Data snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Like most other parts of the world, India saw a drop in agrifoodtech investment in 2022 thanks to macroeconomic headwinds and the relentless onslaught of climate change.

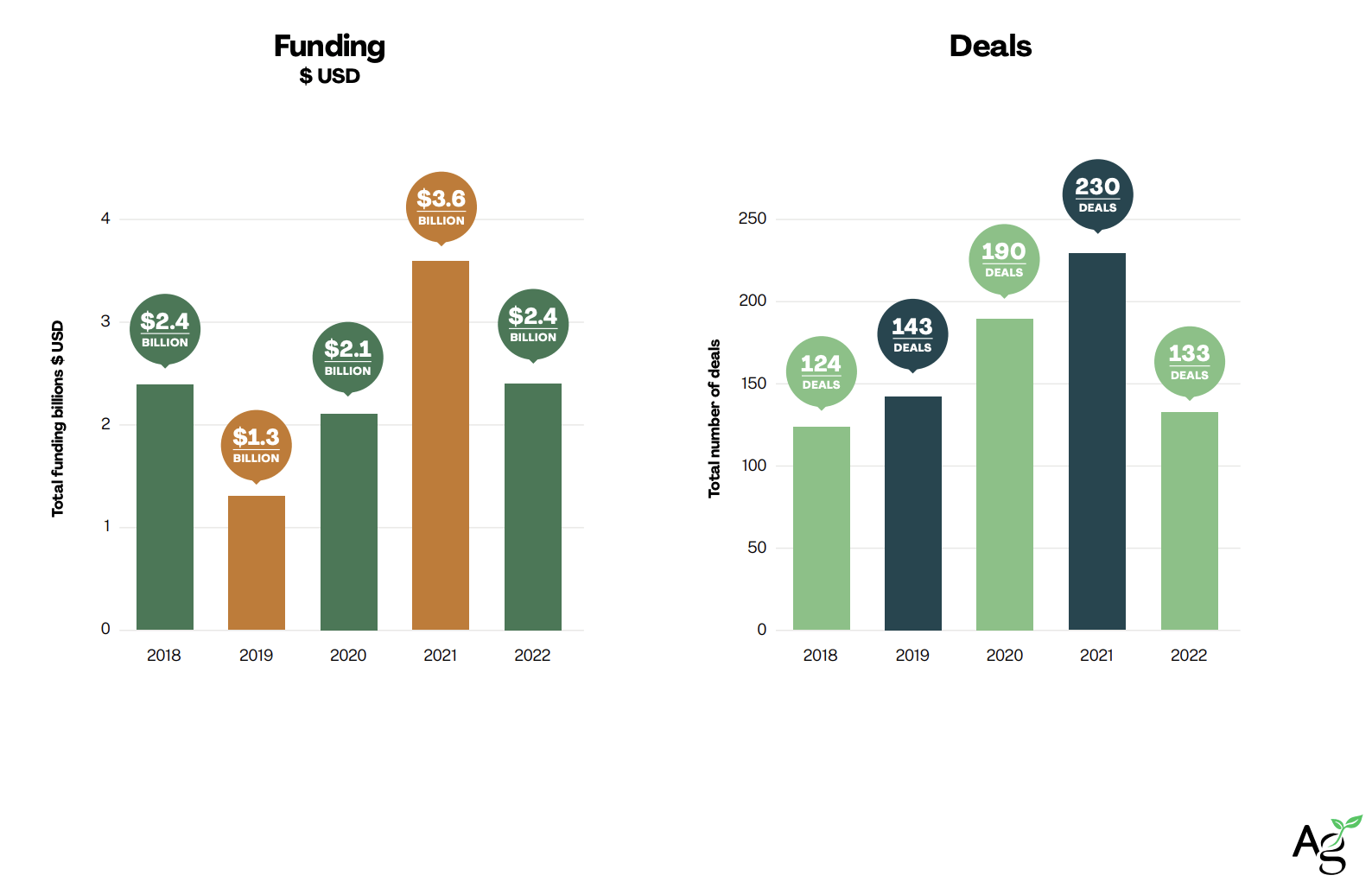

India agrifoodtech startups raised $2.4 billion last year, a 33% decrease from 2021’s $3.6 billion, according to AgFunder’s India AgriFoodTech Investment Report 2023.

The number of deals also declined for India from 230 in 2021 to 133 in 2022.

However, a more heartening portrait of India agrifoodtech emerges when one widens the timeframe of startup funding in that country, and despite the seesawing in dollar amounts over the last few years, investment is back on par with 2018 levels.

Ups and downs of India agrifoodtech

Globally, 2021 was an outlier year for agrifoodtech investment. A favorable economic climate created cheap money and shot valuations through the proverbial ceiling.

Said ceiling crumbled in 2022 as the impacts of the pandemic, the war in Ukraine, supply chain issues and climate change turned economic tailwinds into headwinds and reduced the investment flow to a mere trickle. Hence the 33% drop in funding amounts for India agrifoodtech.

Back in 2018, India agrifoodtech startups raised $2.4 billion across the agrifoodtech value chain. The following year saw a significant drop to $1.3 billion thanks to India’s slowdown in consumption growth, deteriorating finances and general economic malaise.

The number crawled back up in 2020 as India agrifoodtech experienced an investment boom; startups raised $2.1 billion that year. This was despite — or perhaps because of — the Covid-19 pandemic, which forced the country into the world’s largest lockdown. Seed investments into agrifood startups grew threefold as entrepreneurs and investors alike rushed to solve problems in the food system that had been underscored by the pandemic.

India in 2023

Preliminary data from AgFunder shows that in 2023, much of India agrifoodtech investment has gone upstream, in keeping with global agrifoodtech investment trends.

And despite the tough funding environment, a few notable milestones for India include ag marketplace DeHaat’s $60 million fundraise (at the very end of 2022) and meal delivery startup FreshToHome raising $60 million in February 2023.

Most recently, Indian agrifoodtech investor Omnivore made the first close of its third fund, with $150 million to invest in startups developing breakthrough technologies for agriculture, food, climate, and the rural economy.