There are no prizes for guessing that the leading US state by agrifoodtech investment last year was California. It hosts Silicon Valley, after all – as well as being a major agricultural producer in its own right.

Massachusetts in second place isn’t exactly a bombshell, either – given its pedigree for scientific research, with Harvard and MIT within is borders, and a thriving startup ecosystem that has grown around them and other renowned institutes and companies.

But move a little farther down the rankings, and there are a fair few surprises. As revealed by AgFunder‘s 2021 Agrifoodtech Investment Report, Michigan and Florida were among the top five states by agrifoodtech investment last year.

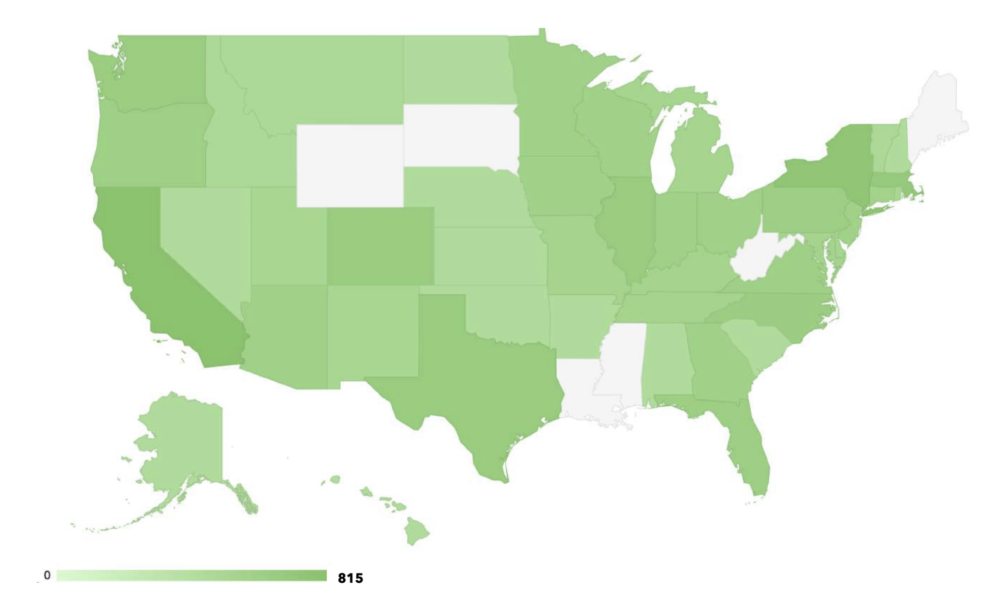

Here are US states mapped by the number of agrifoodtech funding deals that took place in each during FY 2020; the darker the shading, the more deal activity there was:

Source: AgFunder

Image credit: AgFunder

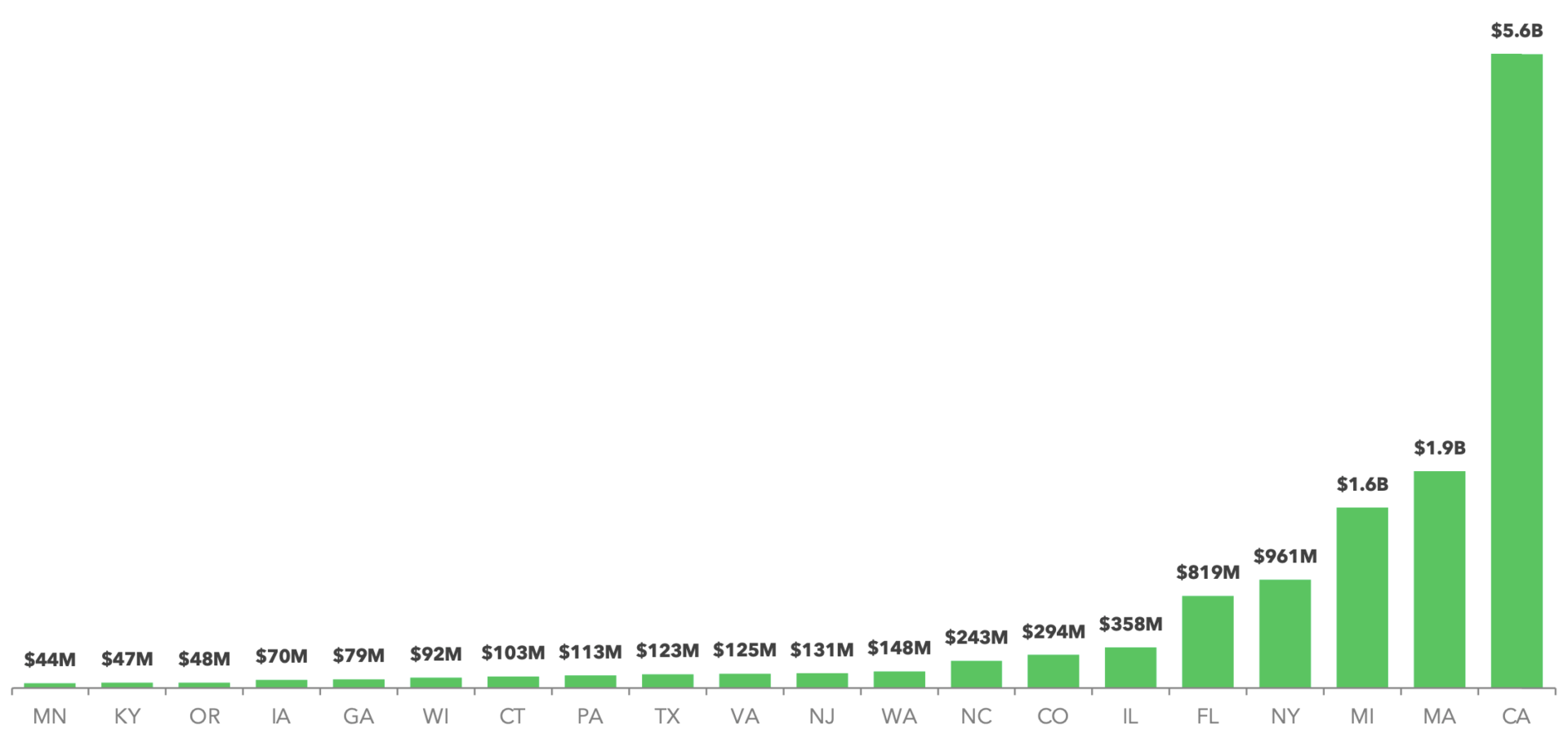

And here are the states charted according to the dollar value of agrifoodtech funding each received last year:

Source: AgFunder

Image credit: AgFunder

Conspicuous in third place after California and Massachusetts is Michigan, which doesn’t have any particular reputation for being home to numerous agtech and foodtech startups and VC firms

However, the Mitten State’s impressive funding haul last year was almost entirely accounted for by a single deal: Lineage Logistics‘ $1.6 billion private equity raise from investors including Oxford Properties, BentallGreenOak, and Morgan Stanley, among others. The cold chain tech provider, which is based just outside Detroit, said it would use the funding to fuel organic growth as well as M&A activity as it expands its global footprint.

Lineage followed that up with another massive raise of $1.9 billion in March this year, with much of the capital directed towards developing “the temperature-controlled warehouse of the future” using “algorithmic programming and automation software to streamline its operations and optimize every movement within its warehouses.”

The company describes its purpose as “transforming the food supply chain to eliminate waste and help feed the world.”

As with Michigan, much of fifth-placed Florida’s funding total for FY 2020 reflected the $700 million raised by Miami’s Reef Technology in November.

UAE sovereign fund Mubadala led the round, with SoftBank Vision Fund, Oaktree Capital Management, UBS, and Target Global also participating.

Reef was founded in 2013 as ParkJockey, a provider of tech for parking lot management. Since then, the startup claims to have become North America’s largest parking lot operator – and has been using this lofty position to diversify into other verticals. In particular, it has started setting up ‘ghost kitchens’ — commercial cooking establishments focused solely on delivery — in its lots.

Last month, Reef announced a partnership with burger chain Wendy’s to launch 700 ghost kitchens by 2025, building on an earlier pilot with Wendy’s in Canada which saw eight Reef kitchens rack up $1 million in annual sales.