This week, US telehealth startup Equip raised funds for its eating disorder management platform, while Danish agtech company Agreena secured $22.5 million to help farmers participate in carbon markets.

In Asia, Next Gen Foods, the company behind the Tindle alt-protein brand, scored a record-breaking amount for plant-based foods; while South Korea’s Seawith got funding for its novel approach to cultivated meat scaffolding.

[Disclosure: AFN’s parent company AgFunder is an investor in Hyphen, which is mentioned below.]

Foodtech startup funding

🇸🇬 Beatle backs Tindle as Next Gen Foods raises record-breaking $100 million. It’s the plant-based protein segment’s largest Series A round to date. Paul McCartney’s MPL Ventures joined Indonesia’s Alpha JWC and Singapore’s EDBI as new investors in the alt-chicken brand. (AFN)

🇺🇸 Equip, a telehealth startup for youth eating disorders, raises $58 million. The platform connects families with medical and health professionals, while helping parents to manage menu planning, portion control, and meal scheduling. The Chernin Group led the round. (Fast Company)

🇺🇸 ‘Functional soda’ company Olipop gets $30 million for Series B round. Olipop’s total funding to date is $55.9 million; its valuation is now $200 million, according to the company. (Food Navigator)

🇺🇸 AgFunder-backed Hyphen scores $24 million in Series A round led by Tiger Global. Hyphen will expand its robotic makeline to more commercial kitchens in the US. (AFN)

🇦🇺 Kepler Analytics nets $22 million in Series B capital. The retail tech company will use the new funds for hiring, launching new products, and expanding in North America, Europe, and Asia. (Startup Daily)

🇺🇸 Animal-free cheese company Change Foods raises $12 million. The funding, led by Route 66 Ventures, is an extension of the company’s seed round and brings the round total to $15.3 million. (Food Dive)

🇺🇸 Plant-based nutrition brand KOS secures $12 million funding. KOS will use the Series A to add retail partners, develop new products, and enter new service categories. (Vegconomist)

🇺🇸 Agot AI raises $12 million. The company develops computer vision solutions for the foodservice industry and has pilot programs in place with some of the world’s largest quick service restaurants – including some of those operated by its earlier investor Yum! Brands. (Agot AI)

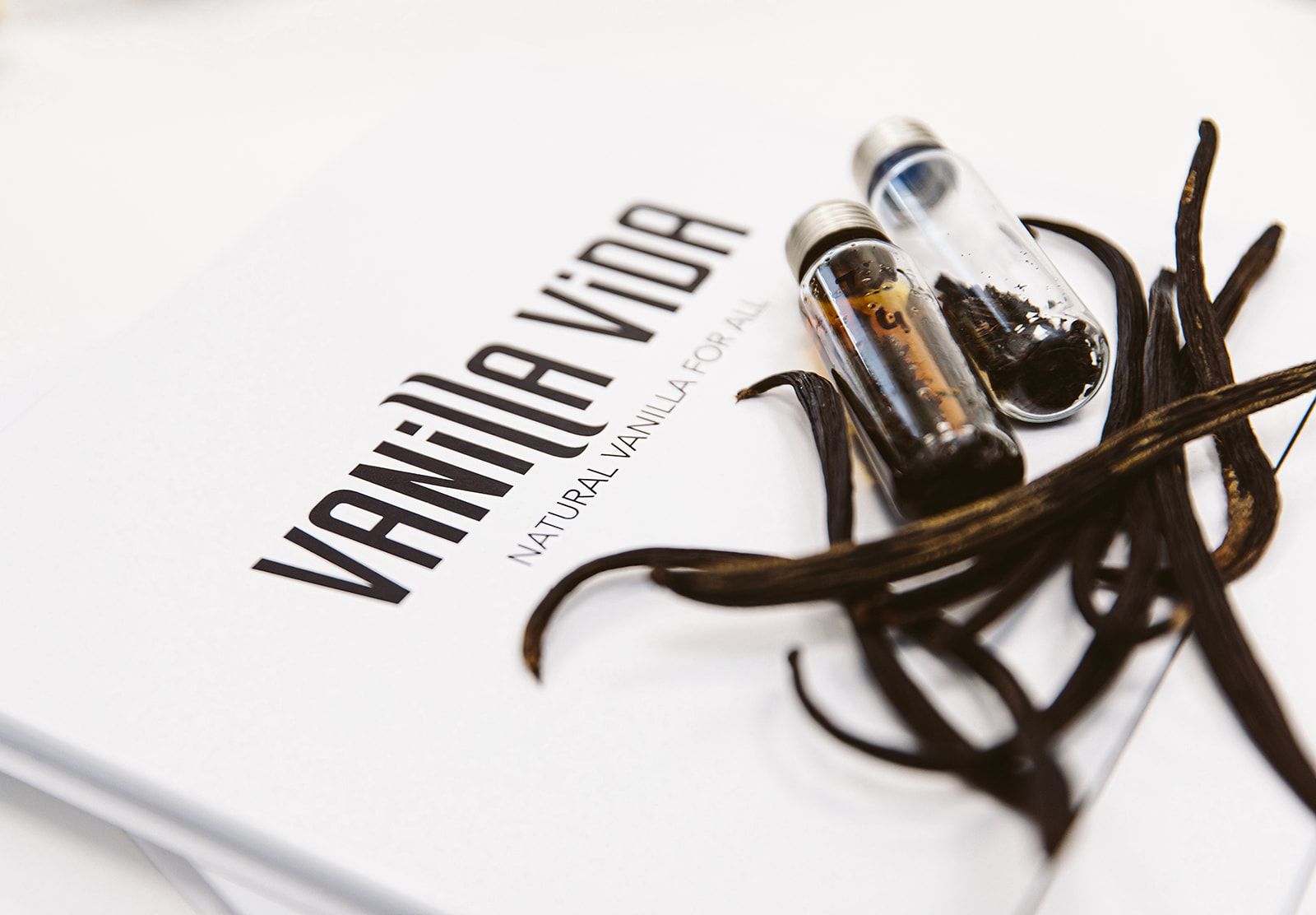

🇮🇱 Vanilla Vida raises $11.5 million to fix the vanilla value chain. It’s achieving this by optimizing vanilla yields and using data to enhance the curing process. Swiss investment firm Ordway Selections led the Series A round. (TechCrunch)

🇺🇸 NourishedRx nets $6 million to grow its “intelligent food-for-health platform.” The Stamford, Connecticut-based startup aims to provide “personalized, culturally relevant” food solutions to health plan members. S2G Ventures led the seed round. (NourishedRx)

🇰🇷 Cultivated meat startup Seawith closes $5.4 million Series A round. It’s culturing beef from cells using algae as a scaffold, which it claims will bring its products’ cost down to $3 per kilogram. (Vegconomist)

🇺🇸 Elo banks $5 million. The seed funding will help the company scale its smart nutrition platform and develop additional products. (Elo)

🇧🇷 Oat milk brand Nude raises $4.8 million. The company plans to use the funding to expand to other Latin American markets. (Contexto)

🇦🇪 $2.2 million bridge round closed by Yalla Market. The quick-commerce startup will open ‘dark stores’ in the UAE and other Gulf countries. (Wamda)

🇨🇦 Cubbi scores $1 million. The company offers internet-connected food storage lockers for offices as well as a food-delivery service called Cubbi Kitchens. (Betakit)

🇦🇺 Woolworths invests undisclosed sum in alt-protein startup All G Foods. This is the retailer’s second investment in a plant-based protein company. (Australian Financial Review)

🇺🇸 Alt-chocolate maker California Cultured gets undisclosed sum from CULT Food Science. It uses cell-culturing technology to produce cocoa powder and cocoa butter. (Food in Canada)

🇸🇬 ‘Food fingerprinting’ platform ProfilePrint closes Series A round. The undisclosed amount of capital will go towards the food quality testing startup’s team expansion, R&D, and international expansion. (e27)

Agtech startup funding

🇩🇰 Agreena raises $22.5 million for its Series A round. Its platform helps farmers to sequester, monitor, and monetize carbon, giving them a reported 20% boost in profitability per hectare of land. (Sifted)

🇪🇸 Noray Seafood nets $18 million for sustainable shrimp production. The company will use the funds to further develop its indoor shrimp farming tech that leverages microbial technology. (The Fish Site)

🇮🇳 B2B farm inputs platform Agrim raises $10 million. Kalaari Capital led the Series A round, with participation from existing investors Omnivore, India Quotient, Accion Venture Labs, and Axis Bank. (Agrim)

🇮🇩 Semaai scores $1.3 million in fresh funding. The Indonesian company provides soil-testing technology, ag inputs, and financing assistance to small- and medium-sized farms. (Tech in Asia)

🇮🇱 BASF Venture Capital and Orbia Ventures invest undisclosed sum in FortePhest. The Israeli startup is developing a novel technology to combat herbicide-resistant weeds and invasive plants. (Financial Post)

M&A, IPOs & partnerships

🇺🇸 Bowery acquires robot harvesting startup Traptic. The latter uses computer vision, robotic arms, and AI for harvesting fruiting and vine crops like strawberries and tomatoes. (Produce Blue Book)

🇯🇵🇺🇸 Marubeni Corp to sell its Gavilon grain business for $1.1 billion. Commodities trading giant Glencore will acquire the unit. (Reuters)

🇺🇸 Musician Sia teams up with Bond Pet Foods. She joins the Boulder, Colorado-based company — which produces plant-based pet food — as an investor and advisor. (Bond Pet Foods)

🇺🇸🇬🇧 Pairwise and Tropic Biosciences announce licensing deal. The latter will gain access to Pairwise’s base gene-editing technology, which it will use to advance plant breeding innovations in coffee and banana crops. (Pairwise)

🇩🇪 BRAIN Biotech and Formo collaborate on milk-free protein. Formo develops milk proteins from specialized microorganisms and genome-editing technology, and will leverage BRAIN’s biotech expertise for the proteins. (Dairy Reporter)

🇺🇸 Farm management platforms Conservis and AgriWebb form partnership. The two companies aim to bring more solutions to farmers need both crop and livestock tools. (Conservis)

🇺🇸 White Castle expands its existing partnership with Miso Robotics. The two companies announced plans to put Miso’s Flippy 2 robot in 100 standalone White Castle locations where it will manage the kitchen fry station. (Restaurant Business)

Other news

🌐 Asian firms top list of protein producers at risk of incubating the next pandemic. Two-thirds of the world’s largest meat, fish, and dairy suppliers are at “high risk” of escalating a global zoonotic pandemic, according to a new report by investor network FAIRR. (AFN)

🇺🇸 Kellogg’s launches $2 million program for farmers to reduce emissions. Kellogg’s InGrained is a five-year program that will partner with farmers in the Lower Mississippi region to help them reduce their climate impact. (Kellogg’s)

🇧🇷 Brazilian government to offer $707 million in agricultural subsidies. The money will be allocated as credit to farmers affected by climate change in certain parts of the country. (Reuters)

🇨🇭Nestlé posts bullish annual results as prices rise and demand strengthens. The agrifood giant reported its strongest growth in a decade, driven largely by sales of coffee and pet food. (Financial Times)

🇮🇱 Future Meat appoints new CEO. Food and ag industry veteran Nicole Johnson-Hoffman joins the cultivated meat company from European food manufacturer OSI. (Food Engineering)

🇩🇪 Aldi’s vegan sales rise by 500% in a year. The grocery chain plans to continue expanding its selection of vegan and plant-based items across its stores. (The Vegan Review)