Data snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Australia agrifoodtech investment in 2022 tells much the same story as heard in other parts of the world: cheap money and sky-high valuations turned 2021 into a banner year; war, climate change and inflation cut the lights on the party in 2022 and sent investment into decline.

Australia VC investment in agrifoodtech saw a 40% year-over-year drop, with startups raising $248 million, according to AgFunder’s 2023 Global AgriFoodTech Investment Report.

But there were bright spots, too, most notably in the Innovative Foods category, which includes alternative proteins (plant-based, cultivated, etc.) and novel ingredients. Those areas as well as midstream technologies are keeping momentum alive down under despite the downturn.

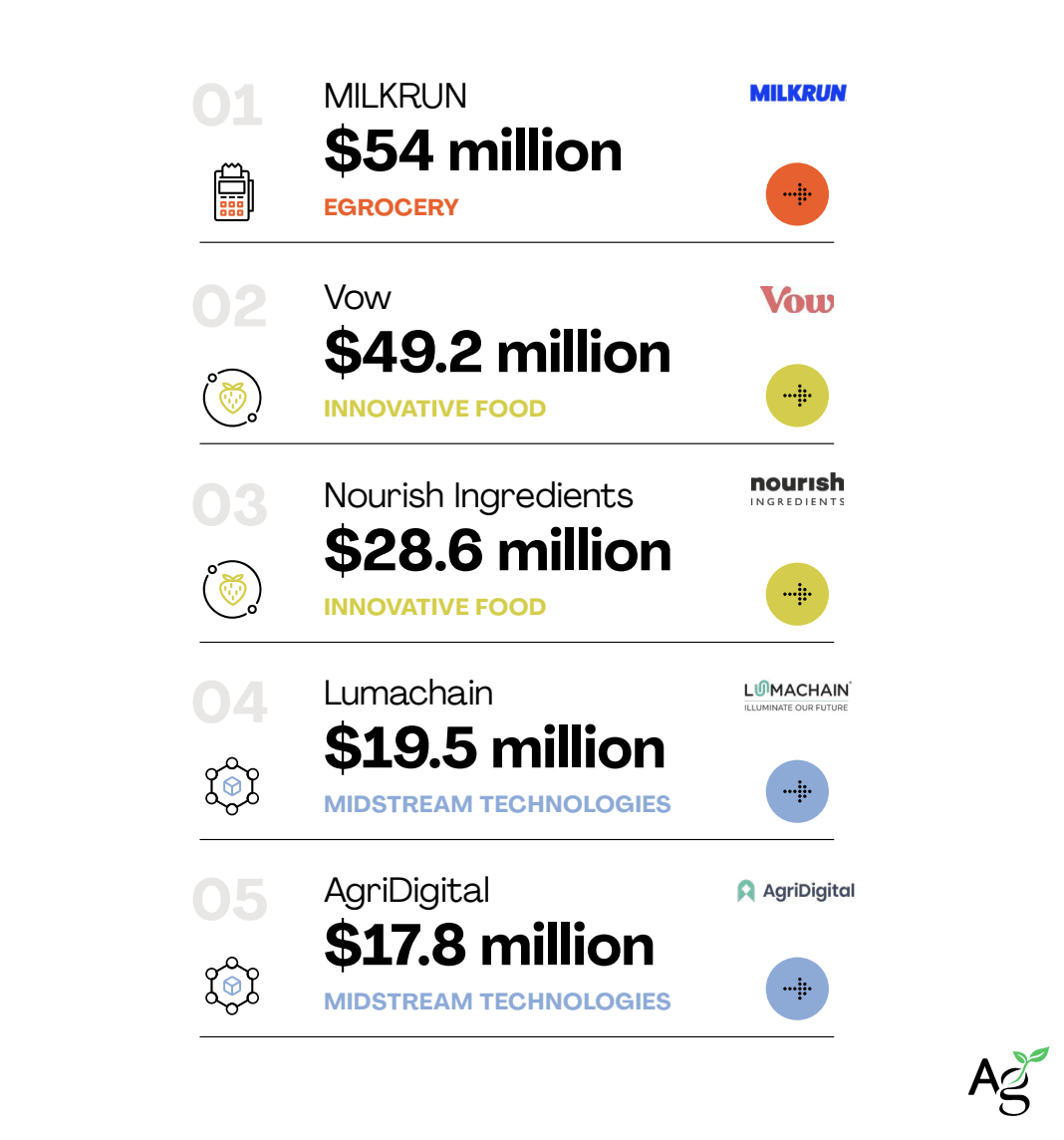

Top Australia deals

Cellular agriculture startup Vow raised a hefty $49.2 million Series A in late 2022, possibly one of the worst times in history for fundraising. The raise was also a record for Series A rounds in the cultivated meat industry.

Vow’s unique approach to cultivated meat — inventing new meats versus trying to replicate chicken, beef or pork — no doubt sets the company apart in an increasingly crowded industry.

Nourish Ingredients, which landed a $28.6 million Series A led by Horizons Ventures, also takes a road-less-traveled approach to alt meat. The company creates animal-free fats using fermentation via proprietary yeast strains.

eGrocery service Milkrun raised the largest amount for Australian agrifoodtech startups in 2022 with its Series A round in early 2022 that included investors such as Tiger Global Management.

Like other eGrocery startups, however, the rest of 2022 was not kind to Milkrun. After restructuring in early 2023, the startup closed its doors for good last month.

Top investment categories 2022

Bolstered by the capital poured into Nourish and Vow, Innovative Foods was Australia’s top VC investment category for agrifoodtech last year, taking 14.7% of the investment pie over five deals and $98 million. Farm Management, Software & Sensing technology came in second, with a larger share of 23.5% but just $26 million in deals.

Overall, upstream technologies close to the farm or lab were Australia’s big breadwinners in 2022, and that trend looks to be continuing in 2023.

Case in point: carbon farming startup Loam Bio raised a $73 million Series B this year and Provectus Algae took a strategic investment from biotech heavyweight CJ Bio for its innovative ingredients platform.

As Loam Bio noted in AgFunder’s report, “Climate tech has proven to be incredibly resilient in the current fundraising environment,” and “there is still strong demand for innovative technologies” despite the downturn.