Editor’s Note: Barclay Rogers is head of business development at Ceres Imaging, a remote sensing startup using multi-spectral imaging from airplanes to provide farmers with insights about their crops including disease prediction, and irrigation and pesticide recommendations. Rogers has written a two-part, in-depth analysis on the development of the agtech market against a backdrop of low commodity prices and industry consolidation.

This article forms Part two of two-part series examining the evolving role of agtech in a changing agricultural economy. Part one explored the current state of the agricultural economy and described the embrace of data platforms by the major players in the ag sector. Part two expands upon this theme by illustrating core themes in agtech adoption to-date on the farm and predicts the next phase in agtech development.

Agtech is a broad category ranging from farm-level analytics to genetics and biochemistry to food processing. This article focuses exclusively on farm-level analytics — which includes aerial and satellite imagery, farm-level profit optimization, field-level production optimization, and sensing — and for the most part has focused on improving machinery, input decisions, and economic decision-making.

Machinery Leads the Way

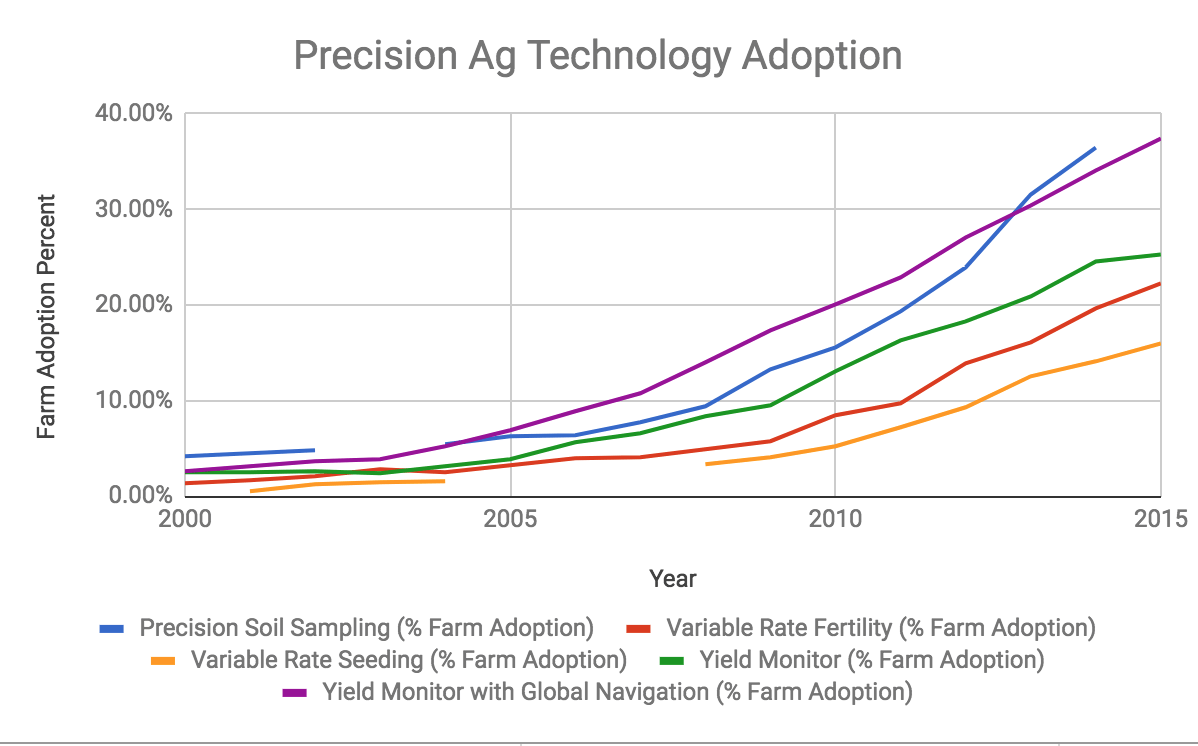

Agricultural technology adoption is increasing each year, and machinery based applications, such as navigation technologies and yield monitors, are leading the way. It appears that adoption is driven in large part by ease of use; the easier a technology is to use (e.g. auto-steer), the more likely it is to be adopted on the farm.

Farm machinery continues to evolve and incorporate new technologies. Most recently, “machine learning” technologies have been added to the mix. In September 2017, John Deere acquired Blue River Technologies. According to the press release, “Blue River has designed and integrated computer vision and machine learning technology that will enable growers to reduce the use of herbicides by spraying only where weeds are present, optimizing the use of inputs in farming – a key objective of precision agriculture.”

Assuming it works, such technology may become widespread in the near future as it could lead to significant cost savings with little to no additional effort required by the grower.

Making Better Input Decisions

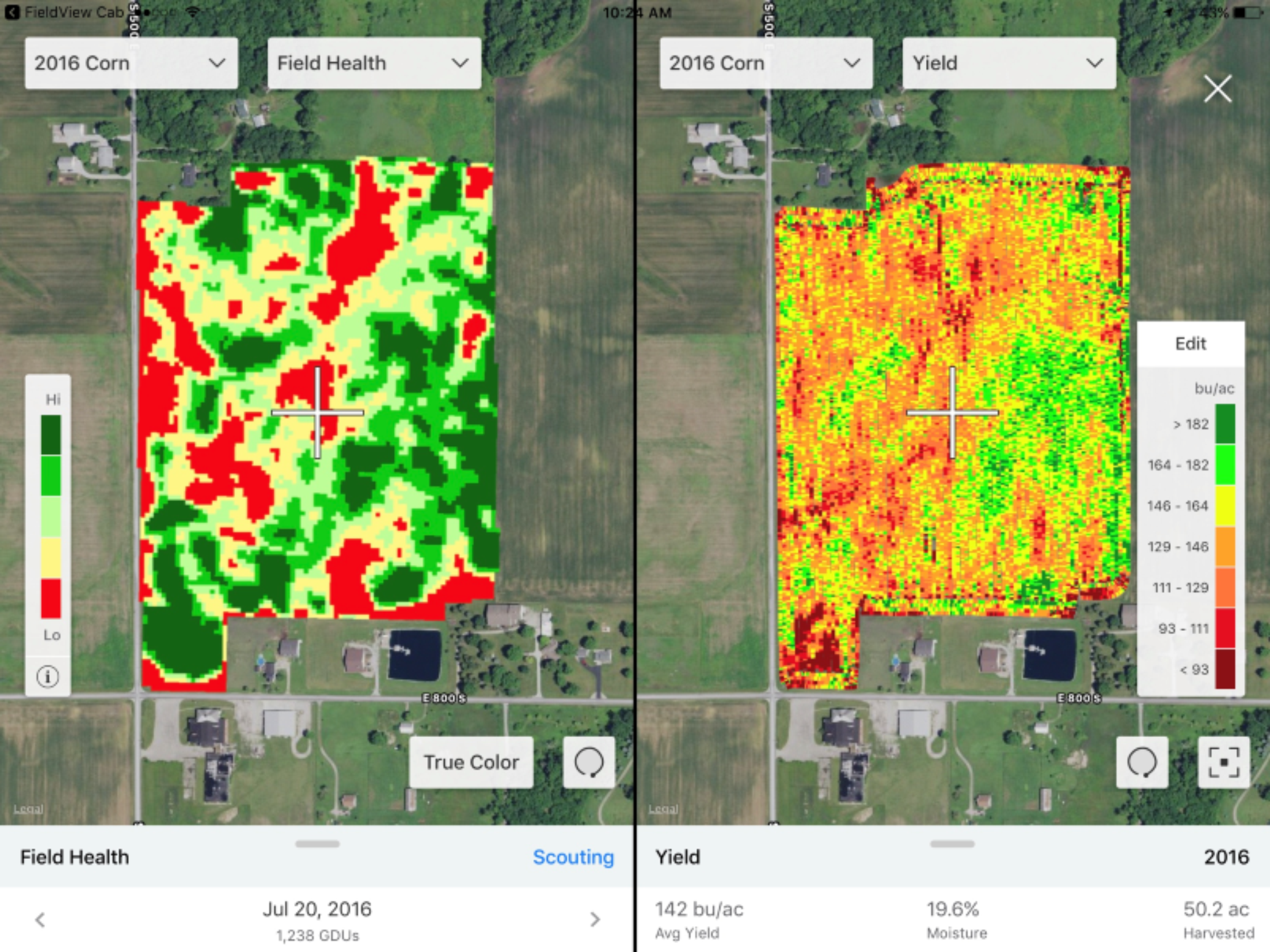

Most farm-level analytics have focused on improving the decision-making process around inputs. For example, Climate FieldView aims to “optimize inputs to maximize yield and profitability on every acre with variable rate seeding prescription tools, nitrogen management tools and fertility scripting tools.” Precision ag tools have long sought to match input decisions with crop needs — largely through management zones built around soil maps and yield data. The steady push toward greater and greater understanding of the spatial variability within fields will likely yield significant gains in on-farm profitability as inputs are matched to actual crop needs.

Money Is What Matters

Driving straighter, enabling the machine to turn on and off automatically, and making more informed decisions are all material improvements. But at the end of the day, what matters is putting more money in the bank.

Two rapidly growing agtech companies are focused on farm-level economics — albeit from different perspectives. Granular, which DowDupont acquired in August 2017, delivers profitability insights at the field level — did I make a profit in this field this year? — and provides guidance to farmland prices — how much is this farm really worth? Farmers Business Network (FBN) is attacking the profitability issue from a different direction. Instead of helping farmers understand their farms better, FBN aims to help them get a better price on both inputs, by providing insights into what others paid for similar products, and outputs, with grain marketing advice and contracting options.

What’s Next

There is little doubt that ag technologies are delivering value on the farm and that major players in the agricultural economy are building out digital agricultural offerings. But a careful review of the progress to date reveals one key shortcoming: no major company has really delivered on the promise of facilitating better in-season decisionmaking.

As noted, most of the ag technologies to date have focused on making better pre-season input decisions, such as how much pre-plant fertilizer to put in each zone of the field, or end-of-season determinations — am I better off selling my grain or holding it in anticipation of a market rally?

The next big wave in agtech will be better in-season decision-making, including:

- Directing resource allocation based upon on actual field performance

- Informing in-season fertilizer applications

- Detecting pest and disease pressure

- Evaluating product performance

- Guiding irrigation decisions

- Forecasting field-level yields

- Providing better management zones

Resource Allocation

Precision agriculture has focused primarily on creating management zones within fields based upon relative potential and guiding resource decisions within these zones. Management zones are a significant advance relative to field-level decisions, but they lack critical information about actual in-season field performance. In effect, management zones today reflect relative potential, but they do not account for actual in-season growing conditions. For example, a high potential area of a field may have a poor stand owing to unfavorable conditions at emergence. In such a case, it may make sense to adjust your plan based upon the real-time conditions instead of sticking to the original script. In-season monitoring, such as high-resolution imagery supported by analytics, is critical to making informed decisions based upon actual growing conditions.

In-Season Fertilizer Applications

Fertilizer plans are generally made pre-season — “I’m going to put down X pounds of nitrogen pre-plant, and I’ll apply another Y pounds through the season.” However, fertilizer needs vary based upon the growing conditions. For example, a large rain flushes out much of the pre-plant fertilizer, or excellent growing conditions increase the plants nutrient uptake.

Professor Brian Arnall of Oklahoma State University and others have been doing excellent research on nitrogen-rich (N-rich) strips. In essence, a N-rich strip is “an area in the field that has received enough fertilizer N so that no matter what the environmental conditions may be, N will not be limiting during the growing season.” The remainder of the field not included in the strip receives the standard amount of nitrogen. The field is then monitored in-season in an effort to detect nitrogen stress. If no difference is observed between the N-rich strip and the remainder of the field, the field is not experiencing nitrogen stress and thus no in-season nitrogen application is warranted; if a difference is observed, nitrogen can be applied before the crop incurs damage. The key, of course, to this practice working at scale is efficient, timely monitoring of nitrogen stress.

Such practices hold great promise for improving the farmer’s bottom line by reducing one of the most significant crop input costs. An added benefit is that such practices may also reduce the amount of fertilizer runoff that occurs from the agriculture sector.

Pest and Disease Pressure

Pests and disease have plagued agriculture since its beginning. And people have long tried to understand and predict when and to what extent infestations may occur. Such detection and prediction methodologies are greatly enhanced by more comprehensive data collection, such as detecting pest and disease pressure remotely, as well as improved modeling techniques — predicting fields where disease pressure is most likely through advanced analytics.

In April 2018, DTN acquired SpensaTech, one of the startups modeling pest and disease pressure, for an undisclosed sum. Other startups are active in this space, and are likely to develop more tools to help farmers manage pest and disease pressure.

Product Performance

One of the more interesting problems facing agriculture is the difficulty in moving from relatively small-scale trials — test plots and field trials — to widespread market adoption. For example, a particular seed variety may perform well in various tests — with limited variability due to the relatively small geographic scale of the trials — but then perform poorly in the “real world” that exhibits almost infinite variability. Similarly, certain products, such as fungicides, seem to work well in some years, yet seem to do nothing at all in other years.

Big data solutions are ideally suited to better inform an understanding of product performance. For example, by tracking seed varieties across large areas, we may gain valuable insights into actual performance — this variety performs well in these soil types under these growing conditions. Climate Corp recently unveiled its Seed Advisor, “a data science-driven tool that provides dealers with a ranked hybrid recommendation by field and optimal seeding rate recommendation to help their farmer customers manage risk and maximize yield.” Similarly, we may begin to predict when certain products will perform well — this product does well when applied at or below this temperature, but poorly if this temperature threshold is exceeded. Such solutions are of immense value to the agricultural sector, and are likely to be a major focus of the agtech community for the foreseeable future.

Irrigation Decisions

Much effort is being directed toward better irrigation decisions. In particular, soil moisture sensors measure the soil moisture profile to guide irrigation decisions; to turn the irrigation system on when certain conditions are met. Similarly, spatial data of moisture variability are being used to identify irrigation system malfunctions and build variable rate irrigation prescriptions.

Many companies are actively selling soil moisture probes, such as Crop Metrics and Arable), and farmers appear genuinely interested in better managing their water resources.

In-Season Yield Prediction At the Field Level

One of the greatest areas of uncertainty in farming is year-to-year yield variability and the knock-on effects it has on crop marketing decisions. Each year, farmers face the difficult decision of deciding how much of their crop to “book”, how much to store, and how much to sell on the spot market. It is a difficult decision because an overbooking decision — selling more than you end up producing — can spell financial ruin, while waiting until harvest to sell can mean rock-bottom prices at the grain elevator.

Current in-season yield forecasting techniques are rather primitive (i.e., counting ears in select areas) as they do not account for spatial variability within the field or future weather events. But data tools are on the horizon that will allow farmers to better assess their potential yields on a field-by-field basis, and thus make better in-season marketing decisions. And when reliable yield forecasting tools arrive, the yield monitor better look out as it may no longer sit atop the agtech adoption curve; farmers are likely to adopt such tools rapidly assuming they help them make better crop marketing decisions.

Better Management Zones

Last but not least, we should return to the starting point for precision agriculture: management zones. Understanding in-field soil variability was a big step toward improving input decisions, such as putting more fertilizer where the crop will use it, and visualizing the significant variation in yields across a field has led to smarter farming such as variable rate seeding. But we’ve got room yet to improve our management zone practices by:

- defining them relative to actual field performance — which could lead to creating variable rate seeding zones based upon historic emergence patterns

- incorporating cleaner data — for example eliminating calibration issues with yield monitors or multiple harvesters operating in a single field

- improving spatial resolution — defining management zones to the row-level where appropriate.

We’ve come a long way with management zones, but we’ve still got a long way to go.

Conclusion

Agtech is transforming agriculture before our very eyes. The major players in the agricultural economy are embracing the digital revolution, and agtech is delivering real value on the farm. The agtech community has made significant progress over the past several years despite strong headwinds in the ag economy. We will continue to face challenges, but the agtech promise is bearing fruit.