California-based remote sensing startup Ceres Imaging has raised $25 million in Series B financing from one existing and one new investor, taking the company’s total investment to $35 million. The new funds came from new investor Insight Venture Partners, a New York-based growth-stage venture and private equity firm, and existing investor Romulus Capital.

Ceres uses multi-spectral imaging from airplanes to provide farmers with insights about their crops including disease prediction, and irrigation and pesticide recommendations. This latest round comes just one year after the company raised a $7.5 million Series A round to finance its expansion into row crops from its original focus on specialty crops.

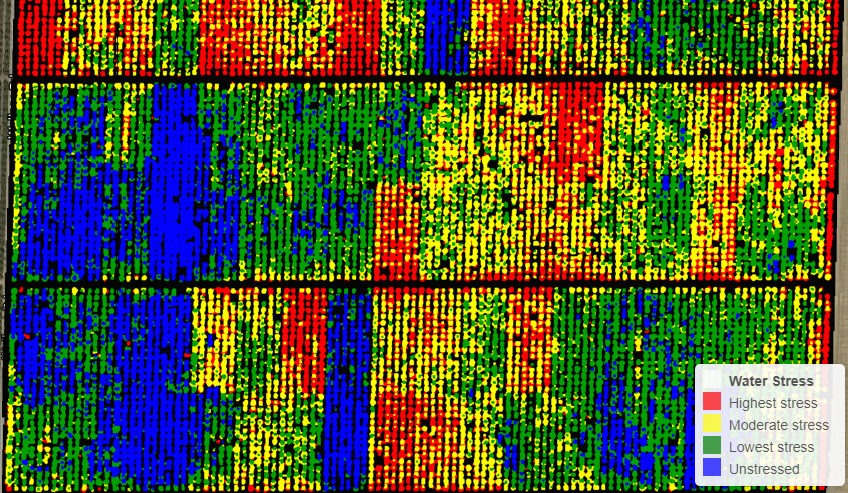

CEO Ashwin Madgavkar told AgFunderNews that his company’s ability to identify disease weeks before it can be spotted with the naked eye was resonating with row crop growers, allowing the service to spread quickly. While many imaging for agriculture startups use NDVI or true color (RGB) images, Ceres uses six different spectrum bands. To capture the most effective images and data, it places proprietary, custom-built sensors on fixed-wing aircraft, which it says enables it to gather data at a higher resolution and quality than satellite imagery options with greater scale and consistency than is possible with drones.

“When we shared some of the test images with early growers and retailers, they saw the ability to detect a lot of these problems weeks before you could see them in an NDVI or true color image, or with the naked eye. That generated a big level of excitement because scouting is such a pain point,” said Madgavkar.

Apart from saving time and labor cost by reducing the amount of scouting necessary, spotting disease earlier allows corn growers to time their fungicide applications in order to ensure efficacy and limit costs, he explained.

“If you get the timing wrong, you spend a lot of money on the spray and still take the damage from the disease.”

Madgavkar said that this round will be put to use in several directions, all aimed at expanding US market share while increasing international presence in Australia and South America, which the company will enter this year, targeting either Brazil or Argentina.

Ceres will grow its sales and marketing teams, expand its computer vision and AI capabilities with an eye on sensing pests and disease in areas larger than single farms, such as whole counties. This could be an offering for municipal and insurance customers.

This marks the first investment for Insight Venture Partners in the agtech space. Insight vice president Harley Miller said this investment is the result of extensive “canvassing;” looking for a software-based agtech investment that fit in with the rest of Insight’s enterprise and consumer portfolio.

“Once you establish that you like the race, then it’s time to find the right horse to back,” Miller told AgFunderNews. “What we saw was that they had established really strong product-market fit on the specialty crops side of the universe. For the last 1.5 years, the company has been aggressively pursuing the row crop farms in the Midwest and internationally and it’s already a very significant part of the business.”

Ceres’s expansion into row crops from specialty crops came largely as a result of its integration into the Climate Corp FieldView platform when the company opened up to allow other vendors to sell services through it in 2016. Other clients and partners include Olam, Integra, and Evergreen FS.

“Farmers want to see their data in a single consolidated space. Integrations are expensive but a worthwhile endeavor to do for the customer,” said Madgavkar.

Miller also acknowledged that combing through agtech companies has required some adjustment in expectations of the speed of growth for a software startup aimed at farmers.

“You have to appreciate what you’re playing for – it’s not just traditional software sales, it’s a little more nuanced than that,” he said.

The size of this round, combined with the recent events in the remote sensing for agriculture sector, suggests that the space is maturing and more consolidation could be likely. Ceres competitor Taranis acquired the assets of Marx last month after Mavrx ran into some financial and operational difficulty and was not able to service its clients for the upcoming growing season despite providing a popular product with a 90% customer renewal rate.

Madgavkar said that the company is entertaining M&A possibilities but added that winners and losers in the field of remote sensing for agriculture are far from settled.

“There’s still a lot of funding coming in, particularly at the early stage, so it’ll likely be years before the bubble could start to burst,” said Madgavkar.