AFN‘s parent company AgFunder released the latest edition of its annual Farm Tech Investment Report earlier this month, which showed that funding for agritech startups saw its biggest increase since 2018.

FY 2020 global investment into the segment totaled a projected $7.9 billion, representing a whopping 41% increase from the previous year.

By comparison, general VC investment as a whole for FY 2020 rose only 4% on 2019 levels.

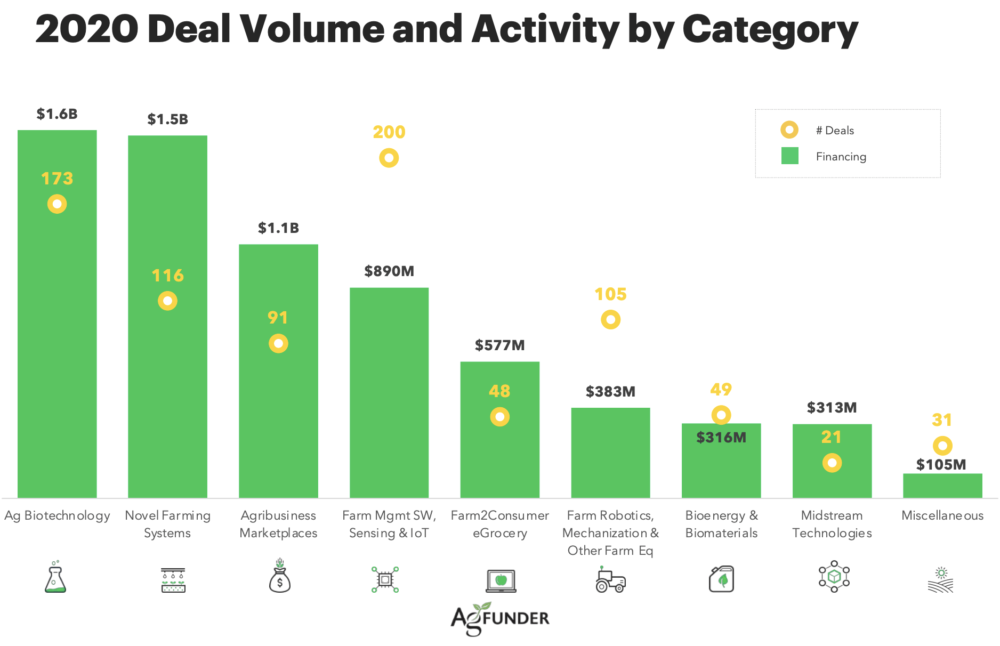

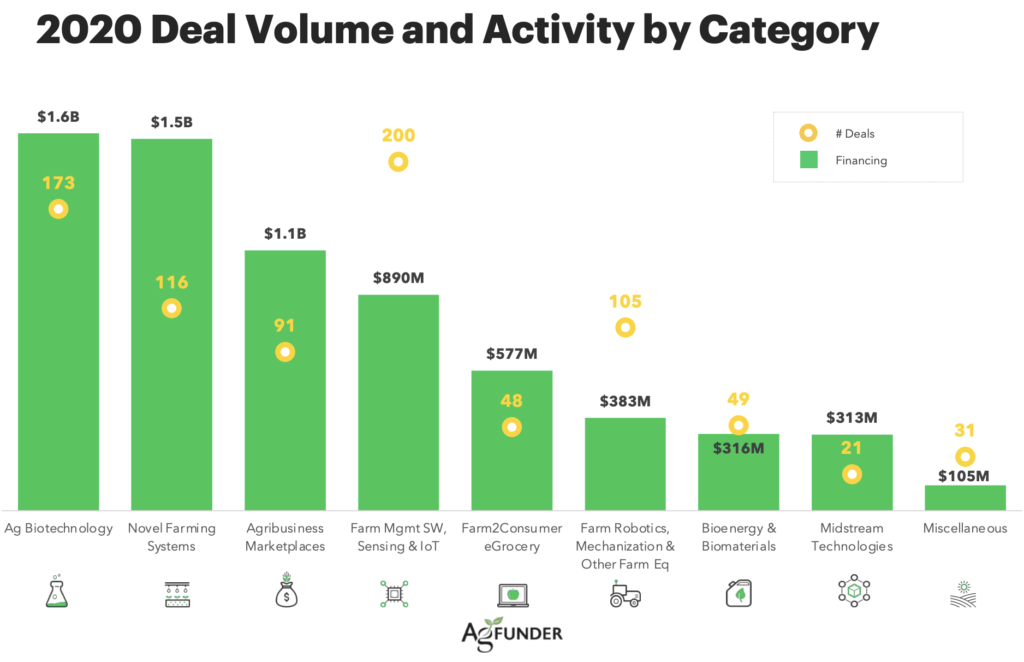

Digging down into specific categories, Ag Biotechnology and Novel Farming Systems secured the largest dollar totals within farm tech, raking in over $3 billion between them (see below for more details on AgFunder’s categorization system.)

Ag Biotechnology also clocked the largest increase in deals, rising 58% year-on-year – though the leading category in terms of pure deal numbers was Farm Management Software, Sensing & IoT, which saw 200 investments worth a combined $890 million.

What is ‘farm tech’?

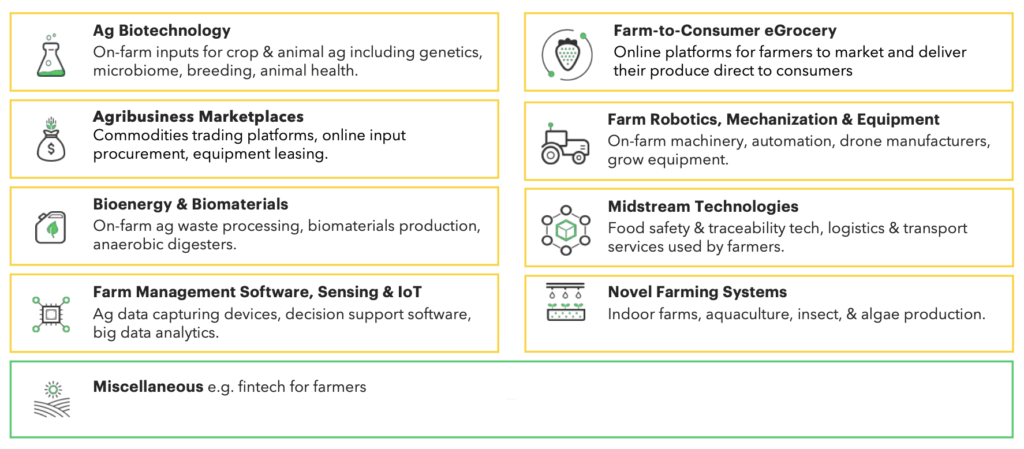

AgFunder splits the broader agrifood value chain into upstream (eg, agriculture, food production, logistics) and downstream (eg, retail, restaurants, consumer-facing) categories.

Its annual Farm Tech Investment Report groups together several of these categories, with a focus on agricultural production, as outlined below:

Why are investors so interested in ag biotech?

Looking at all the funding deals in the Ag Biotechnology category last year, two core themes emerge: genetic engineering and sustainable crop inputs.

Genetic engineering technologies, such as CRISPR, allow for the selection and enhancement of desired traits in crops, These traits include things like disease or pest resistance, or accelerated growth.

Consumers and regulators alike are becoming more attuned to the negative environmental impacts associated with ‘traditional,’ chemical-based crop inputs. Biotech is enabling the creation of more sustainable pesticides, fungicides, and fertilizers which are more targeted in their application and less harmful than synthetic chemicals.

The top three Ag Biotechnology deals in 2020 went to a trio of US companies: crop breeder Benson Hill ($150 million Series D); RNA specialist GreenLight Biosciences ($102 million Series B); and microbial nitrogen fixer Pivot Bio ($100 million Series C).