. In the coming days and weeks, we’ll be looking more deeply into each of these areas and many more. As always, drop me a line to share your thoughts and make suggestions.

Biologicals won’t replace chemicals

In 2022, AgFunderNews cited a report stating that while the biologicals sector is predicted to hit a $19 billion value by 2026 (up from about $11 billion in 2021), the chemical inputs sector is still growing and will outpace the former for years to come.

The reason for this was a major theme in Salinas: biologicals aren’t a replacement for chemical inputs, and they won’t be for the foreseeable future. Instead, they’re both steps in a larger trek towards agriculture that’s healthier for people and planet.

“It’s not a standalone solution,” Secretary Ross said of biologicals. “It’s an integrated approach into a system and understanding of how each one of these things leverages each other.”

“Biologics still suffer from a competitive disadvantage compared to chemical products in terms of biological efficacy,” explained Peter R. Mueller, SVP, global strategy lead for fruit & vegetables at Bayer.

Using pest resistance as one example, he added, “We need the effectiveness of chemical products. Resistance management is a big topic because we need a relatively broad portfolio of different chemical alternatives in order to overcome resistance challenges. In the future, if it’s too narrow, we basically drive the problem of resistance.”

Biologicals’ success rate also varies wildly, which is one reason growers have been hesitant to adopt products. Factors like temperature, light and time of application can impact efficacy. Little wonder that more than half (51%) of growers on a survey cited at the event have yet to venture into biologicals.

Moving beyond ‘bathtub brews’

Thanks to dubious products in the past, many growers still dismiss biologicals as “bathtub brew” or “snake oil.”

“The first wave of biologicals delivered to growers failed because the growers didn’t know how to use them,” said Marrone.

While that’s not categorically true anymore, farmers and growers need more information and education about this new generation of products, said Pam Marrone, CEO and Founder, Chestnut Bio Advisors.

Citing a well-known Farm Journal Pulse poll, she illustrated onstage in Salinas that farmers have “a low understanding of biologicals.” According to the poll, almost half of farmers (41%) say they need to know more before using these products.

But, noted Marrone, there’s also a huge opportunity: 35% surveyed said they see potential in using biologicals — if the industry can manage to get the bathtub brews out of the market.

“How do you distinguish one from the other?” asked Naturipe Berry Growers’ research and technical director, Hillary Thomas. “We don’t have the capability as a grower to do that. We need a third party to narrow the field down to the ones that actually are showing results that have promise. They have to pass the efficacy test, the economics test. The average grower doesn’t have the bandwidth or capacity to test these things.”

Other takeaways

Brazil rising

The biologicals market in Brazil is doubling every two years, Marrone explained during her presentation.

“They’re getting [biologicals] through the regulatory body in less than a year. And so [Brazil is] eclipsing the US . . . because they’ve been registering one [product] after the other without sacrificing human health or environmental safety. In every state, Brazil set up the equivalent of extensions to help growers learn how to use the products. So it’s a lot of lessons learned from Brazil right now.”

“Working with Brazil is a totally different game,” added S2G Ventures principal Audre Kapacinskas. “. . . sales cycle, regulatory cycle, the influencers there are much more concentrated, so that comes together in a way that you could accelerate certain things if you choose to.”

Venture capital’s a ‘double-edged’ sword

One investor told me informally that we’ve already been through “biologicals 1.0” (see above point about “bathtub brews”), which makes him confident VCs will do their due diligence when it comes to investing in “biologicals 2.0.”

But as another attendee said, “You can’t rush science.” Developing biological products can take more than a decade, never mind the regulatory processes involved and the enormity of educating both growers and consumers about this brave new world.

VCs move fast. Hype leads to big checks, outrageous valuations, and bloated expectations. See the mess many in the CEA industry are currently in as an example of this.

There’s not an easy answer to the question. At best, attendees by and large agreed that VC may be “a double-edge sword” and that it’s imperative to get patient capital.

“For the entrepreneurs in the room, I can’t emphasize enough how important it is to understand the investor you’re talking to,” Kapacinskas advised. “When they recently raised their most recent fund, what their investment thesis is and what they’ve already invested in and where there are gaps in their portfolio.”

Biologicals: the next generation

One of the more well-documented struggles agriculture faces is that it’s running out of farmers.

Among other factors, making farming economically viable is a big struggle.

“How do you get this next generation of farmers ready to come in and take over the family business?” asked Kapacinskas. “They cite input costs that are at all-time highs.”

Biologicals could play a role in bringing down the cost of things like fertilizer and in doing so help keep the next generation on the farm, argued Kapacinskas.

“A lot of our emerging businesses that are focused on soil amendments and alternatives to synthetic fertilizers saw a huge uptick, just because the price of fertilizer was not accessible. People were more open to alternatives and the alternatives were cheaper.”

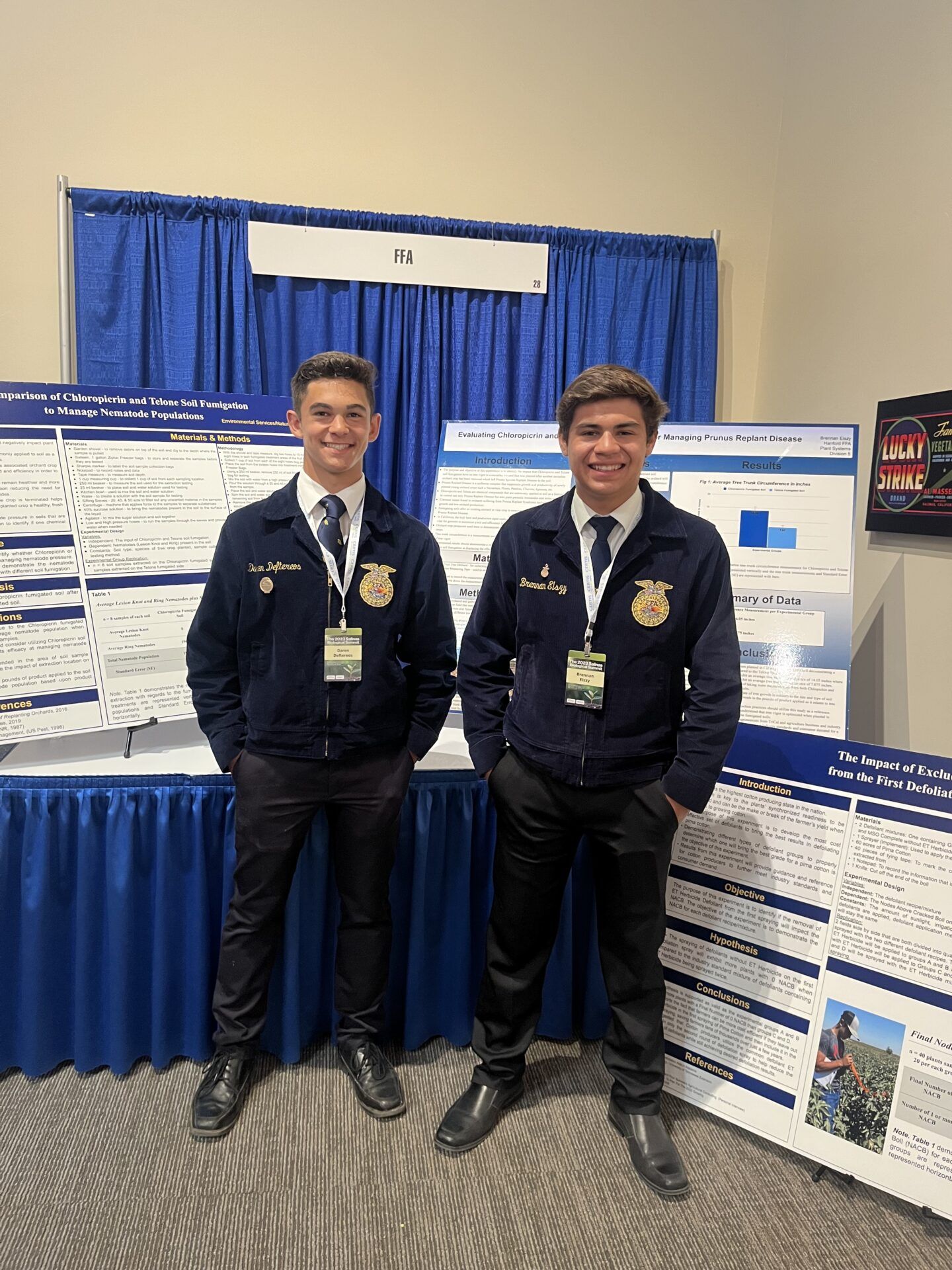

“We are in a new era because we have this opportunity with the new emphasis on nature-based solutions,” Secretary Ross said onstage. She then turned to face one particular table in the room, where two Future Farmers of America members sat. “When we visited their school, they had poster boards of a pest management issue they wanted to address in high school that compared to anything I’ve seen out of college.”

She added, as the room filled with applause, “We’re giving it to you guys so you better step up.”