Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

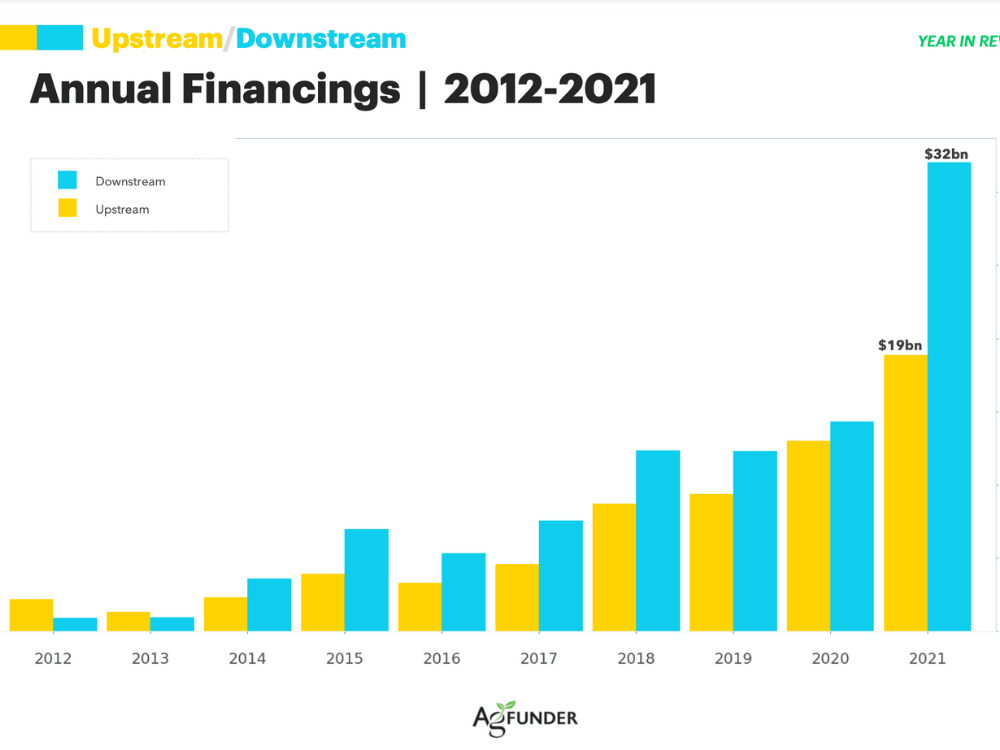

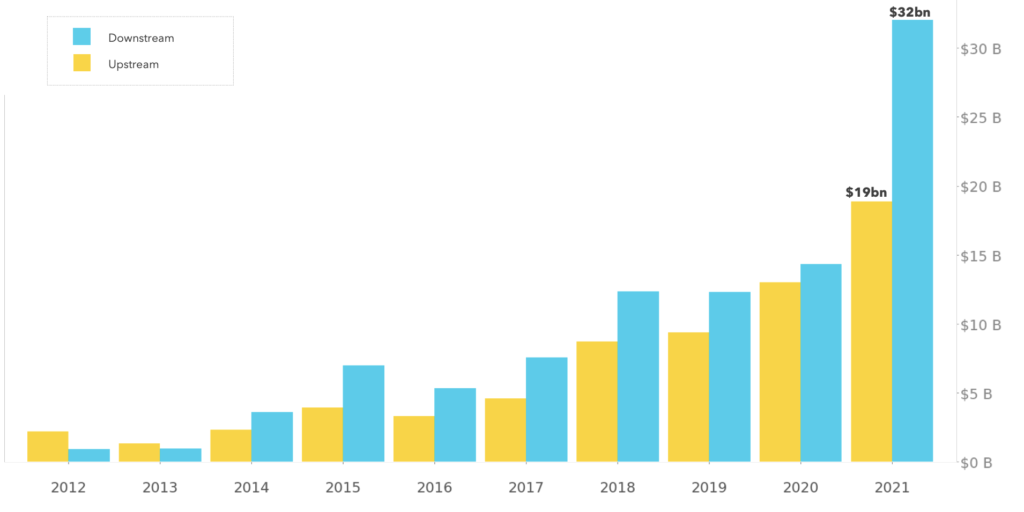

Downstream agrifoodtech investments surpassed upstream investments in 2021, increasing 124% YOY to $32 billion compared to upstream’s $19 billion, according to AgFunder’s latest annual Agrifoodtech Investment Report.

That is a switch from 2020, when upstream surpassed downstream for the first time in years, raising $15.8 billion compared to $14.3 billion, respectively.

Multiple billion-dollar rounds in eGrocery were largely responsible for downstream resurgence in 2021. More than 70% of venture investment went into downstream companies in non-US markets. In the US, upstream and downstream investment was split 50-50, signaling more maturity and diversity in the US agrifoodtech sector.

Total annual agrifoodtech funding, 2012-2021

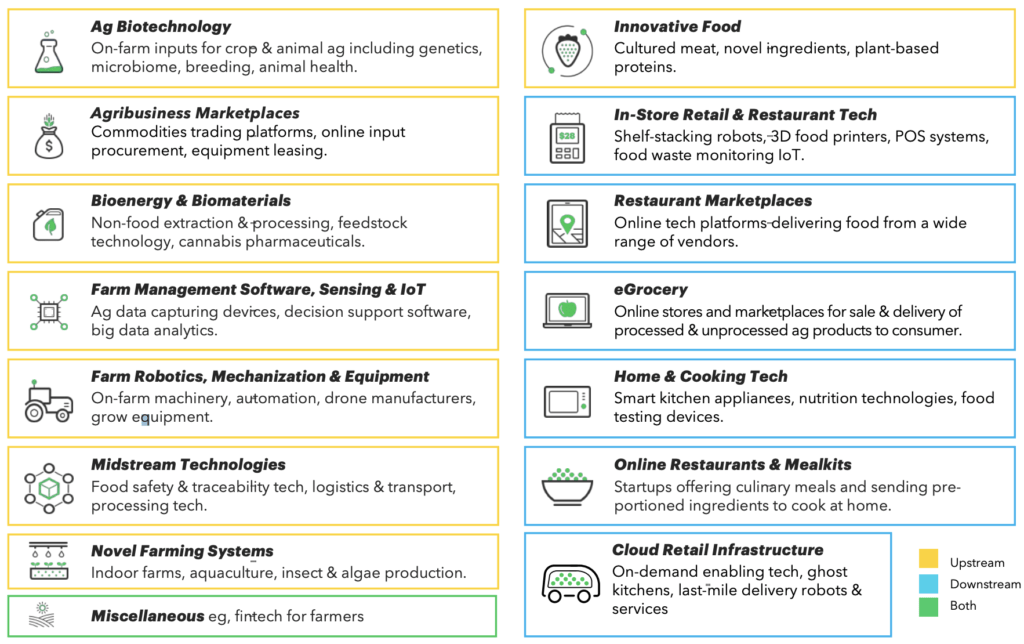

Defining “downstream”

“Downstream” refers to technologies and business models that are removed from the farm and food production. Typically, downstream ventures are consumer-facing.

AgFunder’s self-defined downstream categories include:

- In-store Retail & Restaurant Tech (Shelf-stacking robots, 3D food printers, POS systems, food waste monitoring IoT)

- Restaurant Marketplaces (Online tech platforms delivering food from a wide range of vendors.)

- eGrocery (Online stores and marketplaces for sale and delivery of processed and unprocessed agricultural products to consumer.)

- Home & Cooking Tech (Smart kitchen appliances, nutrition technologies, food testing devices.)

- Online Restaurants & Mealkits (Startups offering culinary meals and sending pre-portioned ingredients to cook at home.)

- Cloud Retail Infrastructure (On-demand enabling tech for retailers, ghost kitchens, last-mile delivery robots and services.)

What’s behind the downstream rebound

As noted, the eGrocery sector was a key driver behind downstream investment in 2021. Mega-deals included Furong Xingsheng’s $3 billion round and “instant grocery” startup goPuff‘s $1.5 billion raise. The category as a whole raised $18.5 billion, accounting for more than half of downstream’s total $32 billion.

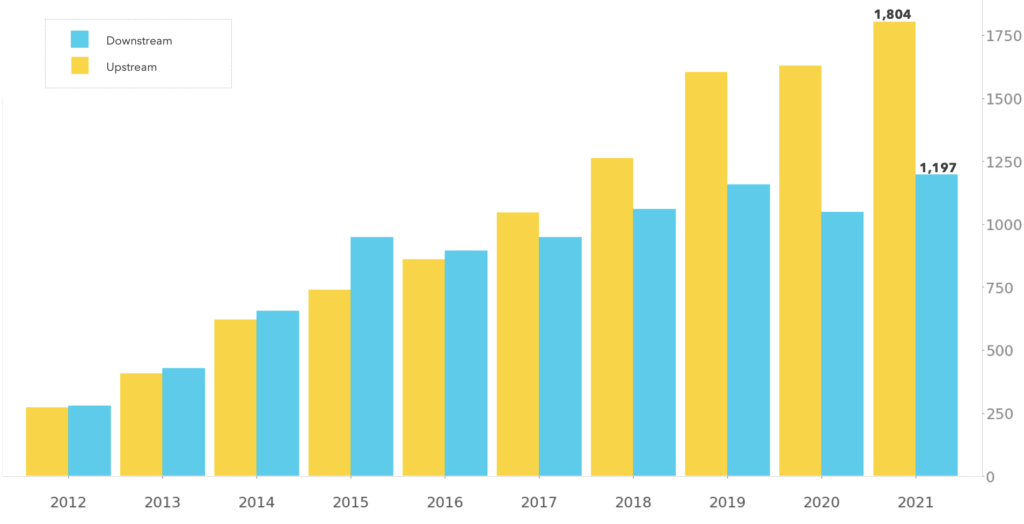

Agrifoodtech funding deal count. 2012-2021

Meanwhile, upstream companies closed more deals in 2021: 1,804 compared to downstream’s 1,197. These numbers are in keeping with historical data, though the difference between the number annual upstream and downstream deals is widening. This is partly because upstream is a larger and more diverse segment of agrifoodtech. But investors are also becoming more comfortable with technologies closer to the farm or lab that were previously harder to prove and scale.

Investors’ particular areas of focus upstream include precision agriculture, cultivated meat and novel farming systems.