AFN‘s parent company AgFunder released the latest edition of its annual Farm Tech Investment Report earlier this month, which showed that funding for agritech startups last year saw its biggest annual increase in since 2018.

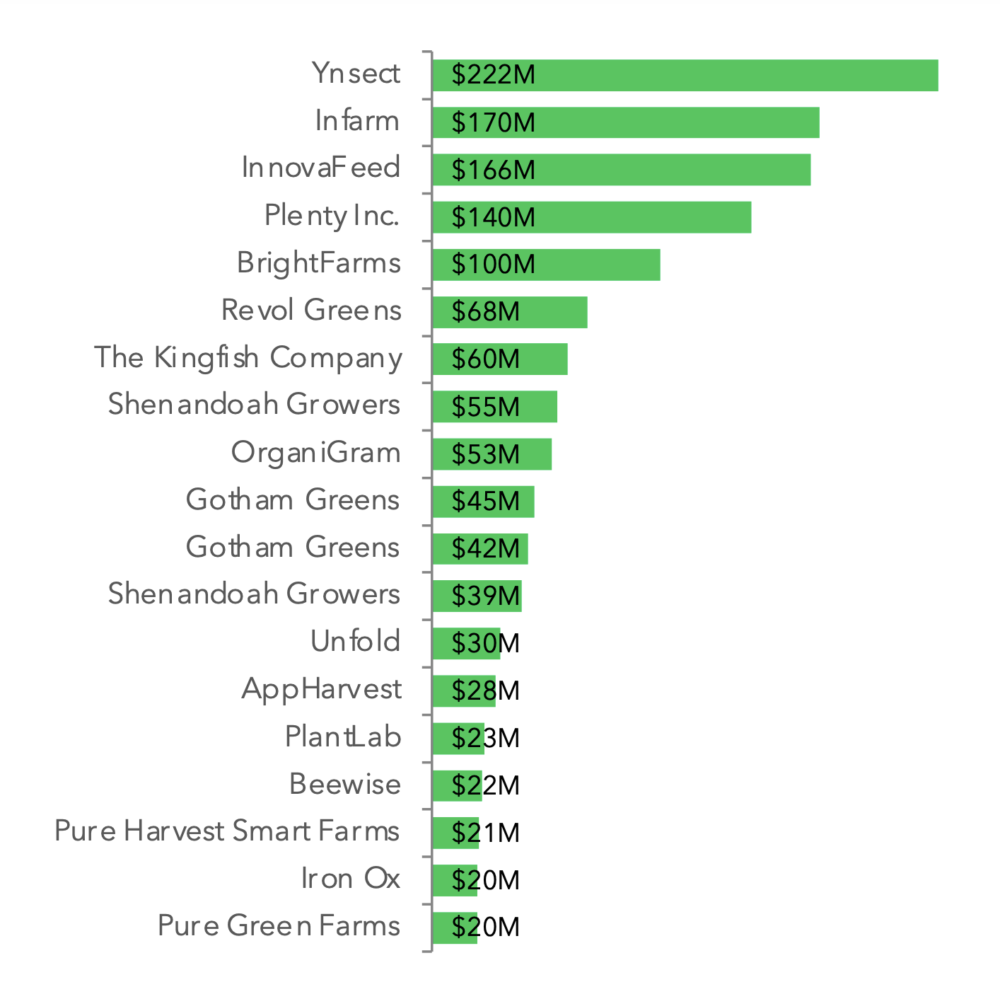

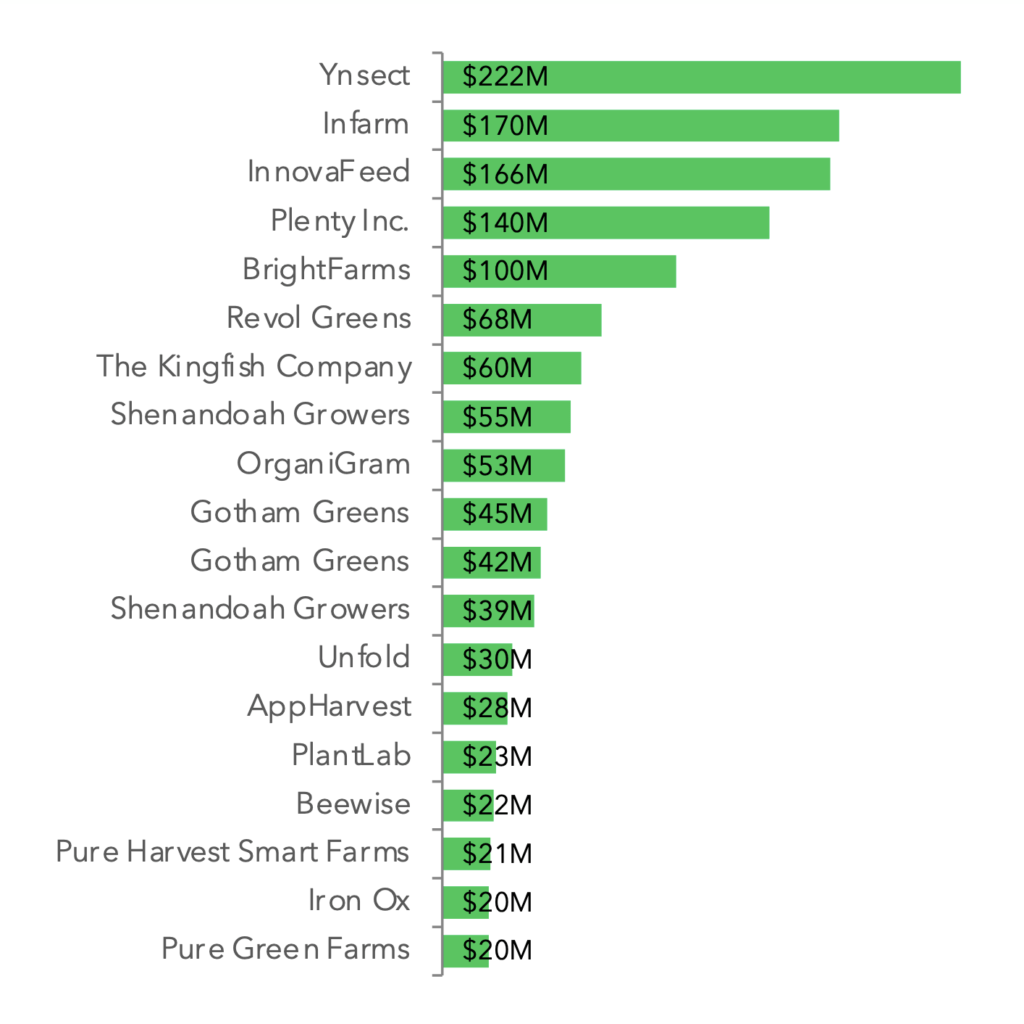

According to the report, Novel Farming Systems was the second best-funded agtech category worldwide last year following Ag Biotechnology. Five startups in the category raised rounds in excess of $100 million.

Of the five, two are French companies that are raising insects for animal and plant nutrition purposes: Ÿnsect and InnovaFeed. The other three are indoor crop farming operations – Germany’s Infarm, and Plenty and BrightFarms from the US.

Here is some of AFN‘s reporting on their fundraising and other activity during 2020:

- Unfazed by Covid-19, Infarm arrives InJapan and InCanada (February 2020)

- This major grocer is stocking up on Plenty’s indoor grown greens (August 2020)

- Infarm raises $170 million in first close of Series C round (September 2020)

- Ÿnsect extends Series C to $372m, targets pet food & aims for carbon-negative status (October 2020)

- Plenty scoops up $140m in Series D round led by Driscoll’s and SoftBank (October 2020)

- BrightFarms raises $100 million in Cox-led Series E round to expand throughout the US (October 2020)

Last week, US communications conglomerate Cox Enterprises announced that it had wholly acquired BrightFarms for an undisclosed sum.

What are Novel Farming Systems?

AgFunder’s Novel Farming Systems category includes controlled environment agriculture (CEA) setups such as vertical farms and greenhouses, as well as tech-enabled insect farming, aquaculture, and algae production.

Why are investors interested in Novel Farming Systems?

CEA and related technologies like hydroponics have seen meteoric growth in recent years in response to concerns around sustainability, food safety, and creating more resilient, localized supply chains.

Many startups in the space claim to grow produce with substantially fewer resources compared to conventional field agriculture, while providing consumers with much fresher produce because they tend to be located much closer to population centers.

Covid-19 also prompted increased interest in CEA as supply chain challenges led to supermarket shortages.

Novel Farming Systems have also led the charge in the recent uptick of SPAC deals in agrifoodtech.

US greenhouse operator AppHarvest completed a SPAC merger to go public in February 2021 at a valuation in excess of $1 billion.

Vertical farming startup AeroFarms struck its own SPAC deal a month later, while indoor farm Local Bounti announced a SPAC merger backed by Cargill in June.