US retail sales of plant-based meat continued their precipitous decline in 2023, while plant-based milk made modest gains, according to a new report from nonprofit The Good Food Institute (GFI).

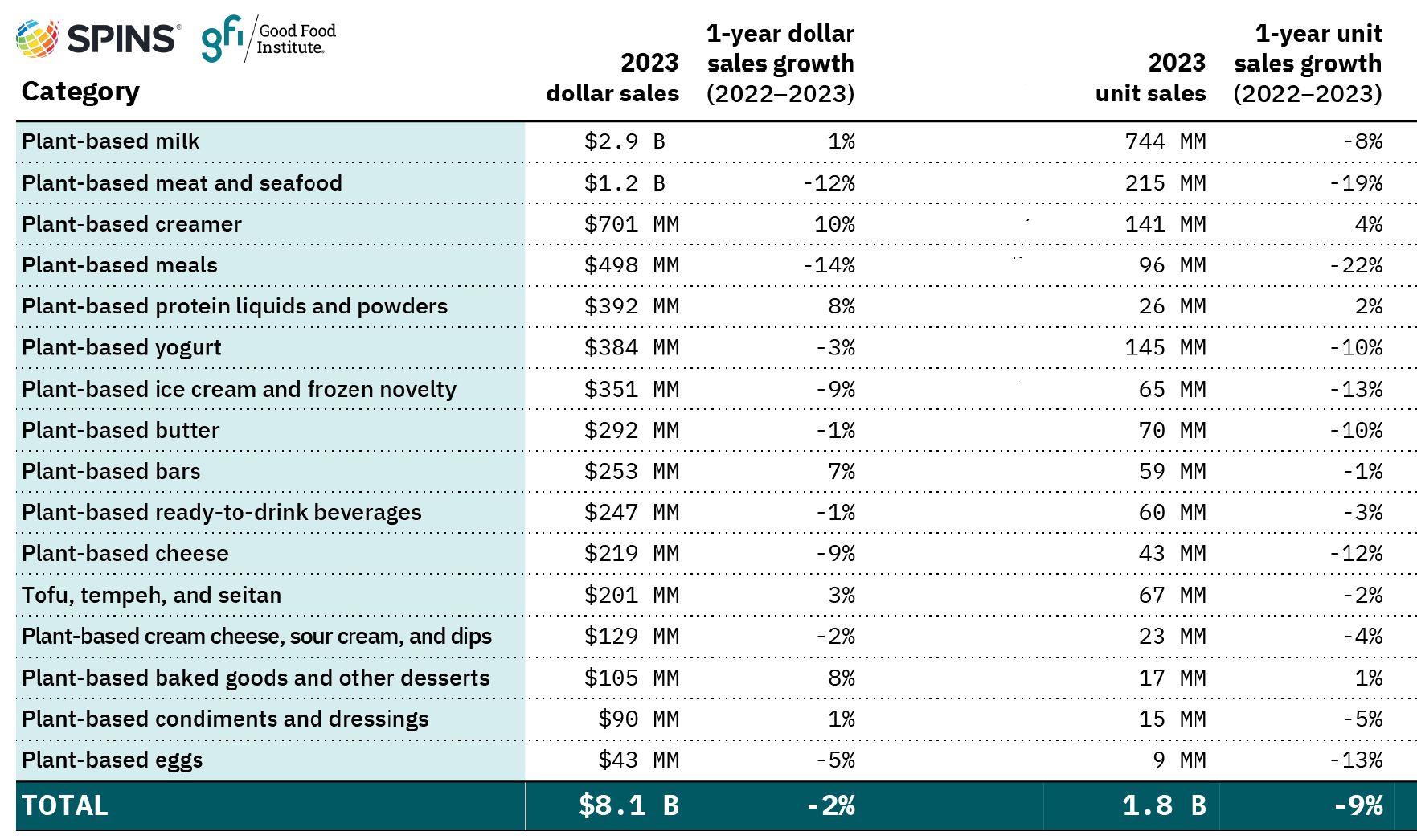

In the 52 weeks ending December 3, 2023, US retail sales of plant-based meat & seafood dropped 12% to $1.2 billion in 2023 with units down 19%, while plant-based milk generated a 1% increase in dollar sales to $2.9 billion, although units were down 8%, according to data from SPINS crunched by the GFI.

For context, US retail sales of conventional meat and dairy milk are also down, but not to the same degree, with unit sales of packaged conventional meat and seafood falling by 6% over the past two years vs a 26% drop for plant-based meat and seafood.

While unit sales of most plant-based categories declined in 2023, there were some bright spots, notably in plant-based creamers, with dollars up 10% to $701 million and units up 4% (while unit sales of conventional creamers fell 1%). Plant-based protein liquids and powders also performed well, with dollars up 8% to $392 million and units up 2%.

Given that scores of food & beverage products and fresh produce are made from plants, the term ‘plant-based’ in the SPINS chart below just covers products that provide a direct intentional replacement for an animal product. In the case of condiments, for example, it would include sales of Vegenaise (egg-free mayo) but exclude a plant-based product such as French’s classic yellow mustard, as it’s not replacing something that is typically animal-based.

US household penetration: 44% for plant-based milk; 15% for plant-based meat

According to the GFI:

- 15% of US households purchased plant-based meat or seafood in 2023, down from 19% in 2022.

- 44% of US households purchased plant-based milk in 2023.

- 10% of US households purchased plant-based ice cream or frozen novelties in 2023.

- 25% of households purchasing plant-based milk also purchased plant-based meat and seafood.

- Plant-based milk accounted for almost 15% of all dollar sales of total milk in US retail in 2023.

- Households with children are more likely to spend more on plant-based milk.

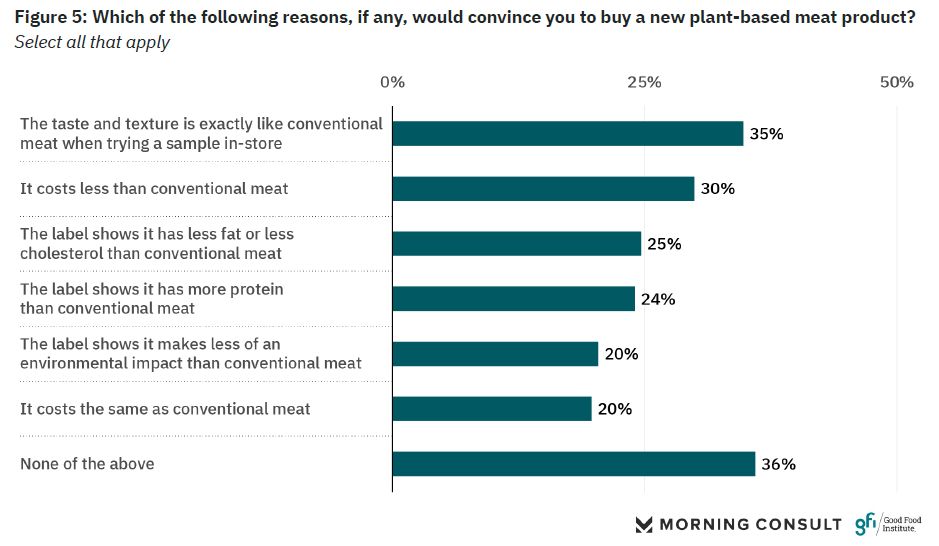

“Currently, taste and price performance is limiting the category’s engagement with meat-eaters. Yet US consumers say they’d be more willing to eat plant-based meat if it tasted better and were more affordable. This underscores the opportunity for brands to innovate to improve the eating experience of their products.” GFI

What is holding back the plant-based meat market in the US?

Around 13% of Americans eat plant-based meat at least once a week, 12% eat it at least once a month, while 11% report eating it at least once per year, says the GFI. “This points to a loyal core of consumers who are likely to continue using the category in the future, despite overall sales declines in 2023.”

Meanwhile, 51% of US adults have never tried plant-based meat products according to GFI/Morning Consult research from December 2023.

So what is stopping those who have tried plant-based meat from becoming regular purchasers, or preventing those who have never consumed it from giving it a try?

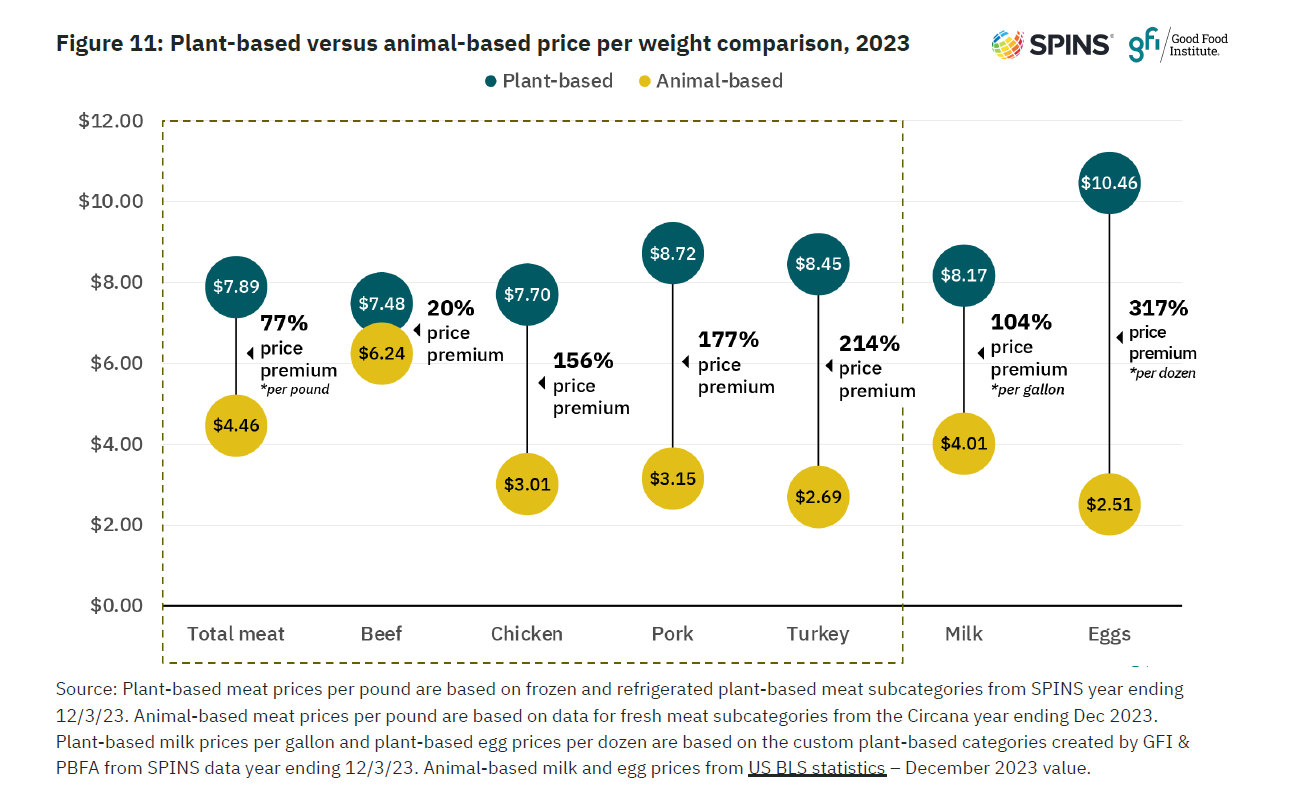

According to the GFI, lapsed consumers of plant-based meat “tend to point to taste and price as reasons they stopped purchasing,” two fairly major barriers, with plant-based meat carrying a whopping 77% price premium per pound according to SPINS data for 2023 (see chart above). That said, such shoppers “remain very open to repurchasing if products more closely match the taste and texture of meat,” says the GFI.

“Around 50% of lapsed consumers claim they would buy a new plant-based meat product if they were offered a sample and found its taste and texture were exactly like conventional meat, and 43% would consider purchasing if it cost less than conventional meat.”

As to what is putting off those who haven’t tried plant-based meat, while Beyond Meat CEO Ethan Brown has blamed meat-industry-backed efforts to paint plant-based meat as ultra-processed for “poisoning the plant-based well,” most consumers “do not appear to be aware of or concerned by these claims,” claims the GFI. “A majority of consumers in 2023 who reported hearing media coverage of plant-based meats said the coverage was primarily positive or neutral.”

Indeed, it says, “US adults are most likely to rate plant-based meat as “better” (in the case of overall healthiness) or “equal to” (in the case of protein) animal-based meat.”

The basic challenge is more straightforward: “US adults are more likely to rate conventional meat as tasty, high-protein, affordable, good value, easy to find, and easy to cook.”

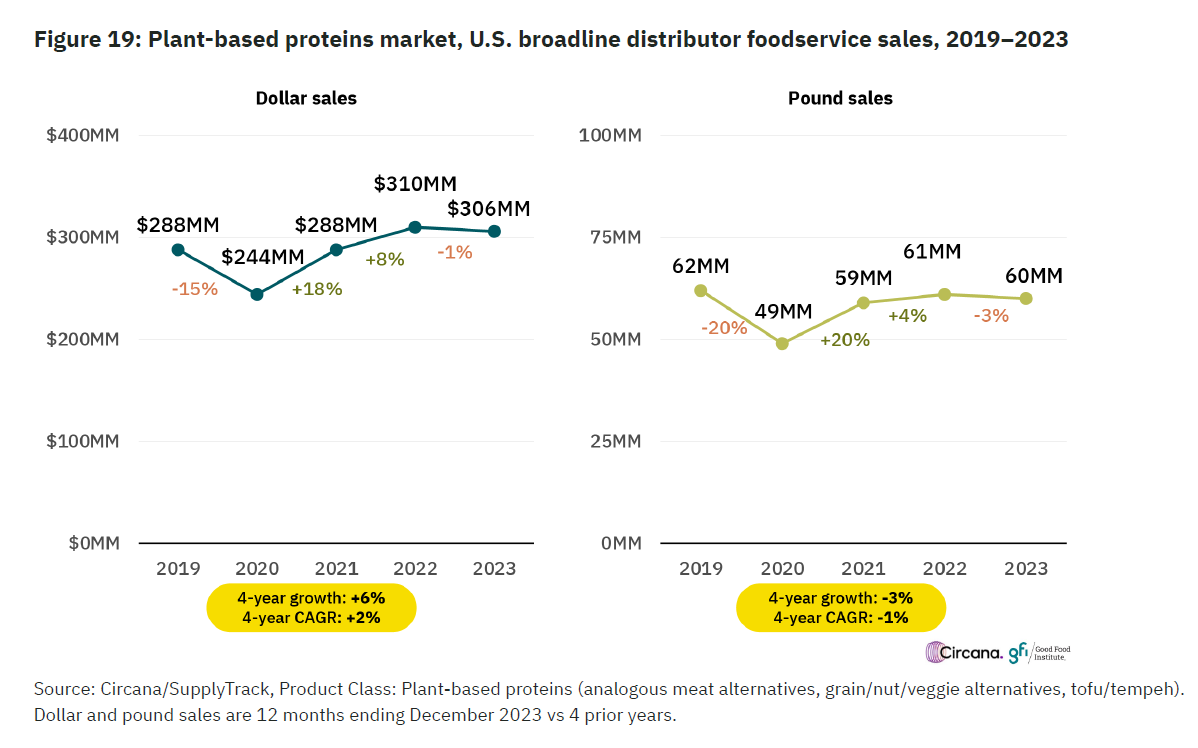

US foodservice channel: more modest declines for plant-based meat, sales surge for plant-based milk

In the US foodservice channel, the figures are less dire, with plant-based proteins posting a modest 1% decline in dollar sales to $306 million and a 3% decline in volumes from broadline distributors to operators in 2023.

For context, dollar sales of conventional meat fell 3%, while volume sales rose 4% in 2023, reflecting price decreases.

Since 2019, analogs—products meant to replicate the taste, texture, and experience of conventional meat—have outpaced more vegetable-forward plant-based proteins (grain, nut, veggie burgers etc), says the GFI. In 2023, analogs made up 50% of the total category pound sales, up from 39% in 2019.

“Three emerging analog product types include pork patties, chicken nuggets, and chicken tenders. All three grew both dollar and pound sales in the double digits in 2023 and now make up 10% of category pound sales, up from 6% in 2019.”

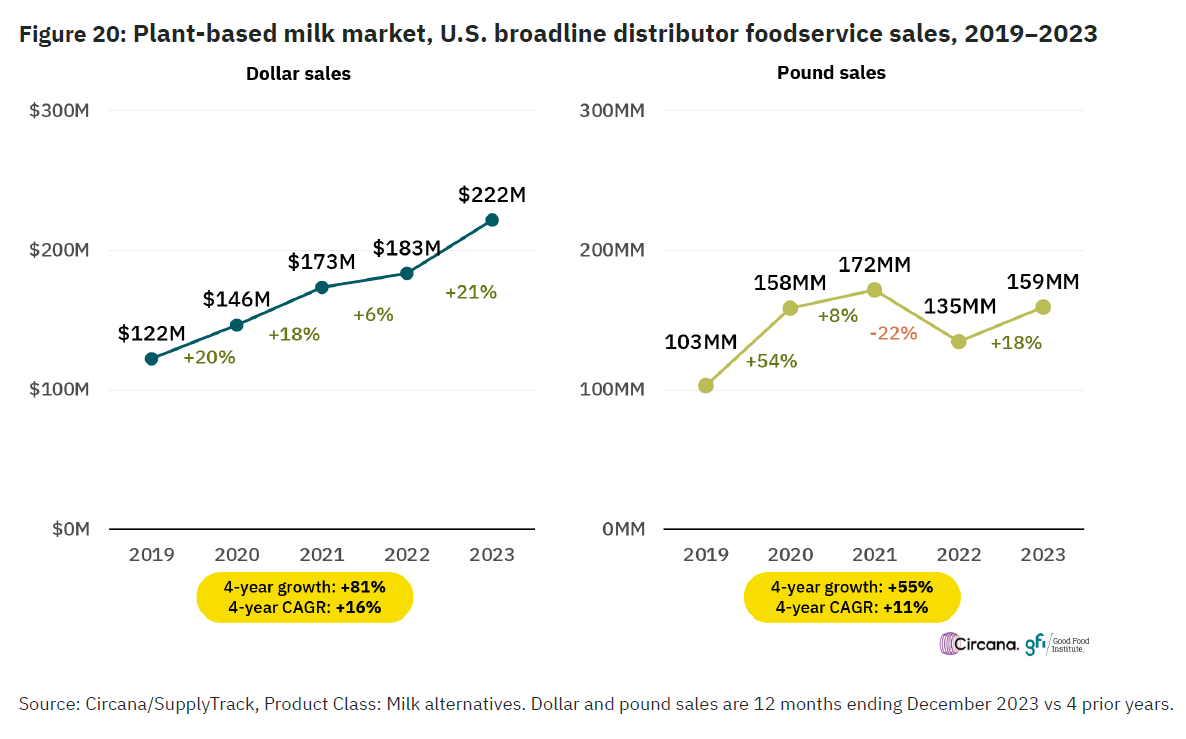

Meanwhile, plant-based milk experienced strong growth in foodservice in 2023, with sales surging 21% to $222m to capture a 12% share of the total milk market in broadline distributor sales; Volumes rose 18%.

Looking back over the past five years, dollar sales of plant-based milk are up up 81% vs 2019 in US foodservice, with volumes up 55%. For context, conventional milk dollar sales grew 34% while volumes grew 8% over the same timeframe.

Dollar sales of plant-based cheese rose 26% since 2019, with pound sales falling 9%, reflecting significant price increases. Over the same period, conventional cheese sales rose 18% with volumes up 3%.

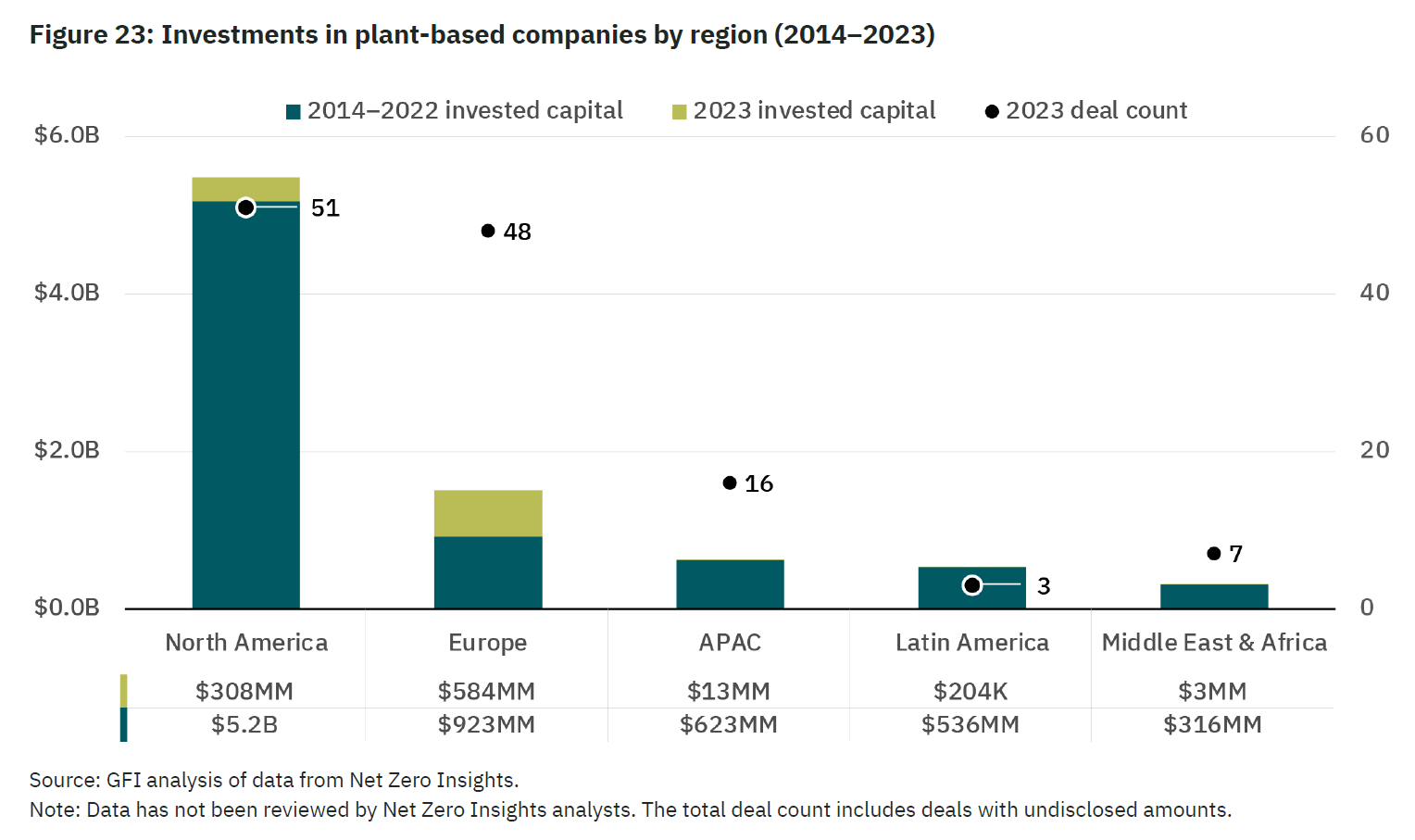

The investment landscape for plant-based, 2023: Sharp drop off in North America, strong increase in Europe

Plant-based companies raised $907.7 million in 2023, representing a 28% decrease from the $1.3 billion raised in 2022—a lower rate of decline than overall global venture funding for agrifoodtech in 2023 (-49.2%).

And while funding for plant-based companies dropped sharply in North America to just $308 million in 2023, it rose 74% in Europe to $584 million, notes the GFI. “For the first time, European investments comprised more than half of all invested capital in the plant-based industry for the year.”