Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Agricultural biotechnology startups raked in $2.6 billion across 209 deals in 2021 according to AgFunder’s 2022 Agrifoodtech Investment Report.

It 2020, the Ag Biotech category was one of the fastest growing in the farm tech sector, raising $1.6 billion across 173 deals. Its continued growth between then and now illustrate the rising interest in more sustainable crop and animal health solutions versus their traditional chemical-based counterparts.

Ag Biotech is an AgFunder-defined category which includes companies developing biological inputs for crops, animal health solutions, and those working with seed and animal genetics, among other areas.

Driving factors

Ag Biotech solutions have the potential to increase crop productivity and improve animal health, both of which are crucial to global food security. The UN Population Division estimates that by 2050 there will be 9.7 billion people on Earth to feed, or roughly 30% more people than there were in 2017.

Pesticides, herbicides, and other inputs can aid against crop losses, but at great cost to the environment and human health. Ag Biotech companies developing less-harmful biological alternatives therefore have a significant opportunity before them.

Inflation, the conflict in Ukraine, and continuing Covid-19 supply chain disruptions have also driven up the cost of inputs and threatened yields, while the ongoing ‘bird flu’ outbreak in the US is also spotlighting the need for better animal health solutions.

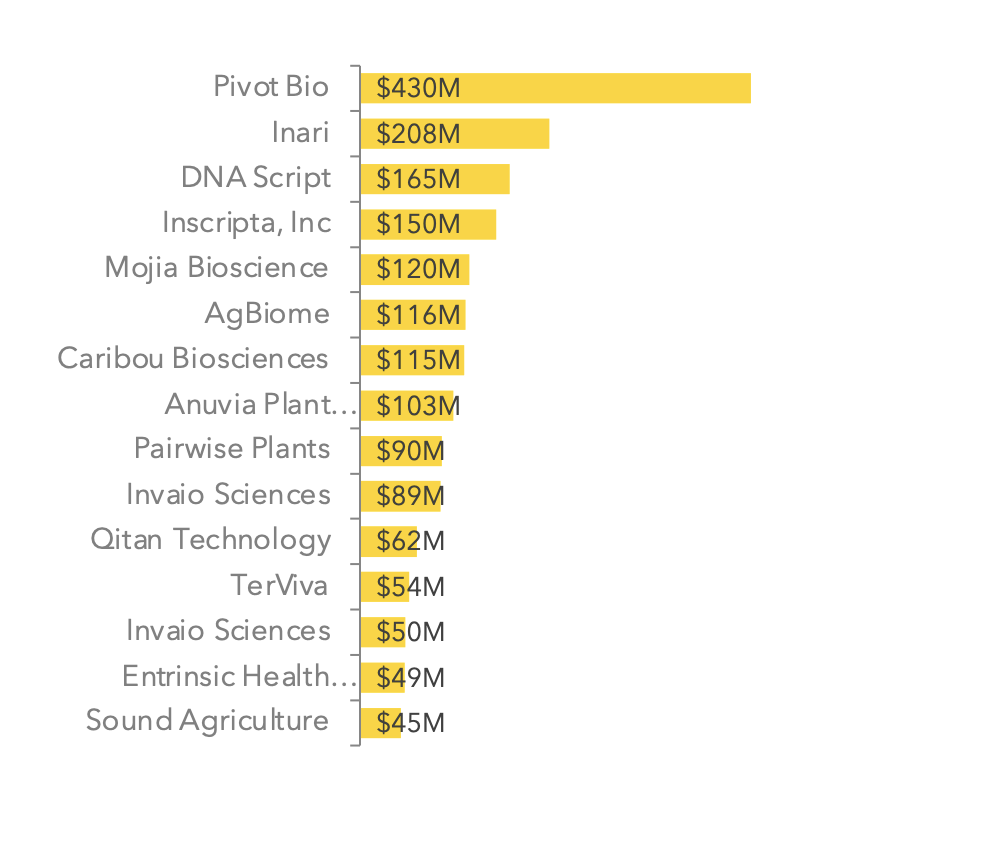

Top 15 Ag Biotech deals 2021

According AgFunder’s report, 2021 saw a greater mix of Ag Biotech solutions — for example, in gene editing, biological inputs, and molecular biotech — involved in the category’s top deals than in 2020.

US soil amendment startup Pivot Bio continued to dominate, raising $430 million in 2021 – the largest Ag Biotech round of the year. Inari, a US company developing genomic tools to improve global seed diversity, bagged the next largest deal with its $208 million raise.

Investors also showed strong interest in more generalist gene-editing platforms, with $165 million going to DNA Script, $150 million to Inscripta, and $90 million to Pairwise Plants.

The ongoing global fertilizer shortage upped interest in the growing biofertilizers sector; in addition to Pivot Bio, US startups Anuvia Plant Nutrients and Sound Agriculture raised big rounds, at $103 million and $45 million respectively.