Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

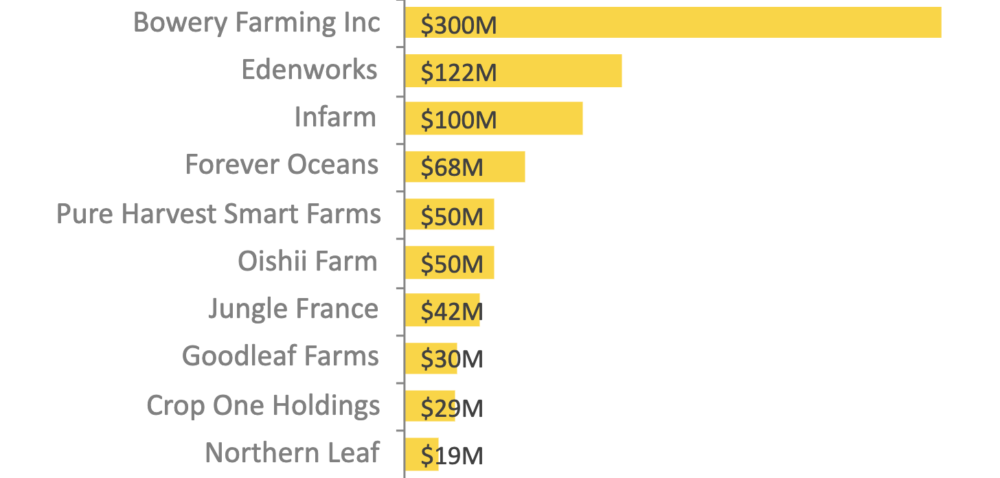

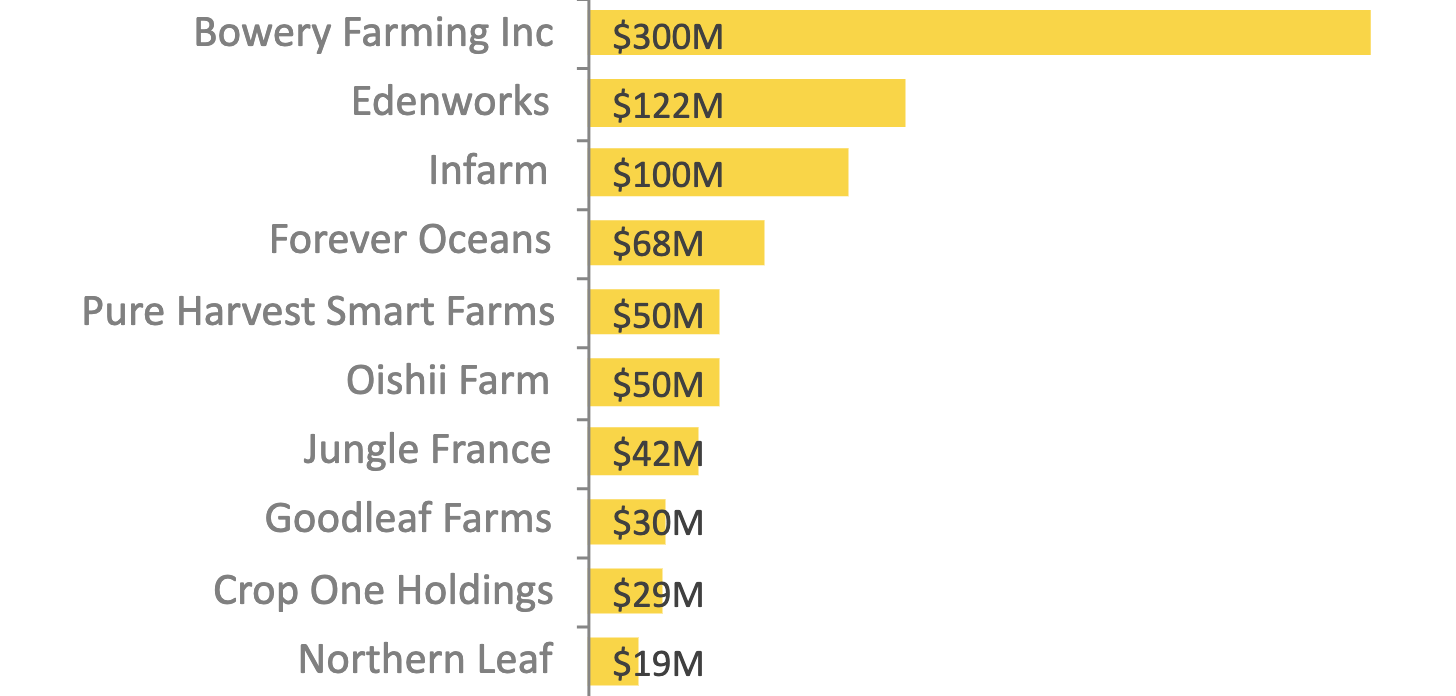

AgFunder data confirms that US vertical farming startup Bowery bagged the biggest investment deal in the Novel Farming Systems category in the first half of this year. The New York-based company claimed that its $300 million Series C raise in May – was “the largest private fundraise to date for an indoor farming company.”

Fidelity led the round with participation from Amplo, Gaingels, General Catalyst, GGV Capital, Temasek, Groupe Artémis, and Google affiliate GV.

In second place was New York’s Edenworks — now known as Upward Farms — which raised $122 million earlier in the year according to a US Securities and Exchange Commission filing. It builds aquaponic farms which raise crops and fish together.

The third-largest deal involved German vertical ag company Infarm, which netted $100 million in an extension to its Series C round from investors including Hanaco and Atomico.

Top 10 Novel Farming Systems funding deals H1 2021

Also of note among the top 10 Novel Farming Systems deals in H1 was the $50 million Series A round raised by New York’s Oishii, which claims to cultivate strawberries in the city using bees and ancient Japanese farming practices; while the Channel Islands’ Northern Leaf scored $19 million from five investors to build a growing facility and extraction plant for medical cannabis.

What are Novel Farming Systems?

Novel Farming Systems is a category created by the AgFunder Research team to cover ventures in controlled environment agriculture (CEA) — including vertical farms and greenhouses — as well as tech-enabled insect, seafood, cannabis, and algae production.

Why are investors interested in Novel Farming Systems?

Investors have been pouring capital into CEA and related models as the need for safe, sustainable, and resilient food sources becomes increasingly apparent amid the Covid-19 pandemic and rising global average temperatures.

Many startups in the Novel Farming Systems space claim to grow produce with substantially fewer resources compared to conventional agriculture, while providing consumers fresher produce with a lower carbon footprint due to the possibility of locating indoor farms closer to population centers.

Reflecting increased investor interest, several companies in the Novel Farming Systems category were targets in the recent spate of SPAC deals in agrifoodtech. However, not all have completed.

Kentuckian greenhouse operator AppHarvest completed a SPAC merger to go public in February 2021 at a valuation in excess of $1 billion. But its share price plummeted -29% in August after the company slashed the revenue targets it had set at the time of its SPAC deal.

Newark-based vertical ag startup AeroFarms struck its own SPAC deal in March; however, that merger was canceled last month as it was deemed that proceeding was “not in the best interests of [its] shareholders” any longer.

Montana indoor farmer Local Bounti announced a SPAC merger backed by Cargill in June. The deal is set to be voted on by shareholders next week.