Investments in African agrifoodtech startups reached record heights in 2021, according to AgFunder’s inaugural Africa-focused report in collaboration with BII and FMO.

But who were the key investors driving the $482.3 million invested in 2021?

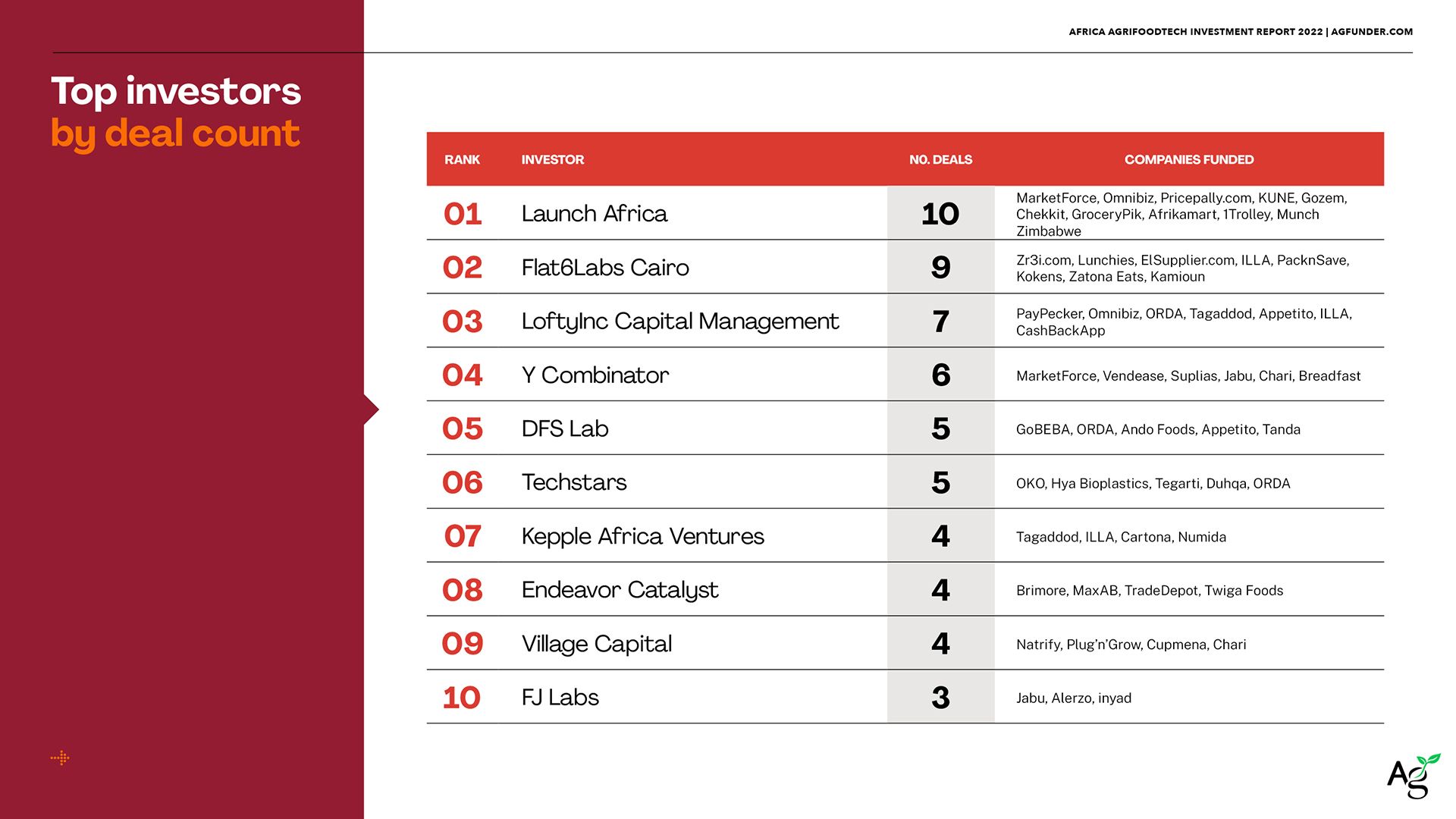

The 2022 AgFunder Africa AgriFoodtech Report highlighted 10 of the biggest, including Launch Africa, Flat6Labs Cairo, LoftyInc Capital Management and Y Combinator – all of which had 6 or more investments.

DFS Lab, Techstars, Kepple Africa Ventures, Endeavor Catalyst, Village Capital and FJ Labs were other investors who had between 3 to 5 deals.

Launch Africa

- Year founded: 2020

- Number of investments in 2021: 10

- Ticket size: upto $300K

This is a sector agnostic VC fund that comes in at the seed and pre-Series A stages, investing in B2B and B2B2C African tech startups.

It has reportedly invested in 108 startups since inception, closing its first fund at $36.3 million in June 2022.

The VC firm funds startups in the food, water, climate and greentech industries, but also invests in fintech, edtech, healthtech, energy, media among other industries.

Startups that secured funding from Launch Africa last year include:

- MarketForce, a Kenyan software company that builds digital marketplaces to facilitate efficient trade for informal traders.

- Omnibiz, a Nigerian B2B e-commerce and distribution platform connecting FMCG manufacturers and retailers

- Pricepally.com, A Nigerian e-grocery startup that sources directly from farmers and manufacturers.

- Kune, a Kenyan cloud-kitchen (Kune has since shut down in June 2022)

- Gozem, a Togolese ‘super-app’ that provides Francophone, West and Central African users with e-commerce, delivery, transport and financial services.

- Chekkit, a Nigerian startup providing anti-counterfeiting solutions to prevent consumers from purchasing fake products, while connecting consumers and FMCG manufacturers including food brands.

- GroceryPik, a Kenyan e-grocery

- Afrikamart, a Senegalese fresh produce distribution platform that sources from rural farmers and connects them to the urban retail and hospitality sectors.

- 1Trolley, an Egyptian pick-up and delivery platform serving North Africa and the Middle East consumers, connecting them to their own neighborhood stores.

- Munch Zimbabwe, a food-delivery startup

Flat6Labs Cairo

- Year founded: 2011

- Number of investments in 2021: 9

- Ticket size: upto around $150K, formerly $76K

Flat6Labs is an Egyptian accelerator launched by the venture capital firm Sawari Ventures. It invests in startups in the Middle East and North Africa Region and has active seed funds in Egypt and a sister fund in Tunisia.

Just last year, Flat6Labs revealed the second close and increase of it’s Egypt fund from $3 million to $ 13 million. It later announced yet another second close for its Tunisia-based Anava Seed Fund from $3 million to $10 million

According to Flat6Labs, it has trained more than 130 startups. It also has offices in Tunis, which collectively with Egyptian office has trained 440 entrepreneurs and invested $10.5 million.

Its 2021 agrifoodtech investees include:

- Zr3i (Zaree), an agritech that leverages satellite imagery to provide farmers with information on climate change, soil conditions, crop health and plant-water monitoring services.

- Lunchies, a startup that produces and delivers fresh, nutritional meals to schools and nurseries.

- ElSupplier.com, an online marketplace connecting buyers directly to suppliers.

- ILLA, a middle-mile logistics provider for FMCG companies

- PacknSave, an e-grocery startup

- Kokens, a Kitchen as as Service platform that turn s online recipes, to menus for home deliveries.

- Zatona Eats, a meal planning startup that also prepares and delivers healthy meals

- Kamioun, a platform connecting local retailers and FMCG companies, offering free logistics services

LoftyInc Capital Management (LCM)

- Year founded: 2017

- Number of investments in 2021: 7

- Ticket size: upto $ 50 000 – $250 000

LCM is a Nigeria-based early-stage venture capital investor. The firm already has under its sleeve called the LoftyInc Afropreneur Funds, the third being a $10 million fund aiming to finance 40 companies in the seed to series A stages.

Being sector agnostic, it invests in the agritech, supply chain, energy, healthtech and SME Services industries.

Startups that joined its agrifoodtech portfolio in 2021 include:

- PayPecker, a Nigerian startup providing e-commerce infrastructure that automates trade for informal retailers, restaurants and their suppliers and clients.

- Omnibiz, a Nigerian B2B e-commerce company digitizing supply chains between FMCG manufacturers and retaliers

- Orda, a Nigerian cloud-based restaurant management platform that offers client and logistics providers connectivity as well as payments processing.

- Tagaddod, an Egyptian waste management and renewable energy solutions company

- Appetito, an Egyptian e-grocery and delivery startup

- ILLA

- CashBackApp, a Kenyan startup helping e-grocers give cashbacks to their clients and purchase goods on credit

Y Combinator

- Year founded: 2005

- Number of investments in Africa in 2021: 6

- Ticket size: upto $500K

Y combinator is an American accelerator that supports early-stage tech startups cutting across various industries. It offers 3-month training programs to these startups and has reportedly funded over 3500 globally at the pre-seed and seed stages.

some agrifoodtech startups to be backed by YC last year were:

- MarketForce

- Vendease, a Nigerian food procurement and food vendor management platform

- Suplias, a Nigeria B2B marketplace connecting retailers to FMCG companies

- Jabu, a Namibian B2B e-commerce platform serving informal retailers and FMCGs, providing free delivery services as well

- Chari, a Moroccan retailtech startup serving small retailers and FMCGs Francophone Africa

- Breadfast, an Egyptian e-grocery platform