This article features insights from one of AgFunder’s international data partners, who provide data for AgFunder’s agrifoodtech investment reports. AgFunder is AFN’s parent company.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

In terms of attracting investment for agrifoodtech ventures, India was the world’s third-largest market in 2021 – behind only the US and China, according to AgFunder’s most recent Agrifoodtech Investment Report.

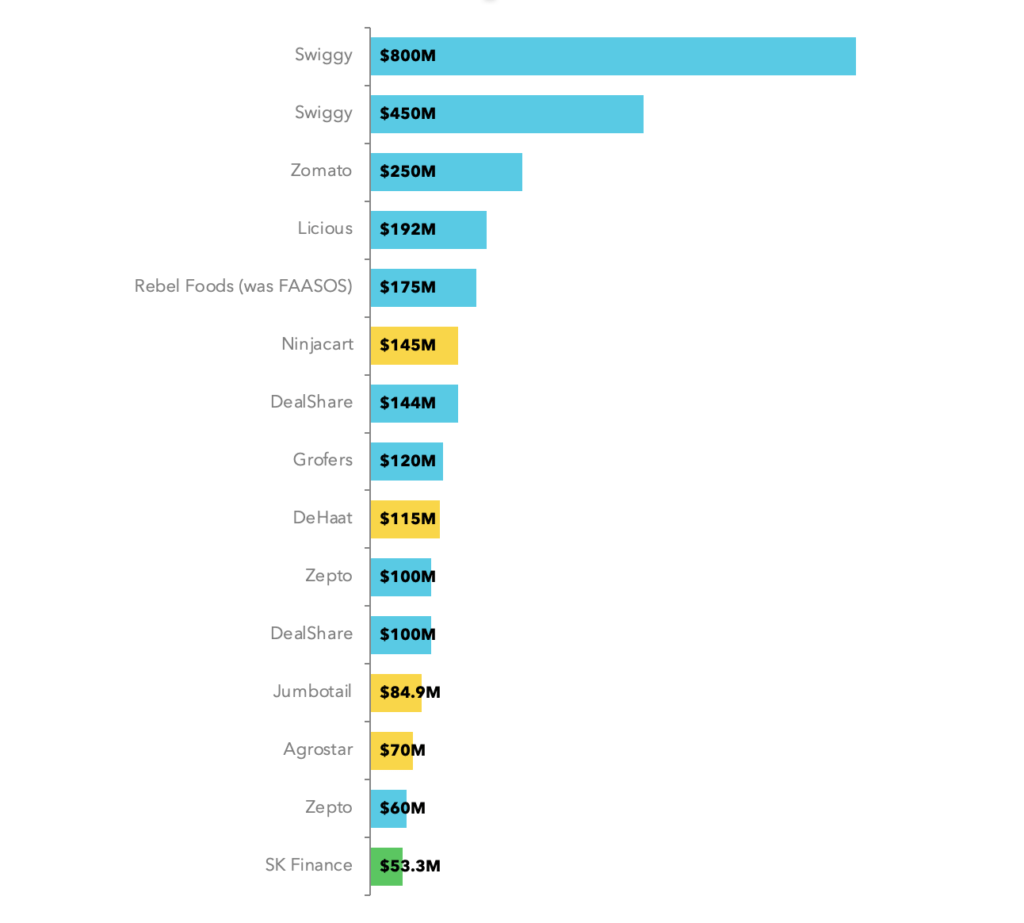

India’s 15 biggest agrifoodtech funding deals in 2021

Indian agrifoodtech companies raised a total of $4 billion in venture funding last year, behind the US on $21 billion and China on $7.3 billion,

However, India placed second in terms of deal activity, with 257 funding rounds compared to the US’s 1,062 deals; the UK came third with 188 deals (raising $1.3 billion in total) and China fourth with 123 deals.

Meal delivery app Swiggy scored the top two rounds, including its $800 million Series J raise in April co-led by Goldman Sachs with Qatar Investment Authority and GIC among the other investors to participate.

Archrival Zomato raised $250 million in February, marking the year’s third-largest deal.

We asked Mark Kahn (MK), managing partner at AgFunder’s India data partner Omnivore, for some added insight on the market.

What do India’s top 15 deals in 2021 tell us about the broader agrifood venture funding landscape?

MK: In 2021, for the first time ever, the number of upstream agrifoodtech deals surpassed downstream deals. While downstream investments saw big-ticket funding in the Restaurant Marketplaces and eGrocery categories, the Covid-19 pandemic helped investors become more aware of the fundamental problems across value chains and the sheer scope of business opportunities.

This is evident from rising investment in innovations closer to the farm. Farm Management Software, Agribusiness Marketplaces, and Midstream Technologies – focused on logistics, traceability and processing – were the dominant upstream investment categories. These will continue to attract more capital in the future, indicating the maturity of the venture ecosystem for agritech.

Overall, what were the key trends and developments in agrifood venture funding in India in 2021?

MK: Broadly, concerns around the impact of climate change, a greater consumer focus on health and nutrition, and the necessity to improve efficiency in ag supply chains catalyzed investments in upstream technologies in 2021. The ever-rising cost of inputs continues to pose a significant threat to farmer profitability and access to nutritious food. Therefore, farm tech has emerged as vital to the future of Indian agriculture and food systems.

What are your expectations for the rest of 2022?

We have an accelerating pace of investment in this space, complemented by a superlative degree of talent. I am hopeful that 2022 will be the year when multiple Indian agritech unicorns will rise. This year will also see significantly higher farmer adoption of agritech solutions and the continuing digitalization of rural India. The climate focus to date has been peripheral in India despite the country’s acute vulnerability to climate change. We expect more entrepreneurs to work towards innovations for climate change mitigation and building resilience within agricultural communities. We are also eager to see – and even catalyze – more innovations in agrifood life sciences, which will be critical for ushering in commercially viable sustainable agriculture.