Hello everyone. I’m back! Again not sticking to my monthly or even bimonthly editorial target — apologies — but here we are. It’s been a busy couple of months that included a great trip to San Francisco for the World Agri-Tech and Future Food-Tech summits. Those agrifoodtech industry events coincided with the launch of AgFunder’s 2023 Global Agrifoodtech Investment report and some much-needed downtime with our very remote and very global team!

It was strange timing given the collapse of Silicon Valley Bank just days before. Credit Suisse followed suit, bringing with it a certain end-of-the-world feeling that colored the above happenings.

Seems things have settled somewhat on that front — at least for now — but the climate news keeps getting worse. A week after our trip to San Francisco, the Intergovernmental Panel on Climate Change (IPCC) released the final part of its assessment detailing “increasingly irreversible losses” in vital ecosystems, intensifying heatwaves in all regions increasing deaths, drought and floods destroying millions of lives and homes, and millions of people facing hunger. They called it the final warning to act now before it’s too late.

“The climate timebomb is ticking. But today’s report is a how-to guide to defuse the climate timebomb. It is a survival guide for humanity. As it shows, the 1.5C limit is achievable,” said UN secretary general António Guterres.

“The climate timebomb is ticking. But today’s report is a how-to guide to defuse the climate timebomb. It is a survival guide for humanity. As it shows, the 1.5C limit is achievable,” said UN secretary general António Guterres.

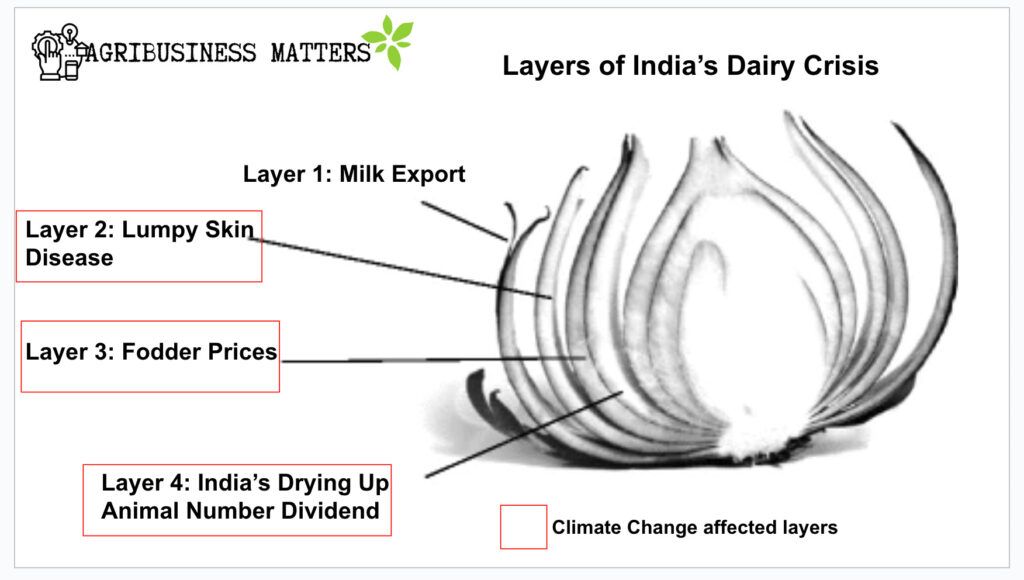

Just a couple of weeks ago, Venky Ramachandran, author of the brilliant Agribusiness Matters newsletter, showcased how climate change is impacting India’s dairy industry; it’s frightening at just how many stages it’s affecting the supply web.

As the politicization of climate change begins to fade away along with declining climate skepticism, our industry has the opportunity to come together as a key solution in mitigating and adapting to whatever the future holds.

And yet, despite the overall growth of investment and interest in the agrifoodtech industry over the past 10 years, I’m still amazed it’s not bigger.

Similarly, looking at our latest investment report, while there were categories that bucked the global decline in 2022 such as indoor ag, ag biologicals and biomaterials, agrifoodtech investment is still just 6% of total venture capital, with the same amount of funding going to crypto and blockchain startups.

By contrast, the global renewable energy sector raised nearly half-a-trillion dollars in 2022.

Finally, I’m writing to you today from the Hack Summit in Lausanne, Switzerland, among 800 attendees, which was double the number from last year, but I have still overheard several people referring to this as a “niche category.”

How is it possible that the sector that literally feeds the world, employs 60% of the population and contributes to one-third of greenhouse gas emissions is still considered niche? Why aren’t more people interested and excited about the potential to positively change the food system socially and environmentally?

There’s a lot to unpack here. I think the relative complexity and nuance of the industry compared to others is part of it. Could the continual in-fighting I see within agrifoodtech (more on that soon) also be playing a role? I’d love to hear your thoughts. Email [email protected].