FarmLink, an ag data analytics company, has raised $24.6 million in Series C funding from new and existing investors.

The company would not disclose further details about the round, just to say the funding will be used for growth.

“We are pleased with the ongoing support by our investors,” Ron LeMay, CEO wrote in an email to AgFunderNews. “This round represents both existing and new investors. As a growing agtech start-up, we remain focused on maintaining a market leadership position by delivering high quality, innovative products farmers and their advisors trust.”

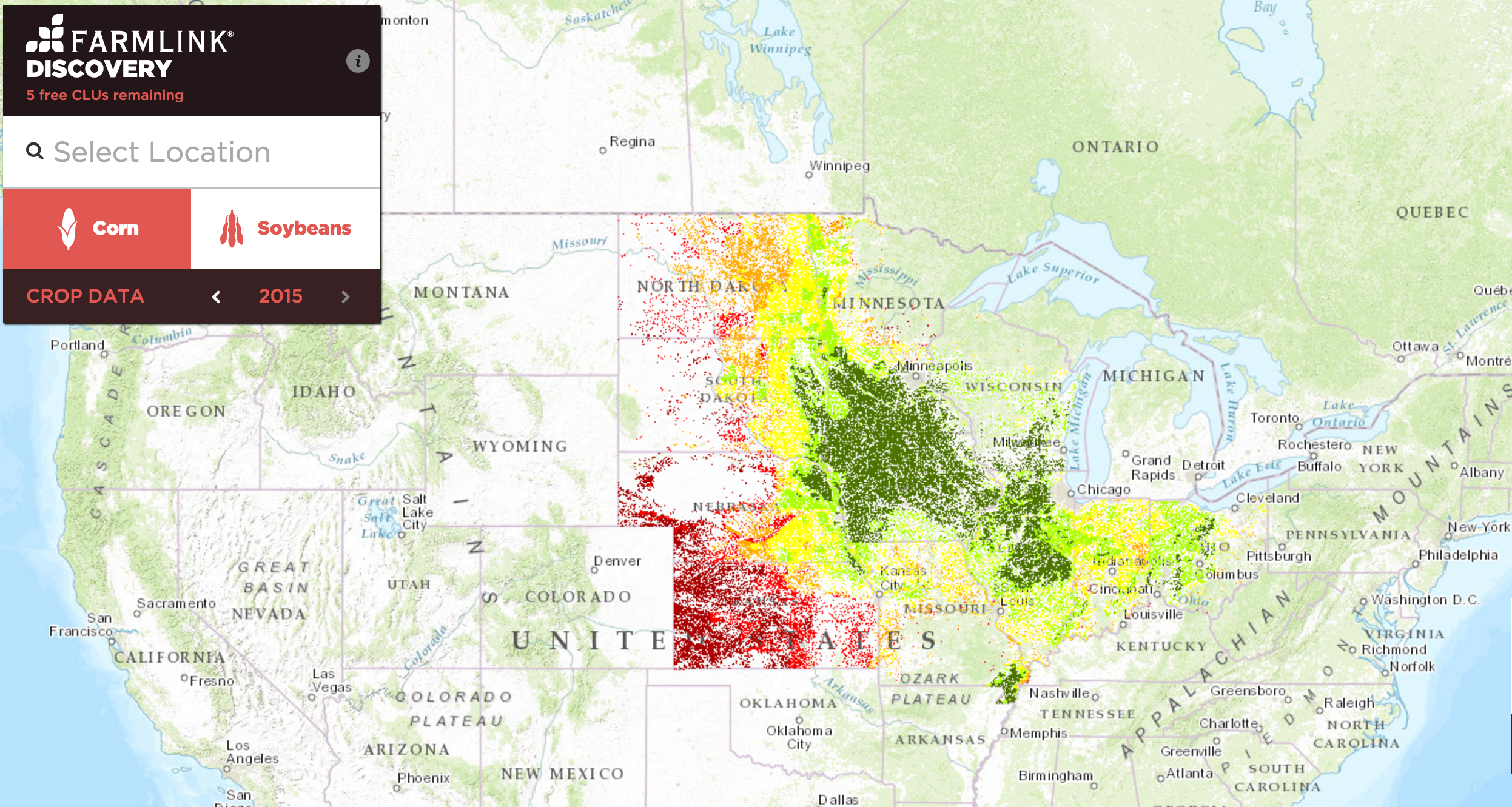

FarmLink offers farmers benchmarked yield data with its original TrueHarvest product, calculating revenue from each field and identifying improvement opportunities which are displayed on a dashboard. New to the market in 2015, FarmLink launched Discovery, a mapping program which highlights the top fields in any given area by yield. It also launched DTN MarketVision, which uses proprietary benchmarking data across millions of acres and years, combined with regional weather data and local grain prices to help farmers evaluate their profit and yield potential.

FarmLink’s final new offering is a machinery sharing platform called MachineryLink Sharing, which enables farmers to rent out any idle equipment. Separately, the company also has a combine leasing solution. Any equipment leased out through MachineYLink Combine Leasing is fitted with sensors, which collect and transmit data real-time back to FarmLink. This is one of the company’s main sources of data, alongside publicly-available data from sources such as the USDA, a spokesperson confirmed to AgFunderNews.

FarmLink last went out to the market in August 2014 to raise $40 million in Series B funding. That round was led by OpenAir Equity Partners, where Lance LeMay is managing director, and included existing investors Thorndale Farm, Don Walsworth and John Rose.

This is the latest funding in the growing ag big data space. Startups range from tracking weather data, moisture levels in the soil or on the plant, nutrient levels, satellite and field-level imagery data, and publicly available yield data. And they can offer pure software solutions, like FarmLink does, or offer a combination of hardware — sensors usually — and software analytics platforms. This segment is poised to account for a large amount of 2015’s funding totals. Watch out for AgFunder‘s 2015 investment report coming soon.

Have news or tips? Email [email protected]

Image: FarmLink’s Discovery platform