Data snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

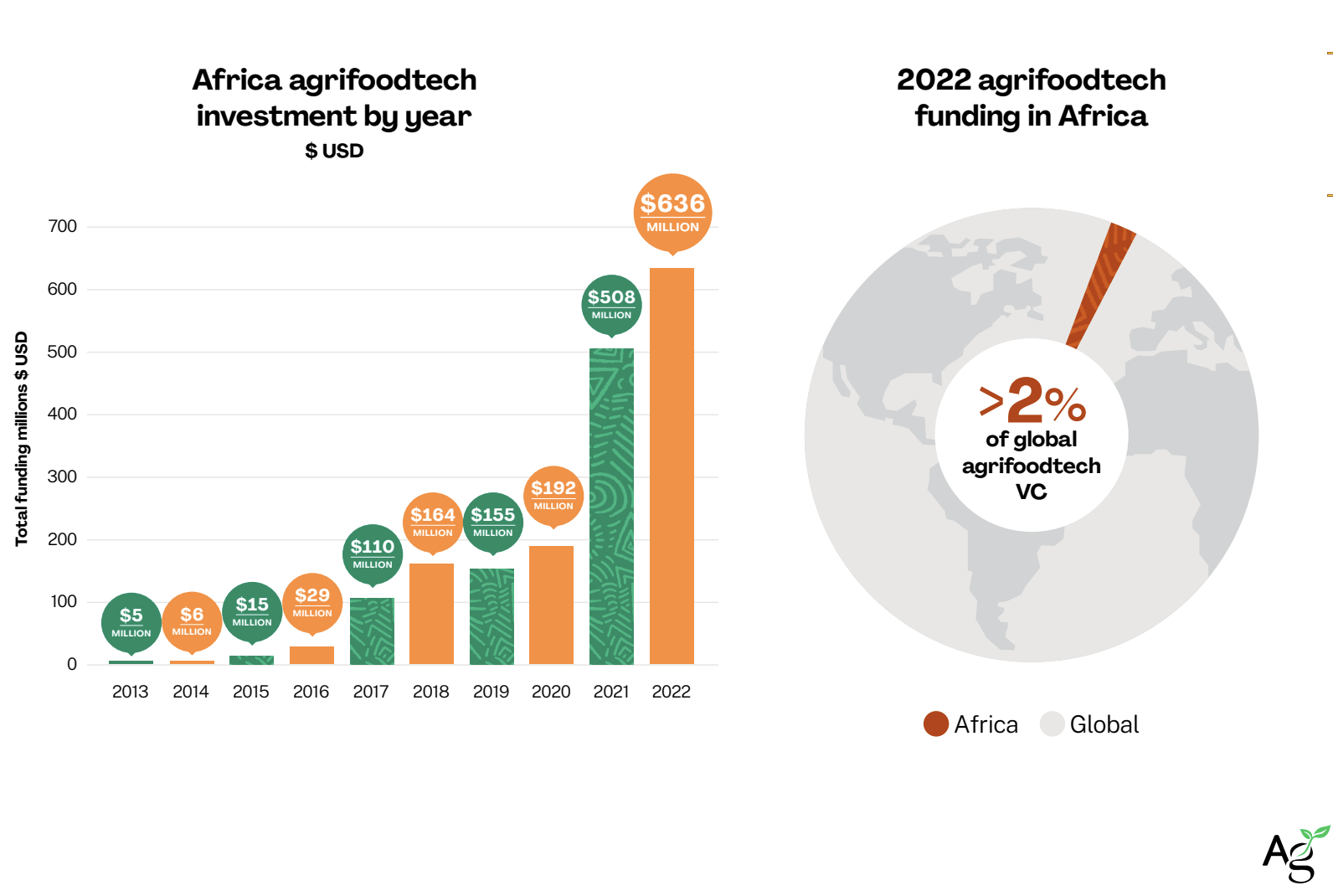

Startups across the food supply chain have built a vibrant agrifoodtech ecosystem in Africa over the last decade. Since 2013, investors have poured $1.76 billion into the continent’s agrifood startups, with numbers increasing at a steady pace for much of that time, according to AgFunder’s new Africa AgriFoodTech Investment Report produced in collaboration with the Bill & Melinda Gates Foundation, FMO Ventures Program, and Mercy Corps Ventures.

As in most regions globally, 2021 was a banner year for Africa agrifoodtech, with startups raising $482.3 million, a 250% increase over 2020 investments.

And unlike many other parts of the world, Africa saw this growth continue throughout 2022, with investments increasing 25% from 2021. Startups raised a total of $636 million in 2022, or about 2% of global agrifoodtech investment.

Worryingly, however, this upward trajectory is about to plunge downward. Macroeconomic uncertainty, rising interest rates and inflationary pressures have impacted investor confidence in 2023, as outlined in the report. Agrifoodtech startups raised $429 million in H12022, but just $99 million in H12023. Deal count, which has risen steadily since 2019, also shrank from 89 in H1 2022 to 51 in H1 2023.

And yet, some VCs maintain long-term optimism for African agrifoodtech’s future.

“Specifically, we see opportunities to scale technologies contributing to sustainable food production, transformative and inclusive services and efficient supply chains and infrastructure on the continent,” Danny Smith, regional director for Katapult Africa, notes in the report.

Despite the “funding winter,” he says the “long-term fundamentals of technology uptake, population growth and the immediacy of risks and opportunities posed by climate change position agrifoodtech strongly.”

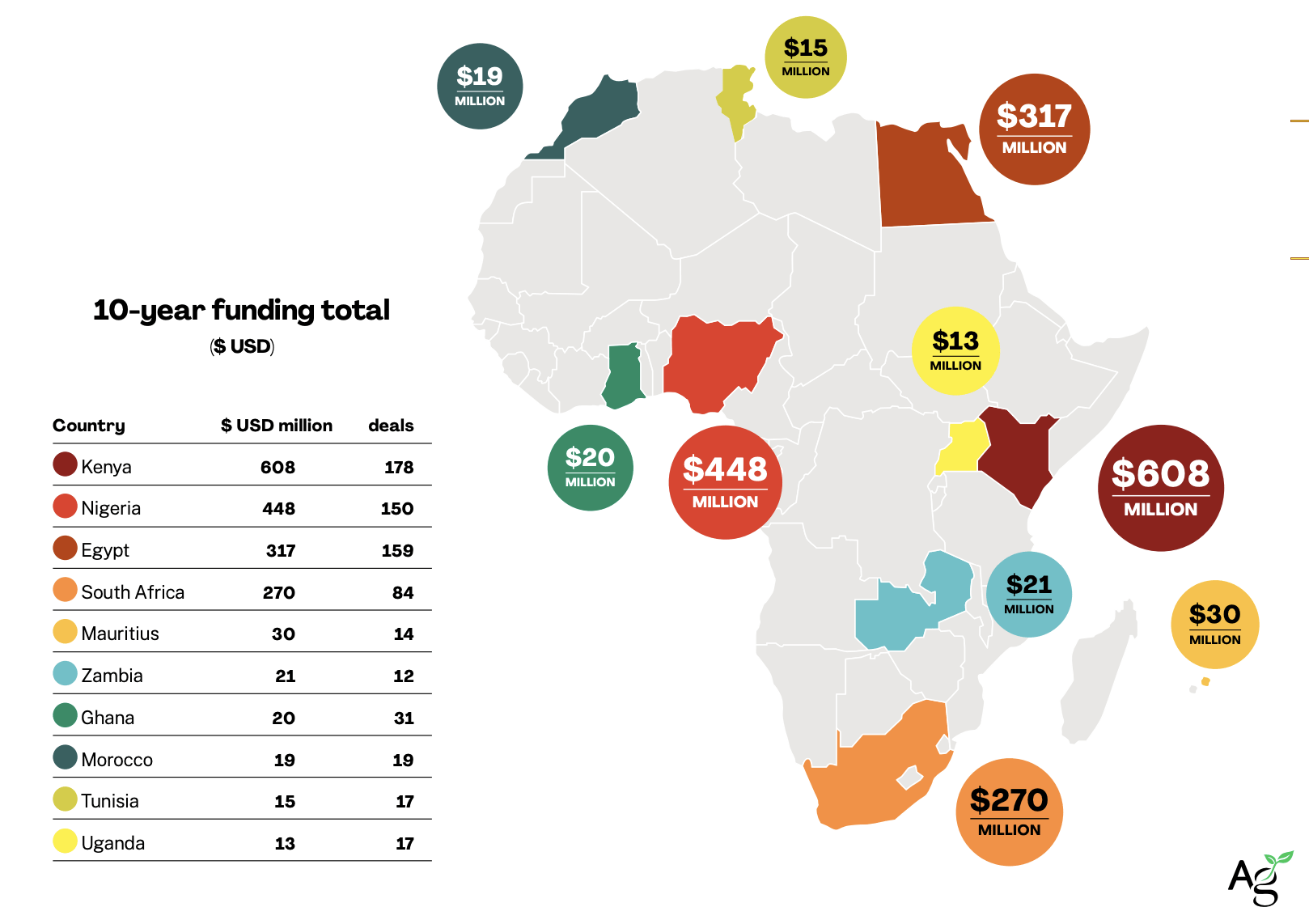

Funding by country

Four countries have attached the lion’s share of Africa agrifoodtech funding over the last decade: Kenya, Nigeria, Egypt, and South Africa.

Startups in Kenya have raised the most capital over the last 10 years, at $608 million across 178 deals.

Nigeria follows with $448 million across 150 deals. Egypt and South Africa have raised $317 million across 159 deals and $270 million across 84 deals, respectively.

The remainder of African nations noted in the report raised significantly smaller amounts over the decade, with the next-highest figure being the $30 million across 14 deals startups in Mauritius have raised.

Top rounds of the decade

| Round amt. | Company | Series | Country | Date | Key investors |

| 125m | Wasoko | B | Kenya | 2022 | Tiger Global, Avenir |

| 105m | Agriprotein | A | South Africa | 2018 | Undisclosed |

| $68m | TradeDepot | Debt | Nigeria | 2021 | Arcadia Funds |

| 54.6m | ThriveAgric | Debt | Nigeria | 2022 | Commercial banks & institutional investors |

| 51m | Uhuru Energy | Late | South Africa | 2017 | Chinese state-owned firm |

| 50m | Twiga Foods | C | Kenya | 2021 | Creadev |

| 48m | Kobo360 | B | Nigeria | 2021 | FEDA |

| 42m | TradeDepot | B | Nigeria | 2021 | IFC, Novastar |

| 40m | MarketForce | A | Kenya | 2022 | V8 Capital Partners |

| 40m | MaxAB | A | Egypt | 2021 | Silver Lake, BII |