Editor’s note: Dan Ripma is a senior associate at S2G Ventures, an agrifood-focused VC firm based in Chicago, US. S2G Ventures partnered with AgFunder and AFN to provide foodtech M&A and exits data for the 2021 AgriFoodTech Investment Report, which was released earlier this month.

VC investment into the agrifoodtech sector has been rising steadily since 2014, with capital increasingly shifting to later-stage fundings over the same period.

Total investment in the sector has grown from a total of $6.4 billion in 2014 to a projected $30.5 billion in 2020, according to AgFunder’s 2021 AgriFoodTech Investment Report.

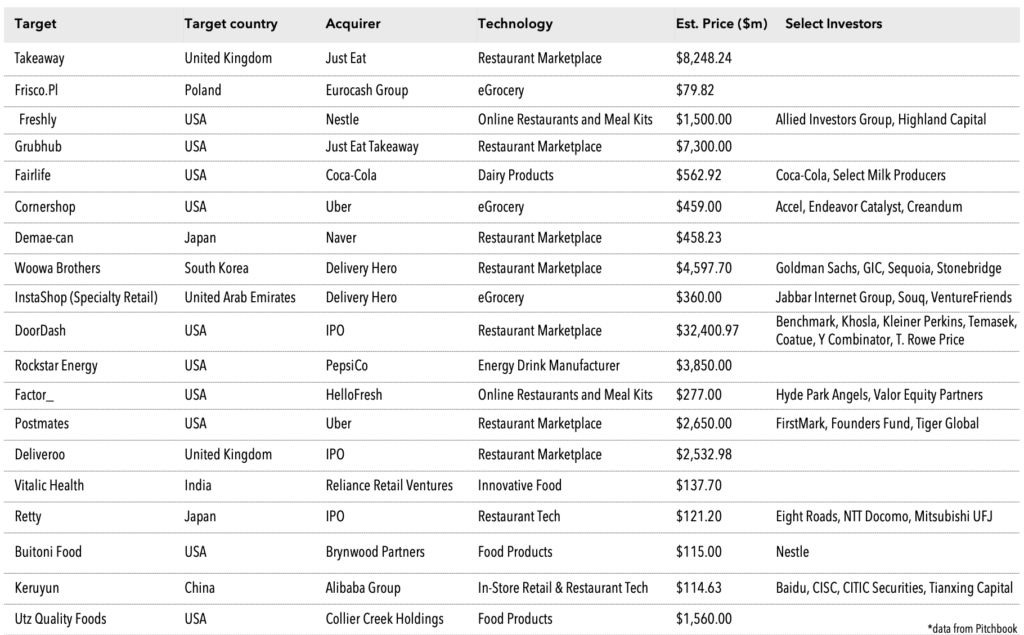

Despite the rapid growth of invested capital in the sector, foodtech exits are still scarce. In the US only five of the 12 exits over $100 million in value involved venture-backed companies. The others were independent companies, private equity-backed companies, and carve-outs of large corporates.

But even with the lethargic pace of exit activity, foodtech caught some promising tailwinds in 2020, which propelled online food delivery, e-grocery, and direct-to-consumer prepared meals to the forefront.

The outbreak of the Covid-19 pandemic at the end of 2019 lowered foodtech exit expectations for 2020. But several large foodtech companies still achieved successful exits last year.

Acquisitions and public market activity were centered on subsectors that grew in relevance in light of Covid-19 – such as digital platforms for food delivery, including those in the AgFunder-defined categories of Restaurant Marketplaces, Online Restaurants & Mealkits, and eGrocery.

The year ended on a high note with DoorDash’s landmark $400 million IPO. On opening day, the restaurant delivery app’s share price was at $102, and rose 86% to close at $189.51. While the stock has seen highs and lows since then, its price continues to grow over time and is indicative of pent-up demand from public market investors who desire greater foodtech exposure.

The Innovative Foods category — which includes novel ingredients, alternative proteins, and other general food product companies — also saw several deals, though they tended to be relatively small. As has been the case in previous years, there was more capital-raising activity than exits in most subsectors.

We also saw further global consolidation of Restaurant Marketplaces and food delivery more generally.

In early 2020, Denmark’s Just Eat merged with the Netherlands’ Takeaway.com in a deal worth $8.3 billion. The combined entity, Just Eat Takeaway, then went on to acquire Grubhub for $7.3 billion in June. Uber continued to build its food delivery business through the acquisitions of Postmates for $2.65 billion and Cornershop for $459 million.

Germany’s Delivery Hero acquired South Korean counterpart Woowa Brothers for $4.6 billion (though not before it agreed to offload another South Korean food delivery app, Yogijo, to placate regulators in the country.)

What the SPAC?! A brief explainer on the next exit tool for agrifoodtech investors – read it here

Beyond these digital food delivery platforms, there were other select large exits – including Pepsico‘s purchase of US beverage maker Rockstar Energy for $3.85 billion and Collier Creek Holdings’ $1.56 billion SPAC deal to acquire Utz Quality Foods.

In the years to come, we expect to see a shift in foodtech exits to include a higher percentage of companies in the Innovative Food and Midstream Technologies categories, as well as ‘better-for-you’ brands.

This is due to a confluence of factors – one being the amount of cash food manufacturers will have on hand after 2020.

They’ve had a successful year with more and more consumers shifting to at-home eating, and this influx of funds — when coupled with murmurs of divestitures of legacy brands — may lead to a highly acquisitive 2021 and 2022.

With that said, we are seeing two diverging valuation strategies, with some companies dedicated to acquisitions that promise future growth while others are increasingly focused on demonstrated profitability. We expect we’ll see a bit of both this year.