Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Early-stage investing in African agrifoodtech startups gathered significant momentum in 2021, according to the newly launched 2022 African AgriFoodTech Investment Report. While seed-stage deals typically dominate venture capital investment activity whatever market you’re in, in Africa, the number of seed stages deals increased nearly 70% compared to 2020. That compares with just an 8% jump in seed-stage deal activity on the global stage year-over-year, according to AgFunder’s global report.

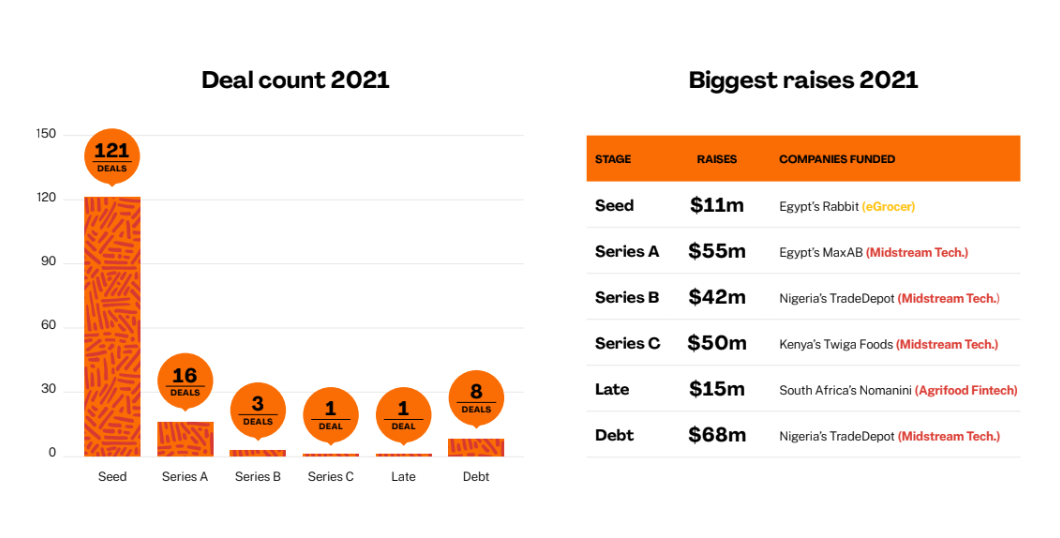

African seed stage activity also represented a larger piece of overall deal activity with 121 deals accounting for 80% of all African agrifoodtech deals closed during the year. On the global stage, that number was closer to 60%.

It’s not just in agrifoodtech where early-stage investing is picking up pace; the dominance of seed stage was evident across VC investment in Africa in 2021. According to a Partech Partners’ report, 74% of deals were at seed stage.

The top seed stage deals recorded were a mix of technologies improving the distribution of food in the supply chain and to consumers — from eGrocery and retail tech to Midstream Technologies and Agrifood fintech. The biggest seed round was Egypt’s Rabbit, an e-grocery and delivery platform which secured $11 million in pre-seed funding.

What could trigger the high number of seed-stage deals?

- An increasing number of early-stage funds are launching across Africa, dedicated to the local market, albeit across sectors. The top three most active investors during the year are all local funds and are all focused on investing in startups at the earliest stages; Launch Africa, Flat6Labs Cairo, and LoftyInc Capital Management all back startups between the seed and Series A stages.

- Other firms that have sprung up to support early-stage startups include Microtraction, Future Africa Fund, Savannah Fund , and Google’s Black Founders Fund for Africa just to name a few.

- The positive momentum garnered by the success of a few fintech unicorns on the continent is no doubt helping boost enthusiasm for early-stage investing; that many agrifoodtech startups have fintech offerings by their nature, can only help promote the sector.